“NC State / Protiviti Survey 2019: There is variation in views among boards and C-suite executives regarding the magnitude and severity of risks for 2019 relative to prior years. Interestingly, board members report the highest overall score about their impression regarding the magnitude and severity of risk for 2019 relative to CEOs, CFOs and CROs. Out of the 30 risks examined, board members rate 26 of the 30 risks as “Significant Impact” risks. In contrast, CEOs only rated six of the 30 risks at that level…(Nevertheless, even) CEOs perceive a noticeable upward shift in risks for 2019 relative to 2018.”

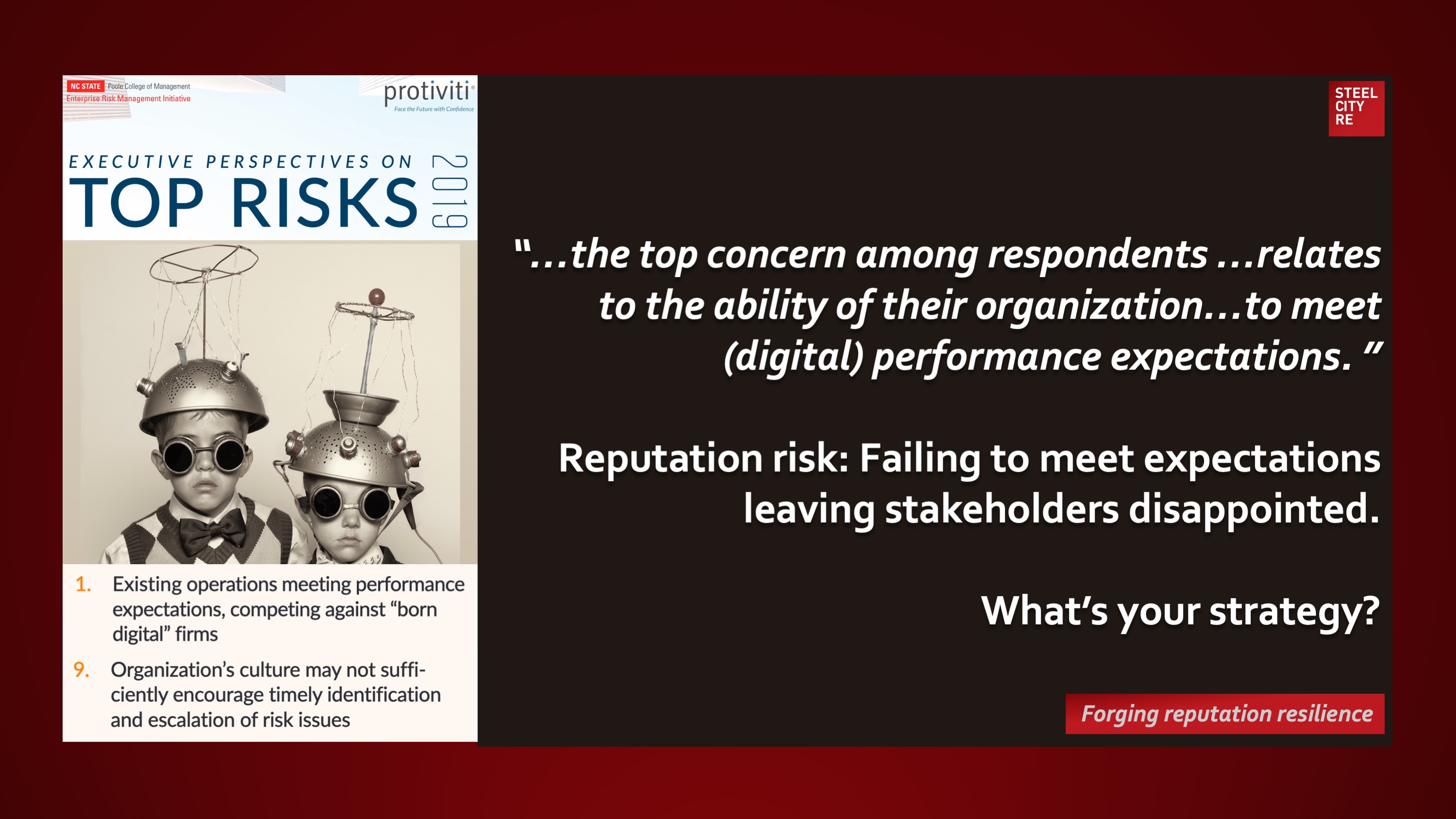

NC State/Protiviti 2019 Survey

March 3, 2019

“…the top concern among respondents …relates to the ability of their organization…to meet (digital) performance expectations.”

Reputation risk: Failing to meet expectations leaving stakeholders disappointed.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution.

What’s your strategy?