Ideas, Beliefs and Practices

\)

Culture Fosters Stakeholder Trust

Steel City Re’s culture—the ideas, beliefs, and practices of our organization—nurtures trust in our products and services. Our ideas and beliefs are an open book. Our intellectual journey is memorialized transparently in the professional literature.

We honor the first principle of corporate law: corporations may only conduct lawful business by lawful means. We believe that quality risk governance and risk management (controls) encourage conformance with this principle. Such controls comprise processes that are auditable, reliable, and repeatable. Both our own internal practices, and those we help establish for our clients, are engineered to evince quality.

“A man I do not trust could not get money from me on all the bonds in Christendom. I think that is the fundamental basis of business.”

John Pierpont Morgan

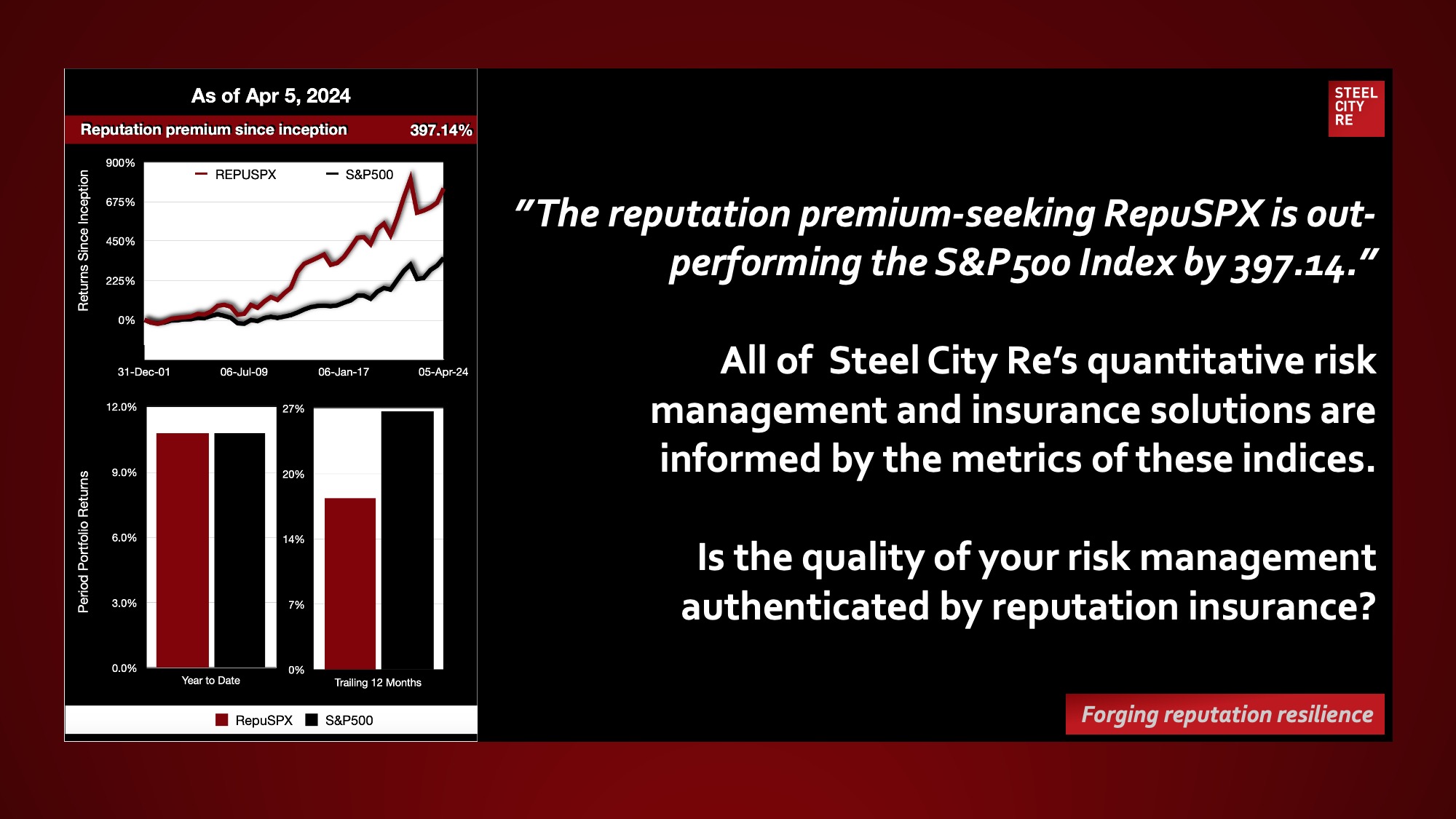

Culture fosters stakeholder trust. Our approach to trustworthy risk governance and management is a blend of quality management concepts (Define, Measure, Analyze, Improve, Control) backed by behavioral economic principles (Nudge and Signaling Theory); and authenticated with financial instruments (Insurance, Equity Portfolios). Features differentiating our solutions in the market include how we define and measure reputation value and risk; how we nudge conformance; how we engineer our parametric insurance solutions and arbitrage strategies, and how we authenticate our synthetic measures of reputation value.

