“In a research note following the hearing, Isaac Boltansky of Compass Point Research and Trading said even though ‘Wells Fargo has clearly taken steps to address the account scandal and the cultural concerns at the core of the bank’s problems, … there is pronounced frustration in Washington regarding the pace of change, the seemingly steady stream of subsequent setbacks, and consumer redress efforts.’

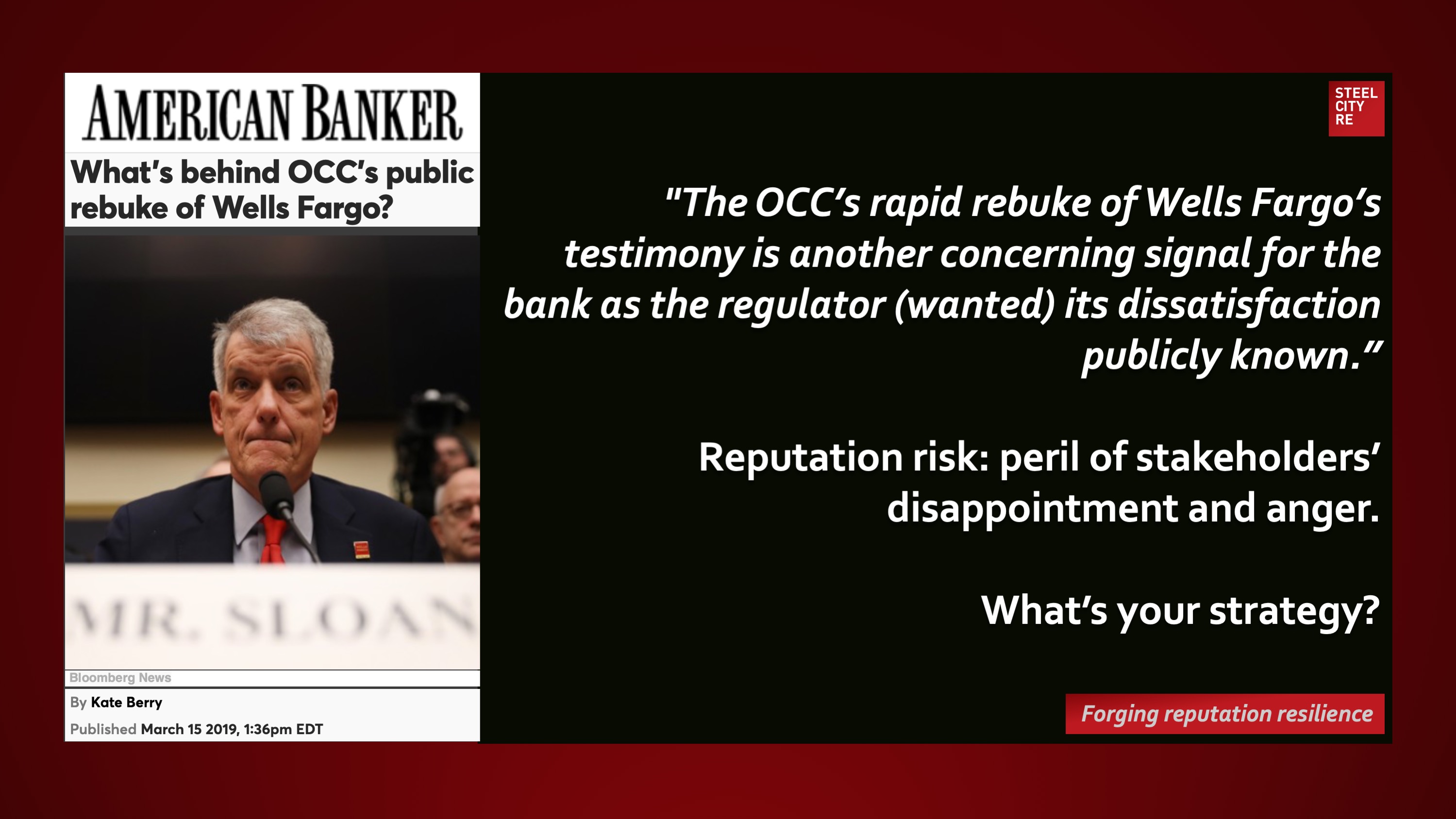

‘The OCC’s rapid rebuke of Wells Fargo’s testimony is another concerning signal for the bank as the regulator did not want a single news cycle to turn without making its dissatisfaction publicly known…’”

American Banker

March 18, 2019

“The OCC’s rapid rebuke of Wells Fargo’s testimony is another concerning signal for the bank as the regulator (wanted) its dissatisfaction publicly known.”

Reputation risk is the peril of stakeholders’ disappointment and anger.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution.

What’s your strategy?