In the case of Purdue, it appears as if they failed to recognize quickly enough that, at some point, their stakeholders – and the expectations of those stakeholders – changed. …Suddenly, elected officials at all levels became stakeholders. Local health organizations and nonprofits became stakeholders. Additional regulatory and law enforcement agencies became involved. All their expectations were different. And then, the expectations of existing stakeholders – from physicians to regulators – changed. Addiction had become a crisis in America, opioids were part of it, and Purdue was at the center of opioid sales.”

PharmExec

February 21, 2019

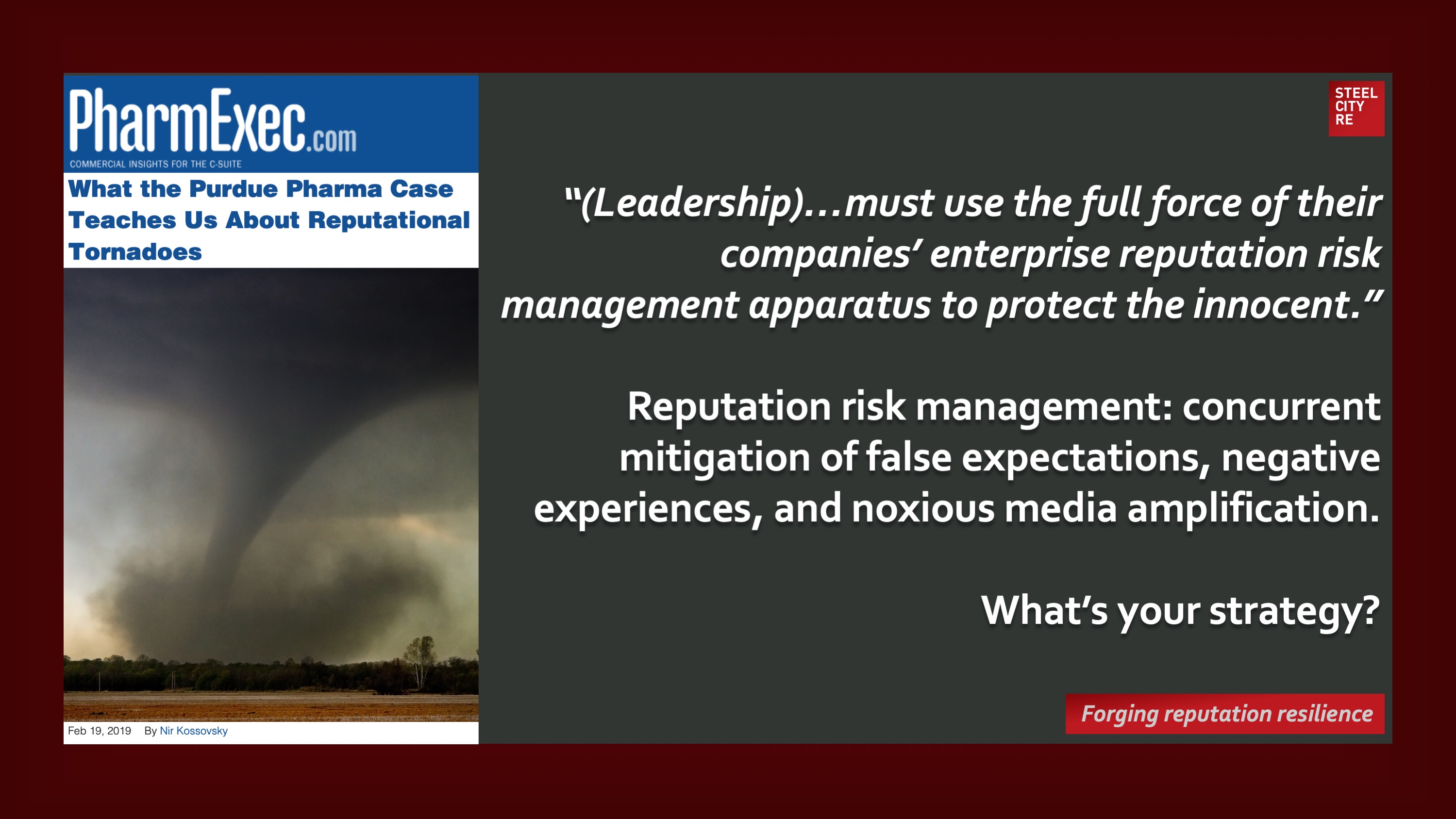

“(Leadership)…must use the full force of their companies’ enterprise reputation risk management apparatus to protect the innocent.”

Reputation risk management: concurrent mitigation of false expectations, negative experiences, and noxious media amplification.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution.

What’s your strategy?