We live in an age where those expectations can change in what feels like an instant. A short time ago, the top reputation risk was allegations of unethical and inappropriate executive behavior that gained prominence through #MeToo. At this particular moment, it is gun violence. No matter how well a company plans, unanticipated risks can emerge suddenly as culture shifts alter stakeholder expectations in dramatic ways. Companies that are not equipped to deal with those risks will ultimately pay the price.

Clearly, while the desire to do the right and ethical thing is a good motive in and of itself, being perceived as a first-mover and leader, especially when major cultural shifts and societal events threaten an entire industry, also yields very real and tangible financial benefits. To realize those benefits, companies need to demonstrate through their actions that whatever may happen elsewhere in their industry or in society in general, they are living up to the expectations their stakeholders have for them.

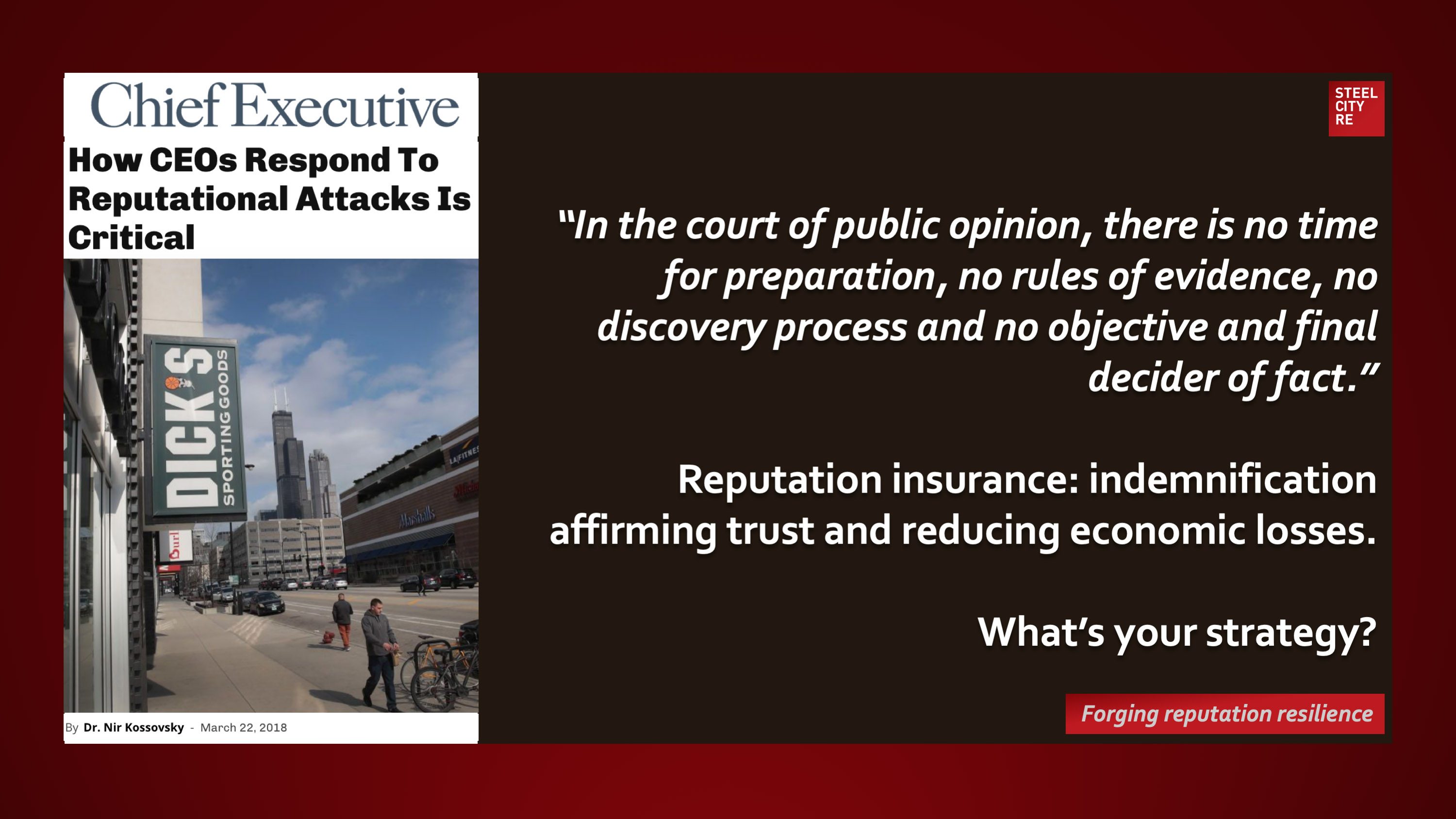

March 22, 2018

Chief Executive

“In the court of public opinion, there is no time for preparation, no rules of evidence, no discovery process and no objective and final decider of fact.”

Reputation insurance: indemnification affirming trust and reducing economic losses.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution. What’s your strategy?