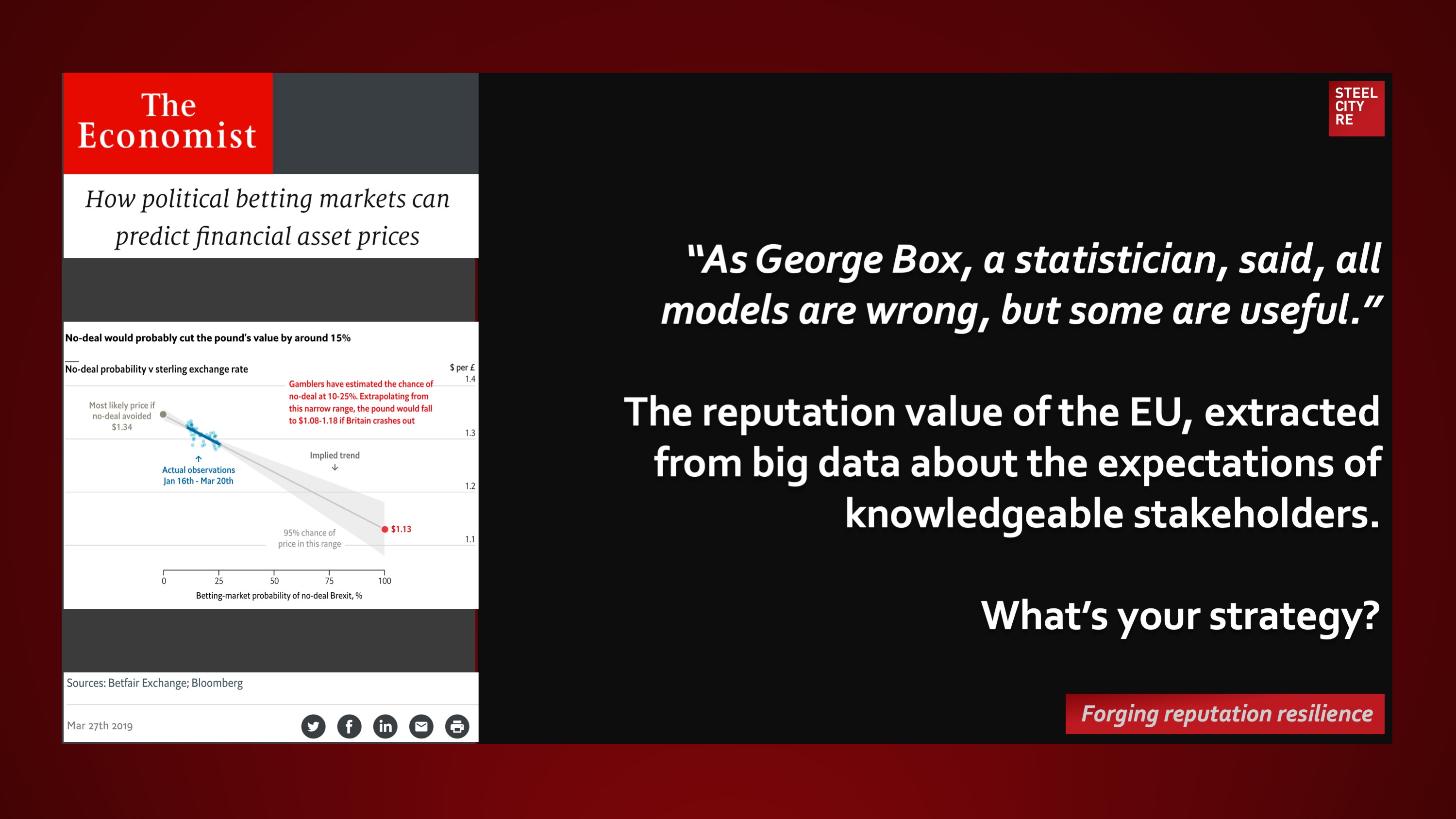

“On January 16th a market opened on Betfair Exchange, a betting website, on whether Britain will crash out by March 29th, the original Brexit deadline. Punters have bet £3.9m ($5.1m)…(The data) allow for educated guesses about where the pound might land if Britain crashes out…(I)n the event of no-deal, there would be a 95% chance sterling would fall from its current price of $1.32 to between $1.08 (last reached in 1985) and $1.18. The most likely value would be $1.13.”

Economist

March 28, 2019

“As George Box, a statistician, said, all models are wrong, but some are useful.”

The reputation value of the EU, extracted from big data about the expectations of knowledgable stakeholders.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution.

What’s your strategy?