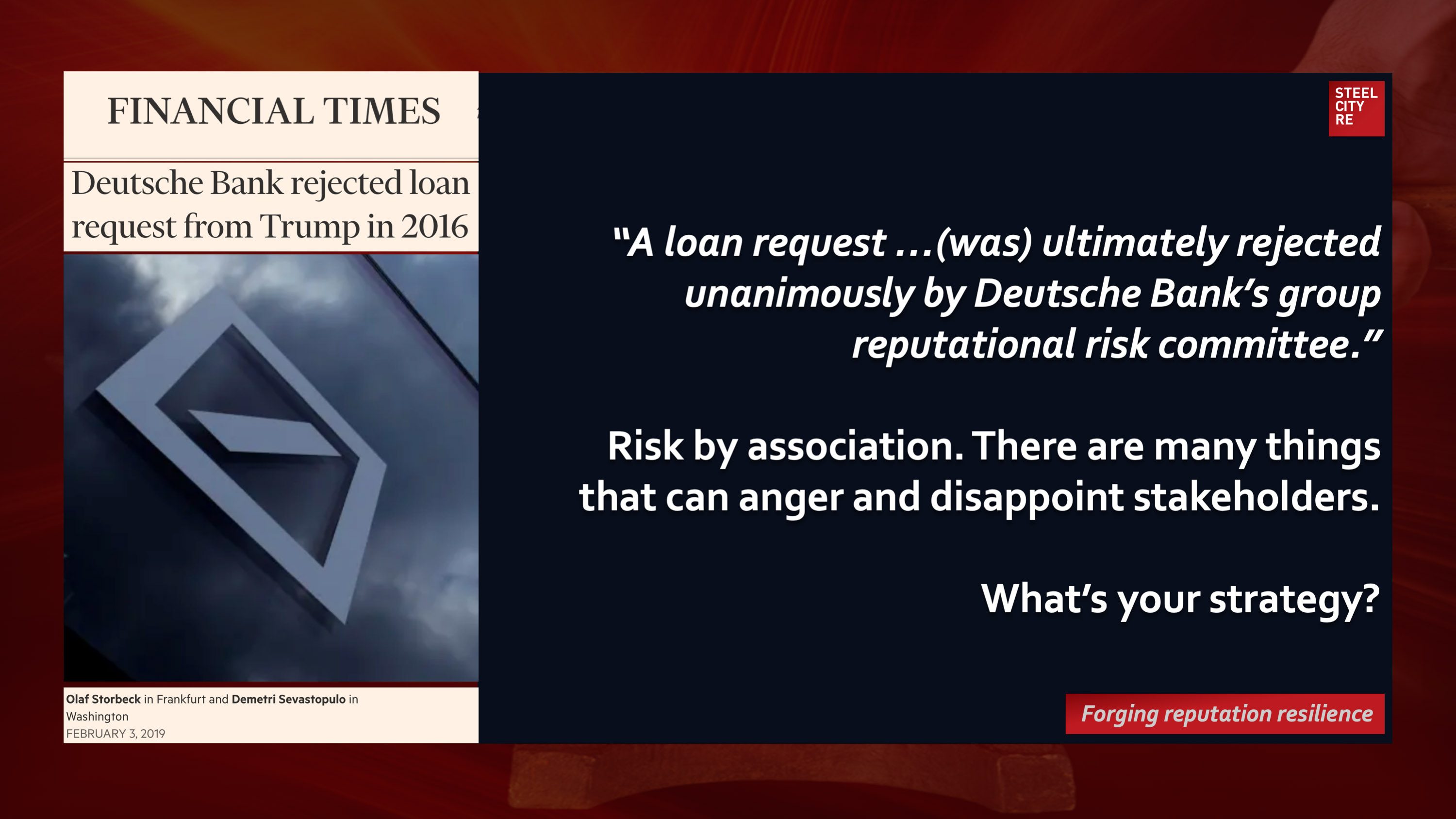

Deutsche Bank rejected a loan request from Donald Trump in early 2016 after deciding the reputational and financial risks were too high, according to a person familiar with the matter….The request was discussed and ultimately rejected unanimously by Deutsche Bank’s group reputational risk committee.

February 6, 2019

Financial Times

A loan request from Donald Trump in early 2016…(was) ultimately rejected unanimously by Deutsche Bank’s group reputational risk committee

Risk by association. There are many things that can anger and disappoint stakeholders.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution. What’s your strategy?