Industry insiders have welcomed the level of transparency provided by the firms on these issues at a time when abuse of power and sexual harassment in the workplace are under intense scrutiny.

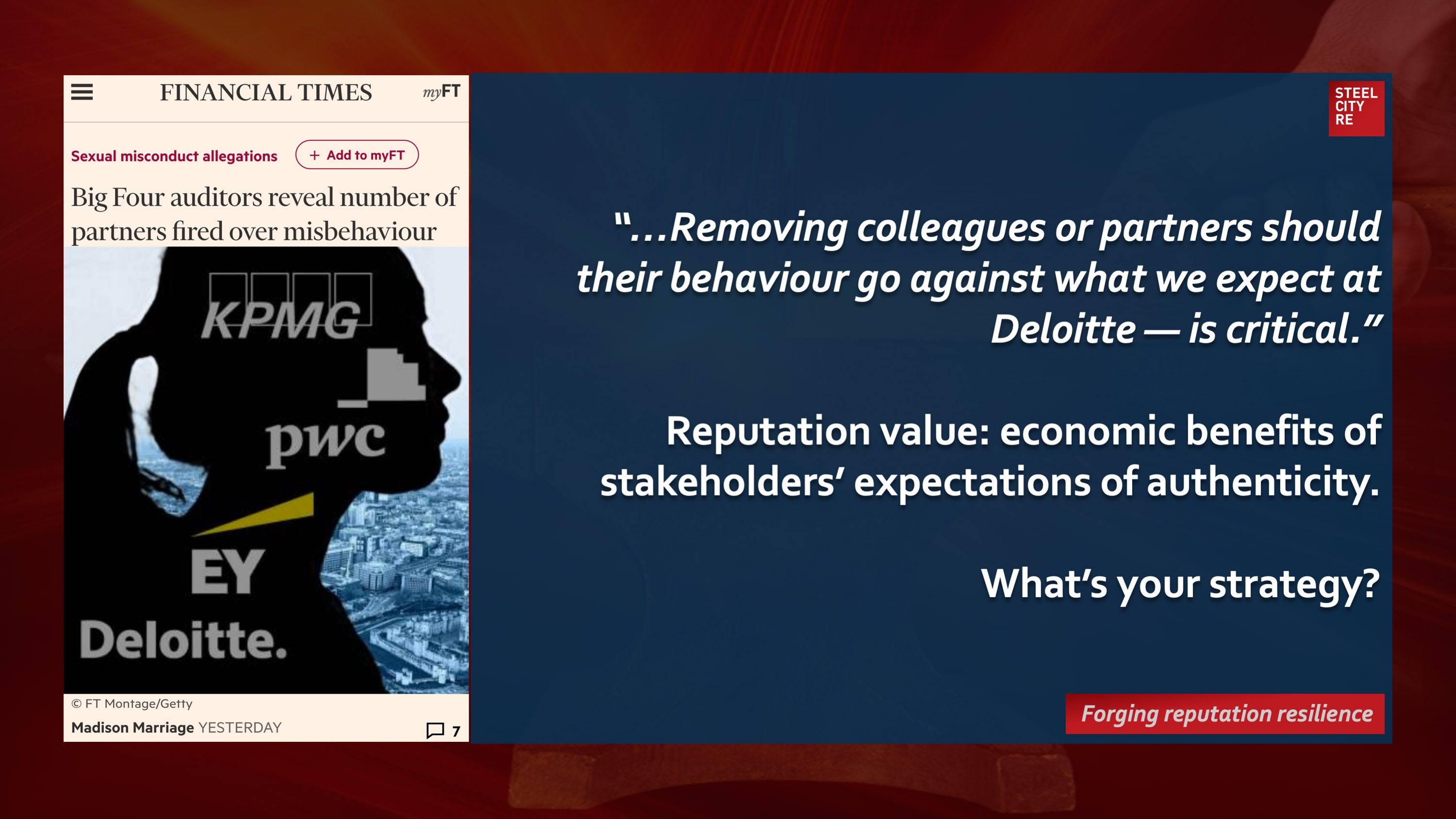

PwC, which has 915 UK partners, said it had dismissed five over the past three years. KPMG said that seven of its 635 UK partners left the firm due to inappropriate behaviour including sexual harassment and bullying over the past four years.

EY said on Tuesday that five partners had left the firm over the past four years for “behaviour that is not in line with our code of conduct, including sexual harassment and bullying”.

Britain’s Big Four accounting firms have revealed that dozens of UK partners have been forced out of their jobs for inappropriate behaviour including bullying and sexual harassment.

December 13, 2018

Financial Times

Reputation value accrues only when stakeholders are aware.

“Mr Sproul said …he had chosen to be transparent …in order to shine a light on our commitment to an inclusive culture’”.

Removing colleagues or partners should their behaviour go against what we expect at Deloitte — is critical.”

Reputation value: economic benefits of stakeholders’ expectations of authenticity.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution. What’s your strategy?