Insurance Business

August 24, 2018

Aon delves into the surging growth of reputation risk

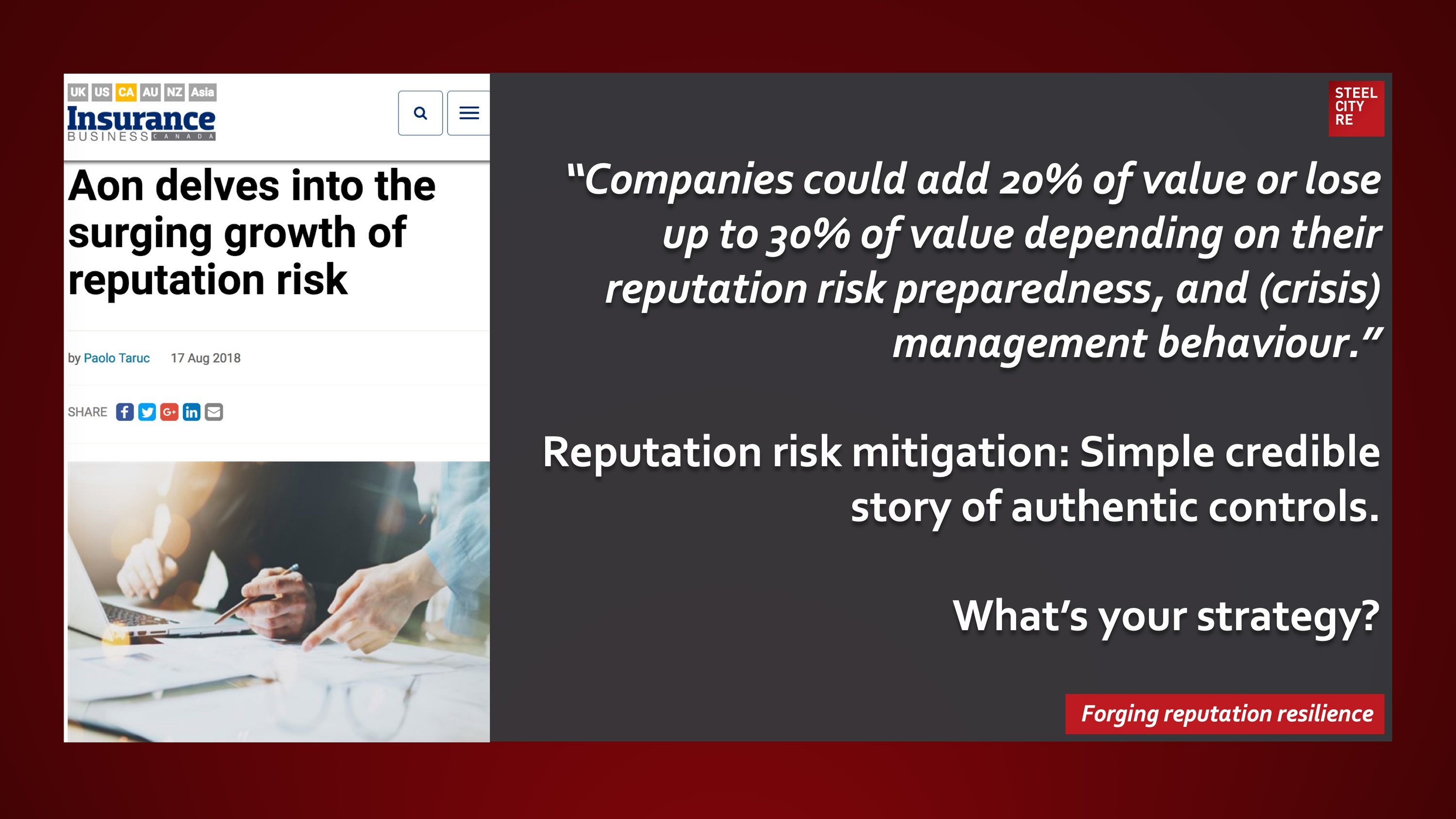

Data showed companies could add 20% of value or lose up to 30% of value depending on their reputation risk preparedness, and management behaviour in the immediate aftermath of a crisis.

The firms scrutinized 125 reputation crises over the past 10 years, measuring the impact on shareholder value over the course of the following year. They found that the value impact of reputation crises has doubled since the introduction of social media. Neither company size nor reputation premium offers any protection against value loss in the wake of a crisis.

“The combination of the 24/7 news cycle with widespread use of social media puts brands at risk that their reputation event will have long-term negative consequences

Reputation risk mitigation: Simple credible story of authentic controls.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution. What’s your strategy?