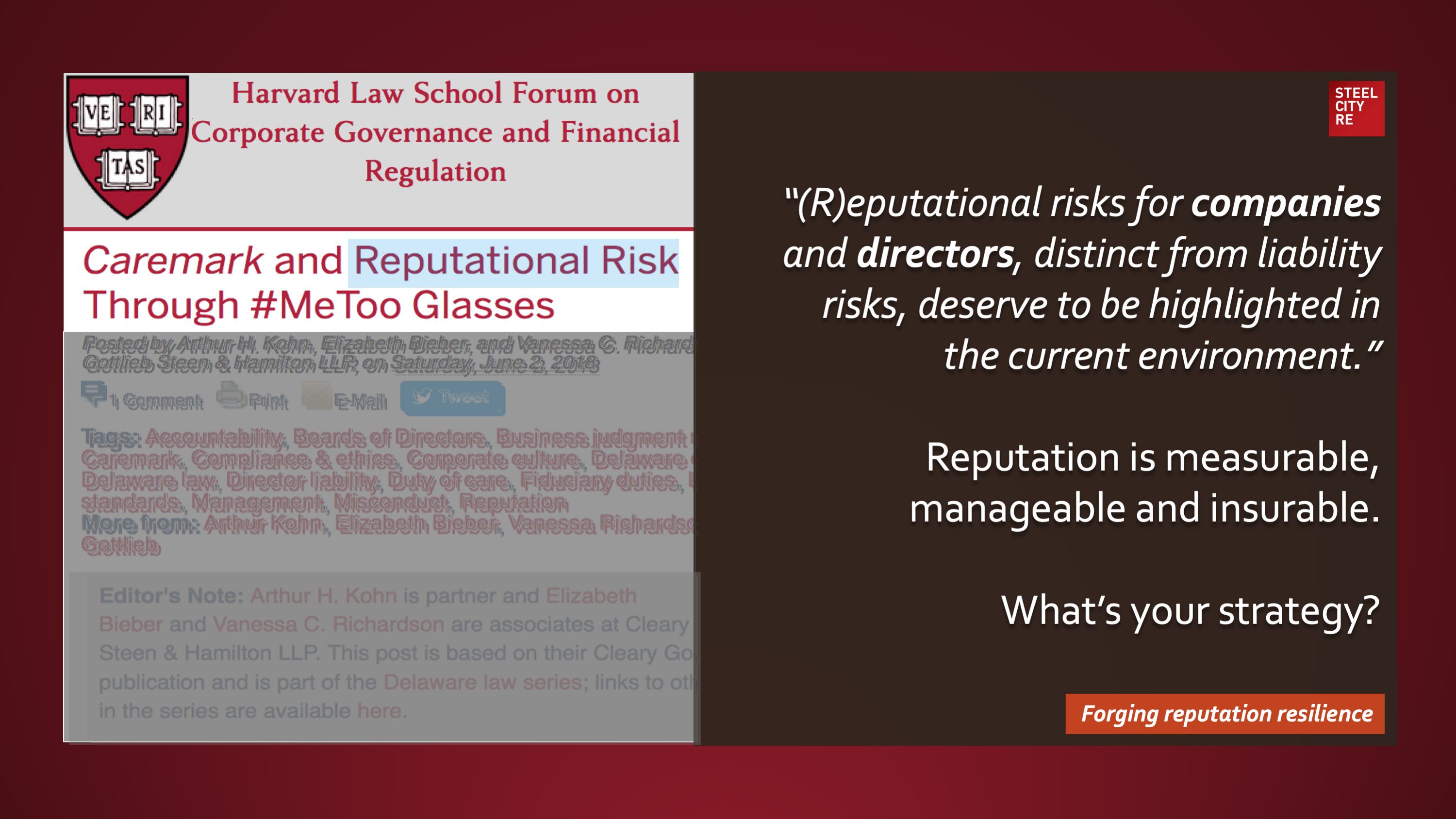

This post explores the potential for change in the Caremark standard in light of the current intersection of business and social, political and cultural issues.

Companies and boards have traditionally viewed the risk of liability under Caremark as being primarily a compliance issue; a well-designed and administered compliance function should bubble up to directors the issues and information that require their attention, satisfying the Caremark duty of attention. A long series of Delaware decisions describe a Caremark-based derivative challenge as “possibly the most difficult theory in corporation law on which a plaintiff might hope to win a judgment.”

Delaware courts and shareholders currently assess decisions made by boards of directors primarily under the business judgement rule and the 1996 Caremark standard. Many other states have similar schemes for evaluating director decisions or follow Delaware precedent. Generally, Caremark addresses the legal standard of culpability when directors are alleged to have failed to address a risk, while the business judgment rule provides a framework for assessing affirmative board decisions unless a more substantive review is warranted.

Public and private businesses today face many decisions that do not arise from, and have consequences far beyond, solely financial performance. Rather, these decisions are primarily driven by, and implicate, important social, cultural and political concerns. They include harassment, pay equity and other issues raised by the #MeToo movement; immigration and labor markets; trade policy; sustainability and climate change; the manufacture, distribution and financing of guns and opioids; corporate money in politics; privacy regulation in social media; cybersecurity; advertising, boycotts and free speech; race relations issues raised by the pledge of allegiance controversy; the financing of healthcare; the tension between religious freedom and discrimination laws; and the impact of executive pay on income inequality, among others. If the nature of the issues is not unprecedented, the number, diversity and polarization seem to be.

June 26, 2018

Harvard Law School Forum

“(R)eputational risks for companies and directors, distinct from liability risks, deserve to be highlighted in the current environment.”

Reputation is measurable, manageable and insurable.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution. What’s your strategy?