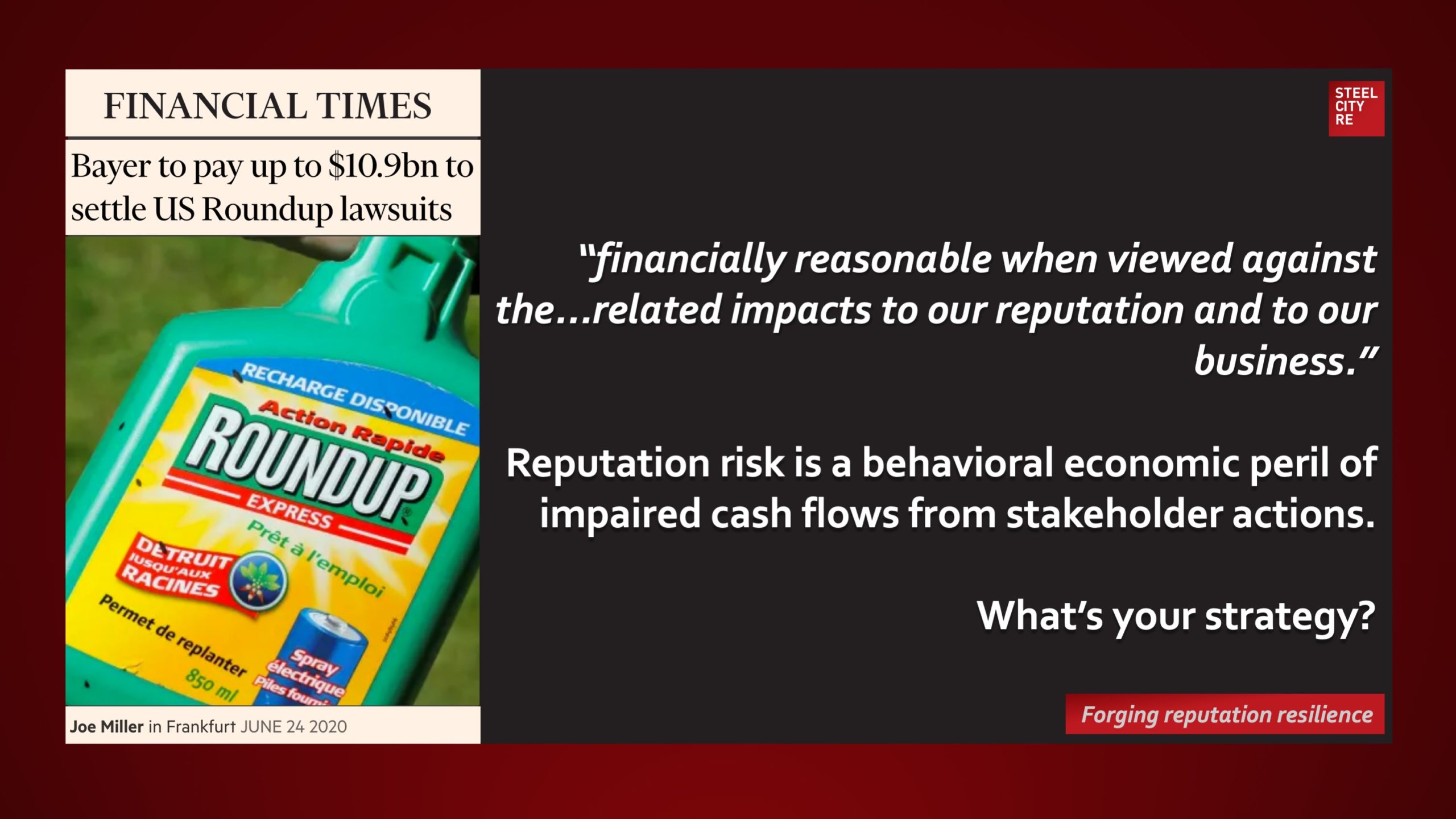

“The $10.9bn Roundup settlement ‘comes at a high price which will delay the company’s deleveraging trajectory’, said Moritz Melsbach, an analyst at rating agency Moody’s, as cash that could have been used to reduce the debt accrued to finance the Monsanto takeover will now be put towards the agreement.”

Financial Times

June 27, 2020

“financially reasonable when viewed against the…related impacts to our reputation and to our business.”

Click on Read More (below) for full text (sorry, paywall).

Reputation ris

Reputation value is a strategic power companies use to sell more, faster, and at premium prices; and to obtain labor, vendor services, as well as capital on preferred terms.

Steel City Re mitigates the hazards of ESG (reputation) risk that threaten reputation value. We use parametric reputation insurances, ESG insurances, and risk management advisory services to make our clients reputationally resilient.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive Steel City Re reputation risk governance and management solution.

Click on the highlighted text for a broader view of reputation risk case studies and reputation premium; or to explore additional articles by Steel City Re here, mentions of Steel City Re here, and comments on newsworthy topics by Steel City Re here.

Learn about our services here.

Context and Background

Risk managers are now central to the process for managing risks to reputation and that’s a process marketers and communications professionals need to be a part of. The oversight of reputation risk management is mission-critical.

Courts have increasingly been ruling that reputation is a mission critical function and oversight of its management is a responsibility of the board of directors. Courts are also ruling that marketing statements companies make – if they related to issues that affect their reputation, like ESG – may be considered material by investors. Litigation along these lines has yielded large settlements or verdicts for plaintiffs.

And now, the SEC has proposed new rules requiring disclosures by public companies related to their ESG activities; those statements could become a communications and reputational minefield.

As a result, reputation risk management is evolving into an intelligence gathering operation spanning the entire enterprise, roping in the enterprise risk manager, compliance counsel, and increasingly, reporting up to the Chief Legal Officer. There is a growing recognition that reputation is not a product merely of marketing and media coverage, but of the degree to which stakeholders’ expectations are aligned with actual performance. The reputation risk management process requires a thorough and ongoing analysis of stakeholder expectations, the risks of disappointment, and a plan for either managing those expectations or assessing and insuring against the cost of failure.

One Last Question

Are ESG insurance or reputation insurance part of your strategy?