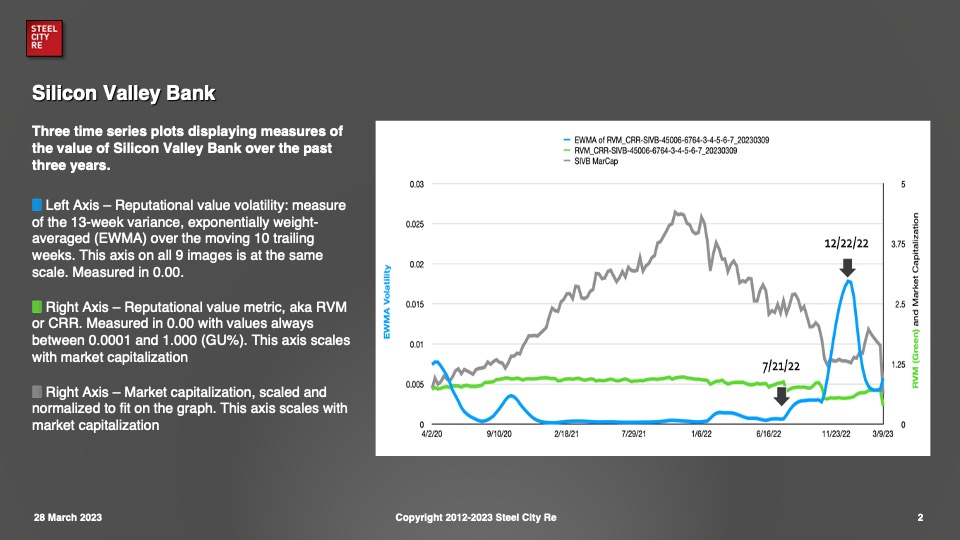

Yes, reputation is insurable. That’s the opinion of several carriers and agencies interviewed by Law360. “The proportion of the asset base of larger companies, and for the majority of companies these days, has shifted from the tangible and physical to the intangible. Reputation and brand are a core part of that,” Neil Kempston, head of Beazley’s Incubation Underwriting team, told Law360. […] Steel City Re instead offers parametric coverage, in which after some reputational loss, the insurer automatically applies a preset coverage amount based on the level of reputation impairment once a policy is found to be triggered.