“(Oklahoma’s) lawyers, including the attorney general, Mike Hunter, laid out their case for nearly two hours, seeking to badly tarnish the company….Though he deplored the use of the courtroom to solve the state’s opioid crisis, Mr. Ottaway (Johnson & Johnson’s lawyer) said in conclusion: ‘When you’re right, you fight.’”

New York Times

May 28, 2019

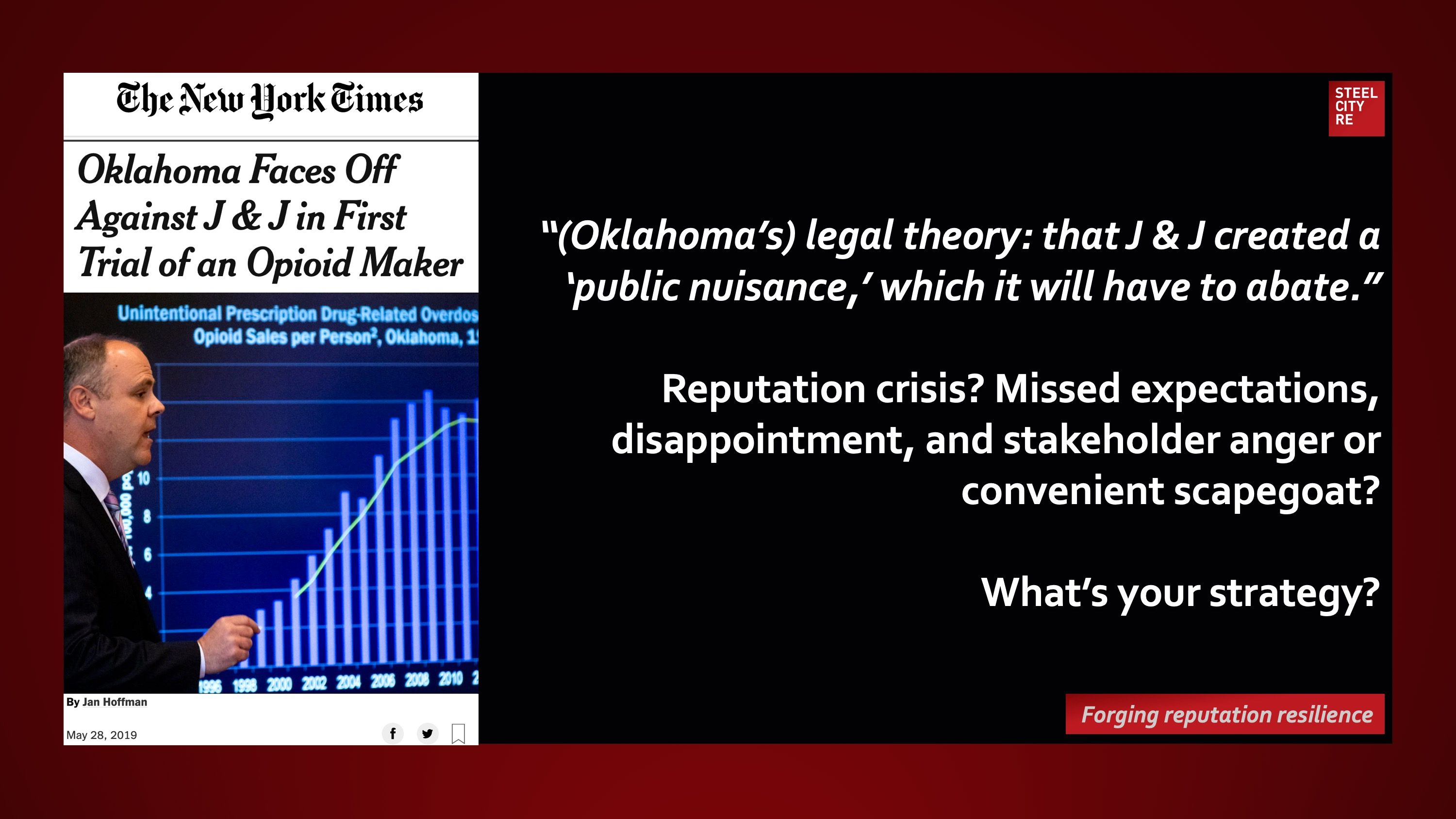

“(Oklahoma’s) legal theory: that J & J created a ‘public nuisance,’ which it will have to abate.”

Reputation crisis? Missed expectations, disappointment, and stakeholder anger or convenient scapegoat?

For a broader view of reputation risk, discover additional articles by Steel City Re here, mentions of Steel City Re here, and comments on newsworthy topics by Steel City Re here. To read an abstracted summary of reputation risk, see below.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution.

What’s your strategy?