“David Spreng, founder of a Silicon Valley lender called Runway Growth Capital, questioned why WeWork’s underwriters had not identified investor concerns sooner in the process. ‘That is their job,’ he said: ‘Today, there’s a lot of pre-marketing [of IPOs]. If JPMorgan’s institutional investors were throwing up all over this, they should have known.’”

Financial Times

September 24, 2019

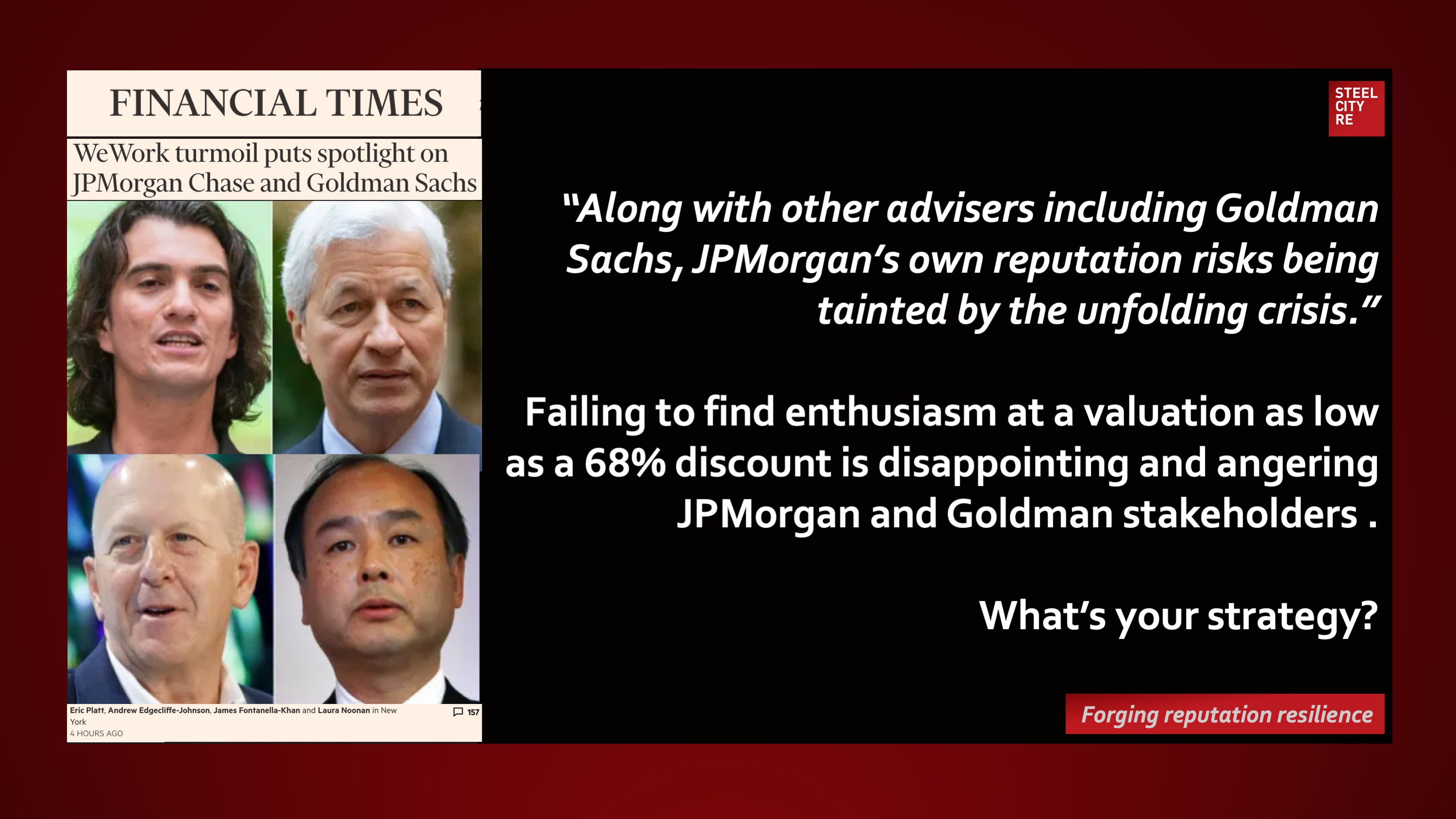

“Along with other advisers including Goldman Sachs, JPMorgan’s own reputation risks being tainted by the unfolding crisis.”

Click on Read More (below) for full text (paywall).

Failing to find enthusiasm at a valuation as low as $15bn (68% discount) is disappointing and angering key JPMorgan and Goldman stakeholders.

For a broader view of reputation risk, discover additional articles by Steel City Re here, mentions of Steel City Re here, and comments on newsworthy topics by Steel City Re here. To read an abstracted summary of reputation risk, see below.

Risk governance and management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive enterprise reputation risk solution.

What’s your strategy?