“Corporate leadership needs new and more effective protection against the impact of reputational crises, for the enterprise and for themselves individually – protections that credibly establish their fulfillment of their management duties; blunt litigious, regulatory and popular attacks; and enable the company to mount stronger defenses when attacks do occur.

They need to establish firmly in the minds of their myriad stakeholders—customers, employees, investors, and regulators, for example—that directors have fulfilled their oversight duties. Otherwise, they may find themselves in the position of having to explain why, having overseen companies that mention reputational risk repeatedly in public filings, their quiescence was not negligent.”

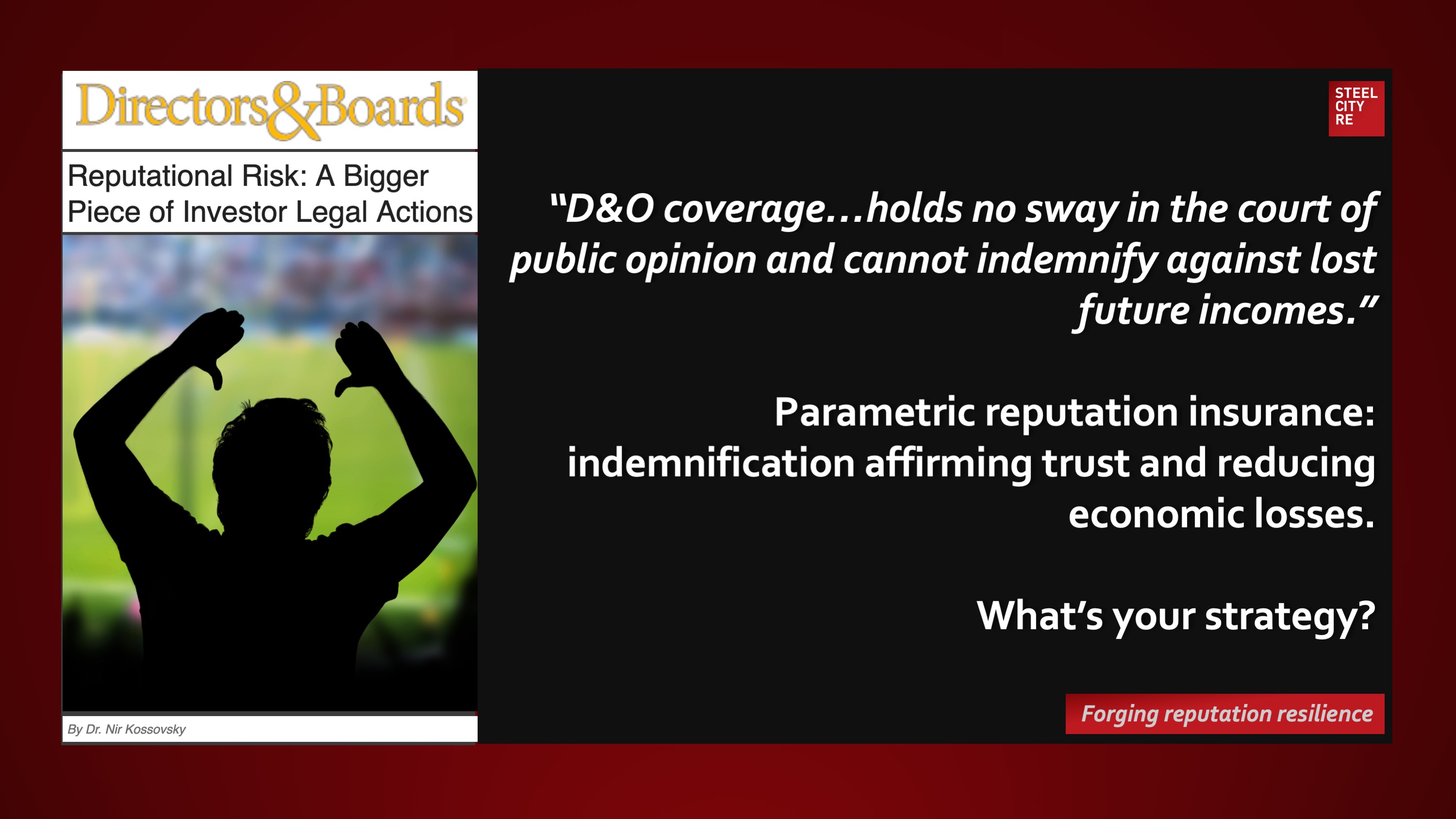

Boards & Directors

May 1, 2019

D&O coverage…holds no sway in the court of public opinion and cannot indemnify against lost future incomes.”

Parametric reputation insurance: indemnification affirming trust and reducing economic losses.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution.

What’s your strategy?