Investors have started to call loudly for action on climate change, but few are following up their words adequately with deeds. More specifically, very few shareholders are voting against directors at companies that have shown themselves to be either oblivious or dismissive of climate risks. As the 2019 proxy voting season approaches, we must up the ante. Investors should seek to fire directors who have become obstacles to building climate resilience. Shareholders should also vote against using auditors who fail to ensure prudent accounting of material climate risks.

February 1, 2019

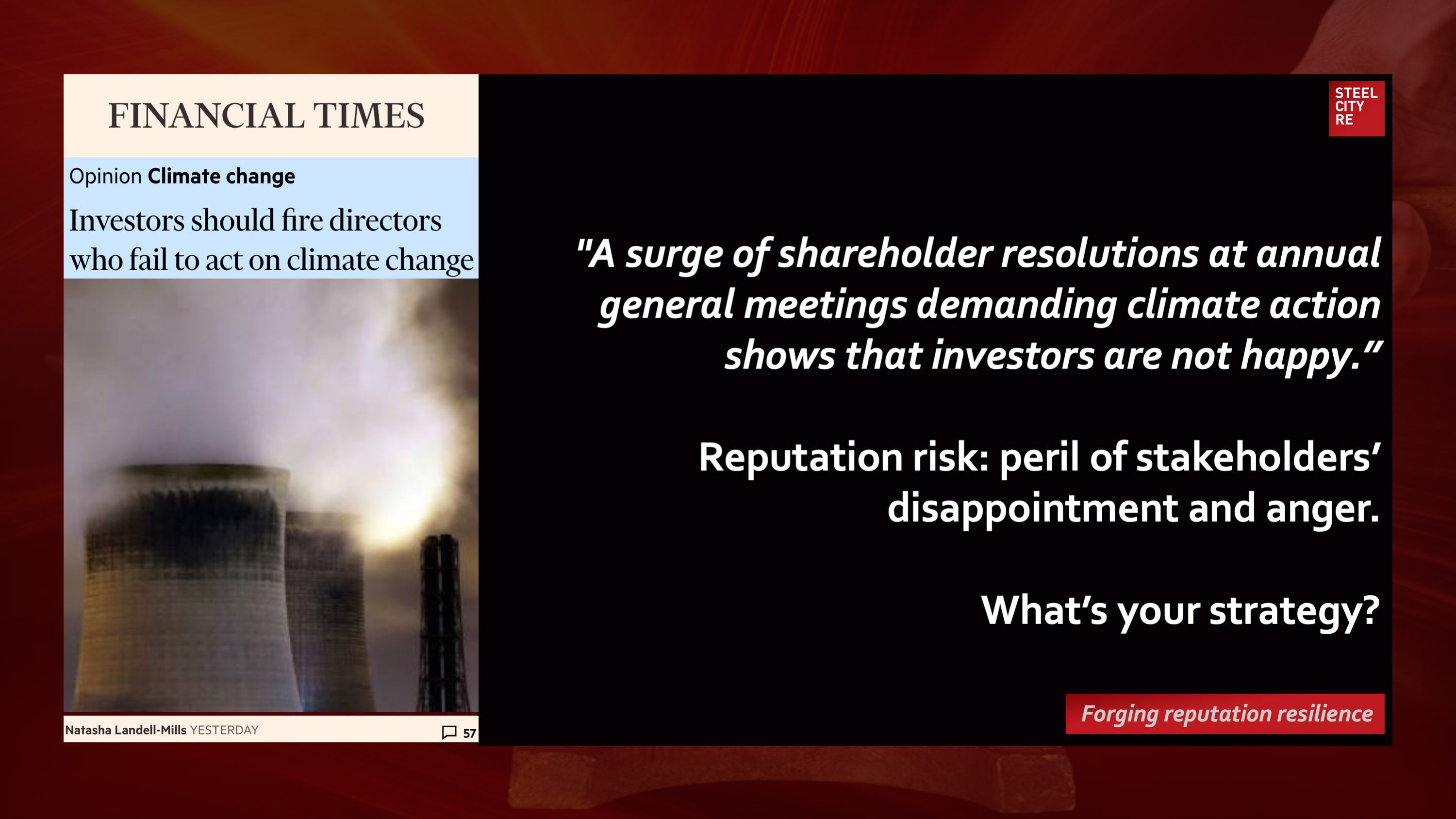

Financial Times

A surge of shareholder resolutions at annual general meetings demanding climate action shows that investors are not happy.

Reputation risk: peril of stakeholders’ disappointment and anger.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution. What’s your strategy?