Irrespective of your strategic issues, there are practical measures that can limit or deter altogether the reputational tornadoes wreaking havoc in the corporate and financial sectors.

As reputation tornadoes like #MeToo, #TakeAKnee, and #DumpNRA rip through society, it might appear that reputation risk is the peril of negative social media. But we’re seeing things differently. Our clients, most of whom are seeking tornado shelters for what can be most concisely described as the peril of economic damage from angry disappointed stakeholders, want reputation risk management, financing and transfer solutions for these four top issues:

June 22, 2018

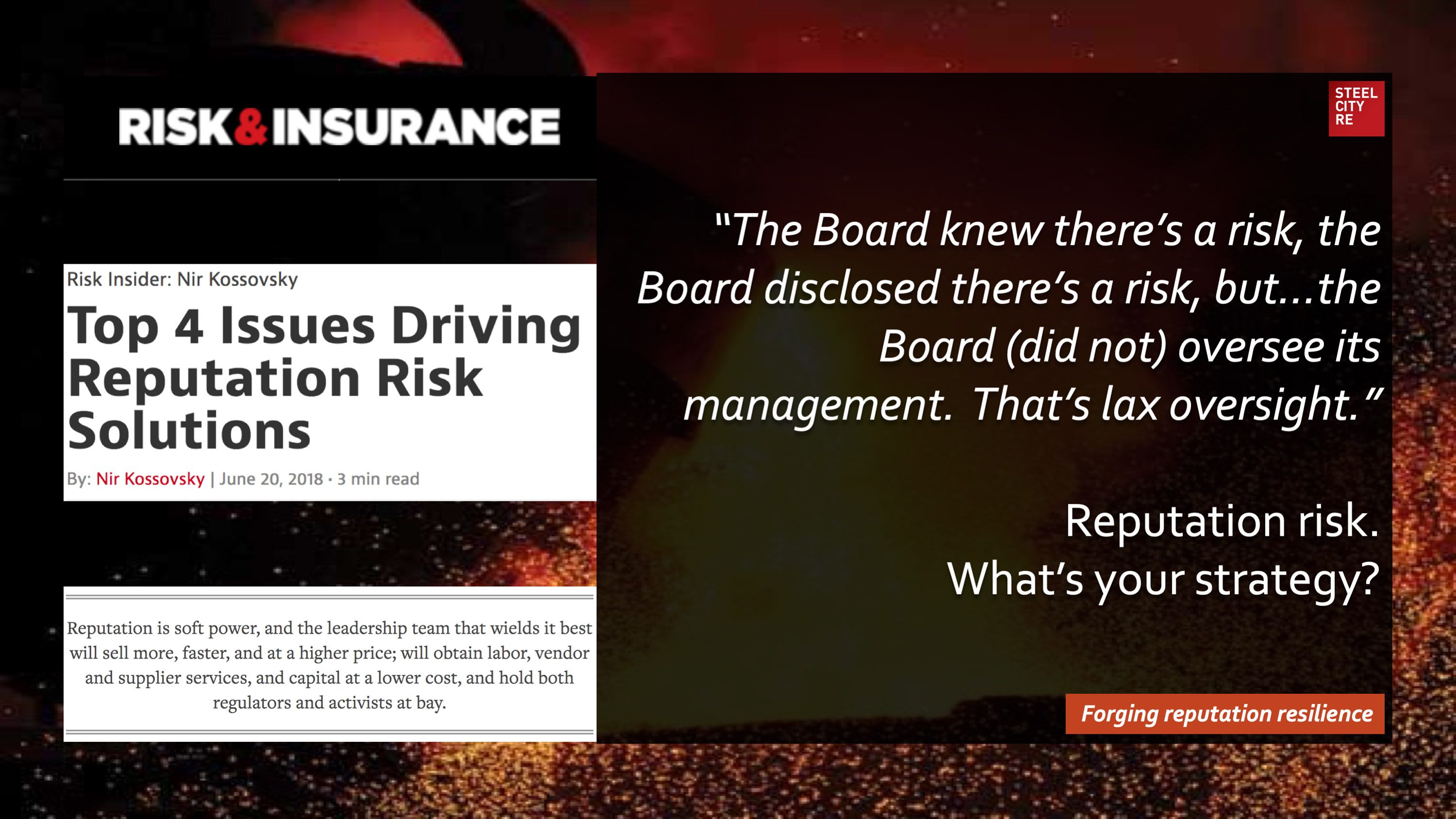

Risk & Insurance

“The Board knew there’s a risk, the Board disclosed there’s a risk, but…the Board (did not) oversee its management. That’s lax oversight.”

Reputation risk management: mitigating both disappointment and noxious media.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution. What’s your strategy?