Reputation Health Monitoring

Parametric Reputation Health Risk Monitoring reports. The speed of recent major corporate and banking events has made it clear that Boards of Directors need better risk oversight tools to recognize looming mission-critical crises before they trigger bank runs or equity value incinerations.

Marchand v Barnhill and In re Signet heralded reputation risk’s breach of boardroom doors. D&O liability coverage is insufficient to protect Directors and Officers against personal reputational damage caused in the court of public opinion. Steel City Re is offering access to its proprietary Reputation Volatility Metrics (RVM) Reports as a stand-alone product to Boards of Directors seeking timely, actionable intelligence tools to help them oversee mission critical risks.

“Stakeholder Expectations: Investors, regulators, and legislators keep raising the bar for boards on the oversight of everything…”

Adaptive Governance: Board Oversight of Disruptive Risk, National Association of Corporate Directors

Reputational Value and Volatility (Risk) Report

Best governance practices encourage boards to improve their risk oversight with independent intelligence sources. At a time when companies face multiple shifting and diverse risks that are magnified and accelerated by weaponized social media, Steel City Re’s RVM report is a powerful tool for board members overseeing the management of enterprise risks such as ESG, reputation, ethics, safety, and security.

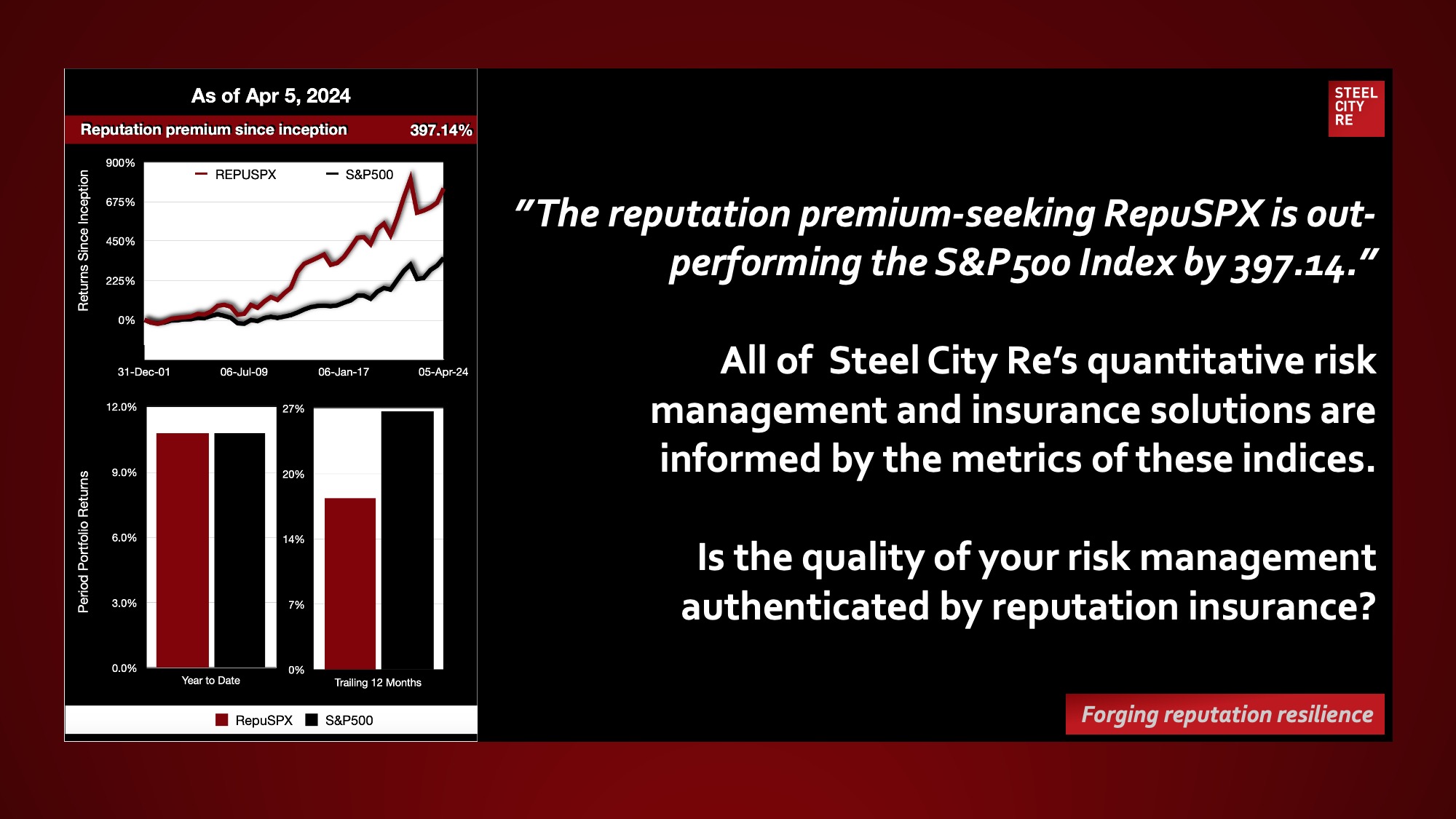

Steel City Re’s RVM report is the only objective quantitative risk strategy product measuring reputation value and volatility, enables peer benchmarking and trend analysis; and is powered by parametric technology that also enables reputation insurance, equity arbitrage strategies, and the public reputation-based equity index (INDEXCME: REPUVAR).

Steel City Re is now offering access to its proprietary Reputation Volatility Metrics Reports, as a stand-alone product to Boards of Directors seeking timely, actionable intelligence tools to help them oversee mission critical risks.

Previously, these reports were offered only as bundled benefits with Steel City Re’s reputation risk management advisory services and parametric ESG / reputation insurances.

“Corporate names are resilient: when their images get damaged, a change of management or strategy will often revive their fortunes. But personal reputations are fragile: mess with them and it can be fatal.”

John Gapper

Reputational Damage Can Turn a Director into a Professional Pariah.

An adverse event can implicate a director. If he or she becomes less desirable to the other corporate boards, that usually means millions of dollars in losses over the course of a career.

With recent bank and general corporate crises demonstrating the need for corporate boards to have better tools for recognizing impending mission critical crises before they surface publicly in bank runs or equity implosions–and tarnish Director’s personal reputations.

Specifically, with corporate ESG activities drawing heightened scrutiny and posing both legal and reputational risks when they fail to meet expectations, Steel City Re launched in September 2021 ESG Insurance. Director and officer reputation insurance pays for extraordinary “strategic managerial and governance actions signaling corporate values” that may arise in the context of an ESG crisis.

In March 2023, Steel City Re began offering access to its proprietary Reputation Volatility Metrics Reports, which it previously had bundled with its reputation risk management advisory services and its family of parametric ESG and reputation insurances.

Metrics on more than 8000 public companies are updated weekly and populate reports that help risk professionals manage reputation risk and board members oversee risk strategies to protect mission critical assets.

What’s your strategy?

Reputational risk is a concern for every company, organization or individual in corporate leadership. Let us help develop your strategy for reputational resilience.