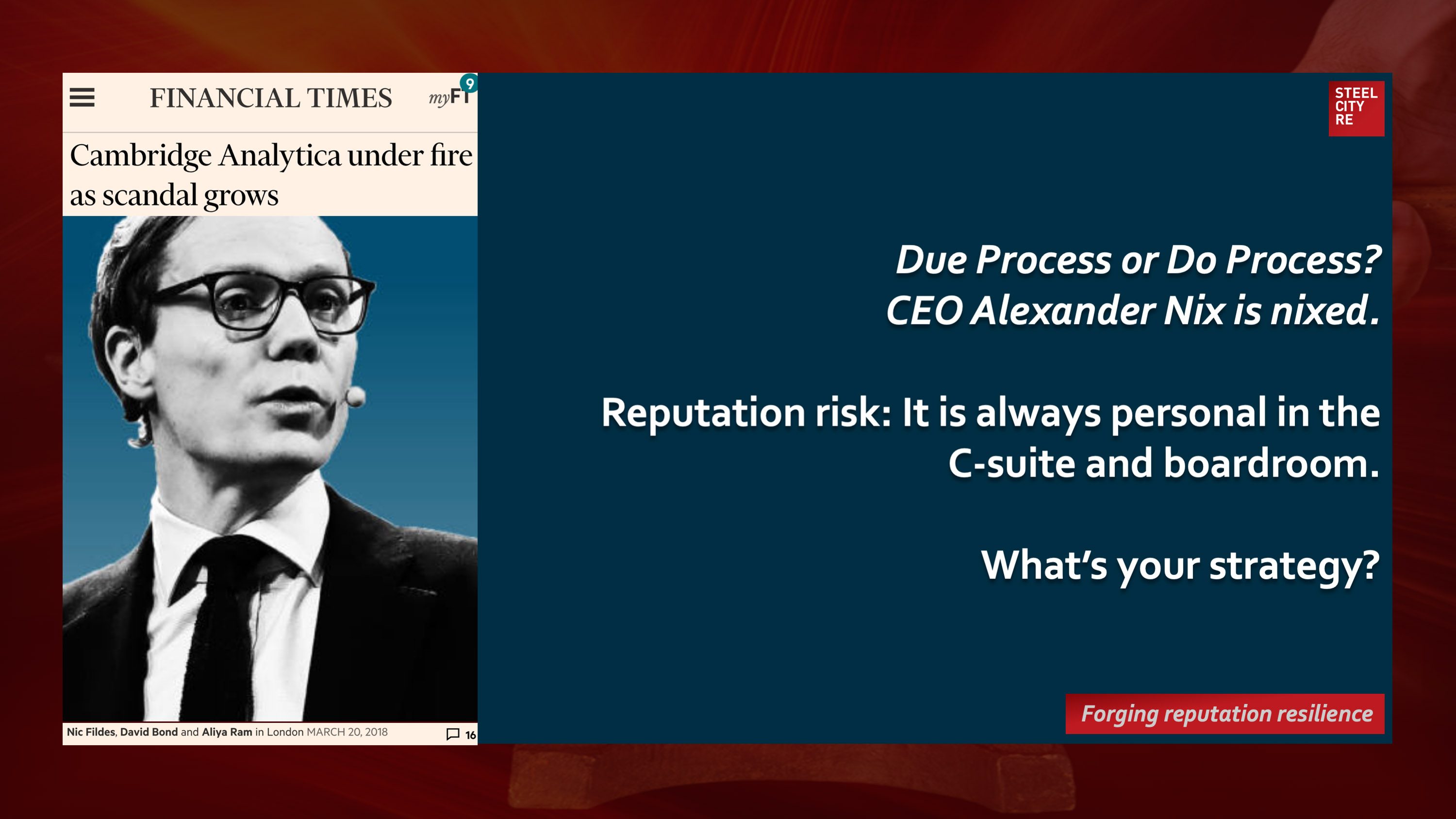

Cambridge Analytica, the UK company at the heart of the privacy breach that has wiped almost $40bn off the value of Facebook, has been characterised as a high-tech business that transformed data into a tool to wage “psychological warfare”. But it is the analytics company that has now found itself in the line of fire. Alexander Nix, chief executive, was suspended on Tuesday night after the company known for operating in the background was thrown into the spotlight following allegations that it had received and exploited data harvested from 50m Facebook users during the campaign to elect Donald Trump as US president.

March 21, 2018

Financial Times

CEO Alexander Nix is nixed. With reputation risk tornados in the era of weaponized social media, leadership is jettisoned overboard quickly. Jonah would have understood. It’s personal.

Due Process or Do Process? CEO Alexander Nix is nixed.

Reputation risk: It is always personal in the C-suite and boardroom.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution. What’s your strategy?