Our deployment of quality risk governance and management solutions begins with the following definitions:

- Reputation Value: the forward moving economic benefit of stakeholders’ expectations. We keep our thumb on the pulse of what our stakeholders expect and we deliver on those expectations.

- Reputation Risk: the threat of economic loss of reputation value from angry disappointed stakeholders. We avoid risk by delivering on our promises and not using aspirational language or marketing pablum to win over our stakeholders.

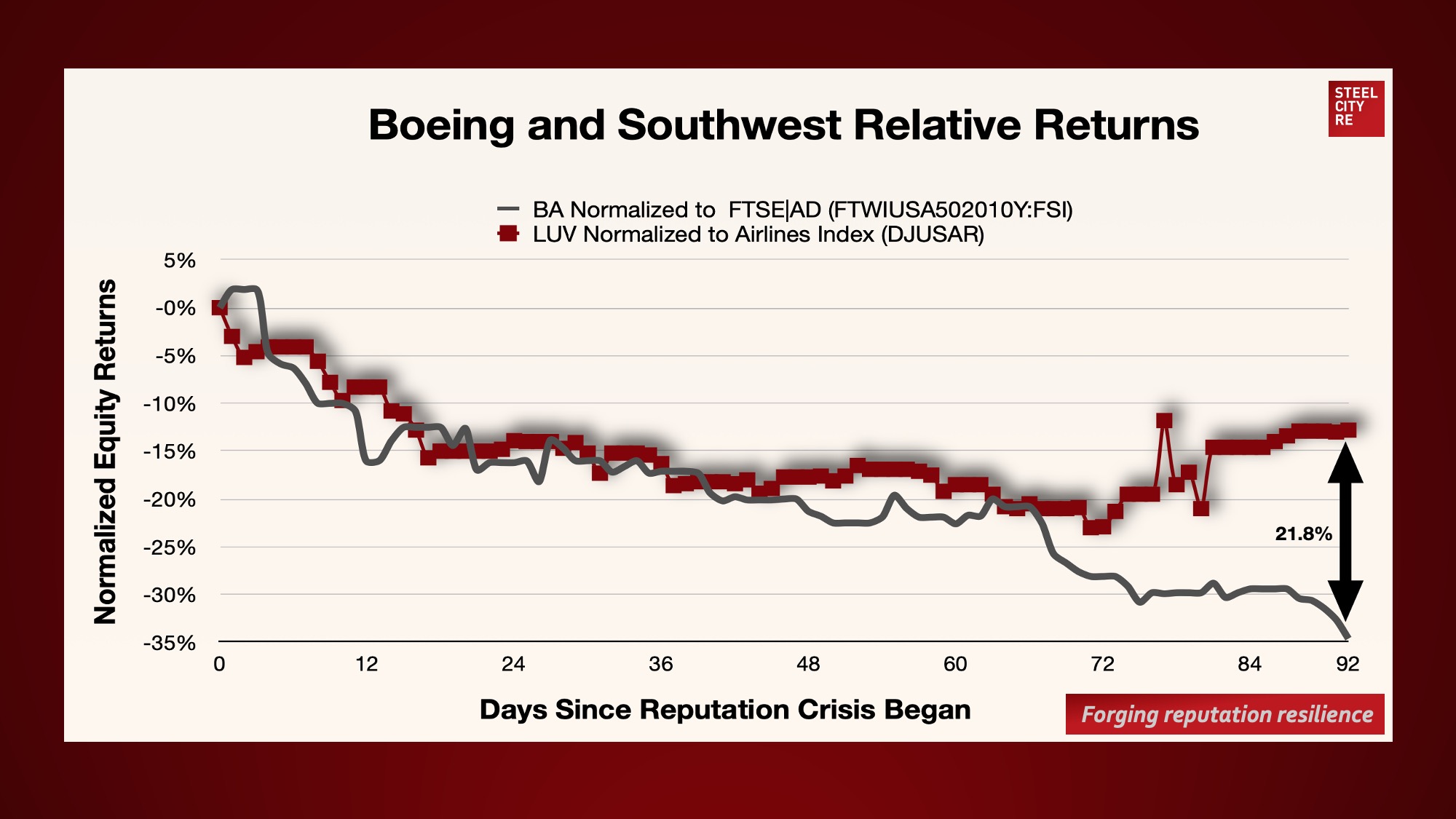

- Reputation Crisis: the ugly moment of truth when stakeholders realize their expectations are not being met and initiate economically painful actions. Losses have a long tail.

- Reputation Risk Management: a strategy informed by behavioral economics to help mitigate a reputational crisis. Reputation Risk Management involves the entire risk management apparatus: dutiful governance, resolute leadership, effective controls and meaningful strategic insurances.

- Reputation Insurance: a parametric indemnification which will reduce anticipated economic losses from the long-tail consequences of a reputational crisis.

We believe that society—markets, stakeholders, activists, et al.—rewards companies with trustworthy risk governance and risk management. When told a simple, authenticated, and convincing story, society will appreciate, value and reward those companies. In other words, the whole point of creating value from these strategic trustworthy capabilities is lost if they are kept secret.