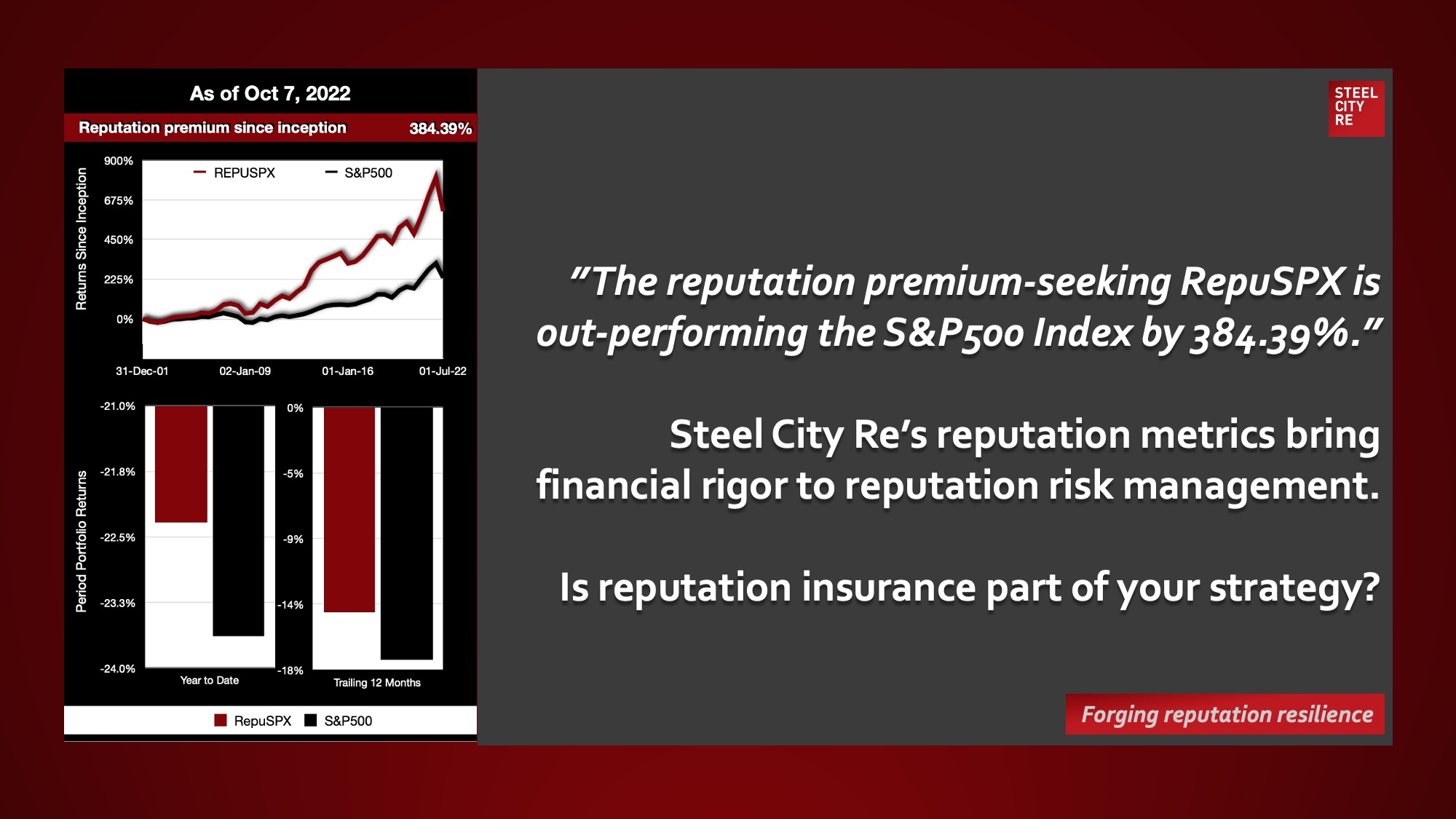

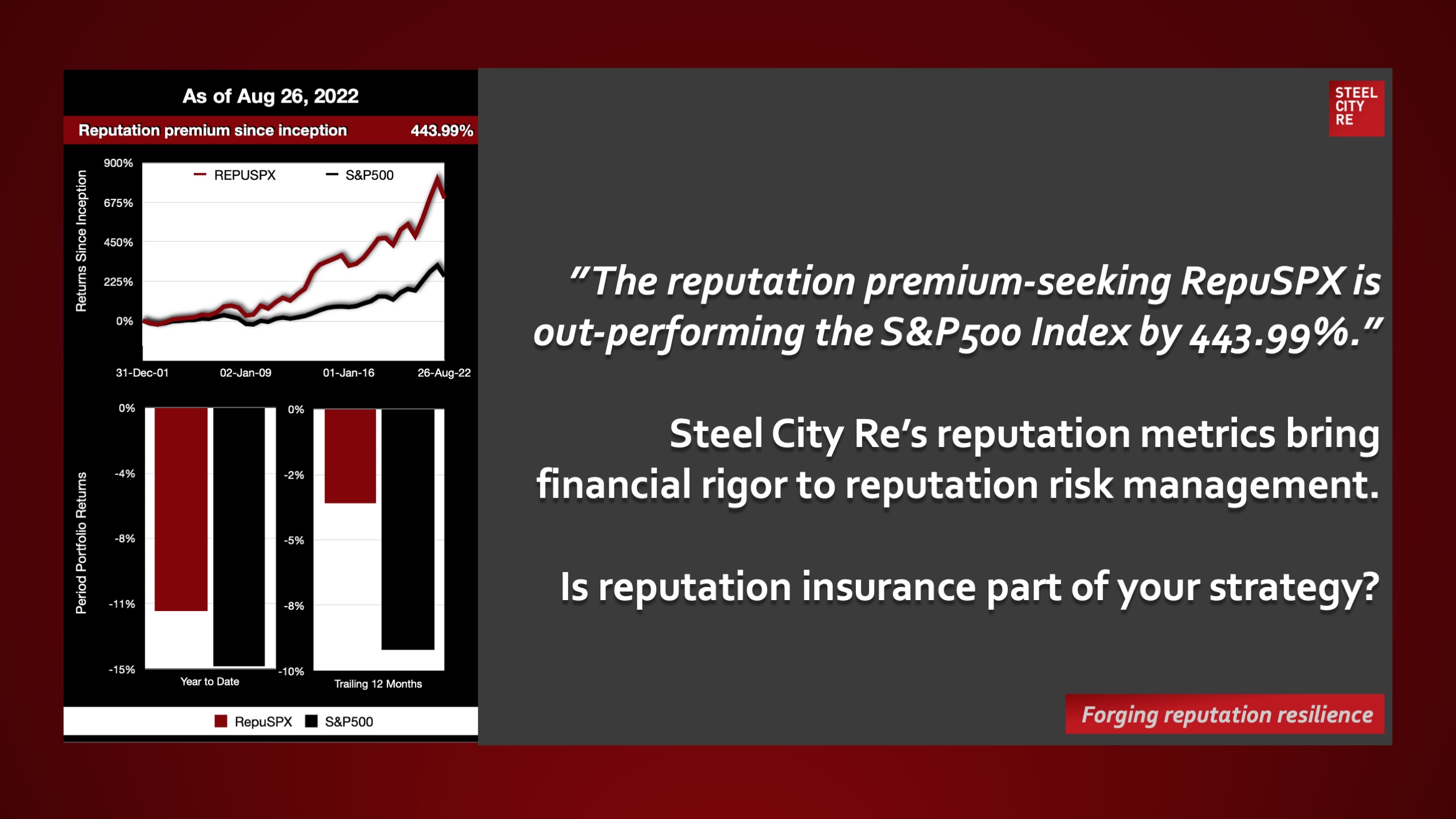

Pay by ESG Performance Metrics. While environmental, social and corporate governance (ESG)-linked pay and bonuses are increasingly popular in big businesses, the concept found a lack of support among two recent visitors to Intelligent Insurer’s hub for debate and discussion: Nir Kossovsky, head of Steel City Re, an insurance intermediary and risk advisor for reputation and ESG linked reputation risk; and GCY Associates’ founder Gerald Chen-Young, who specialises in institutional investment management, consulting and advice, and has worked with several boards on ESG issues.