Cost of Loss

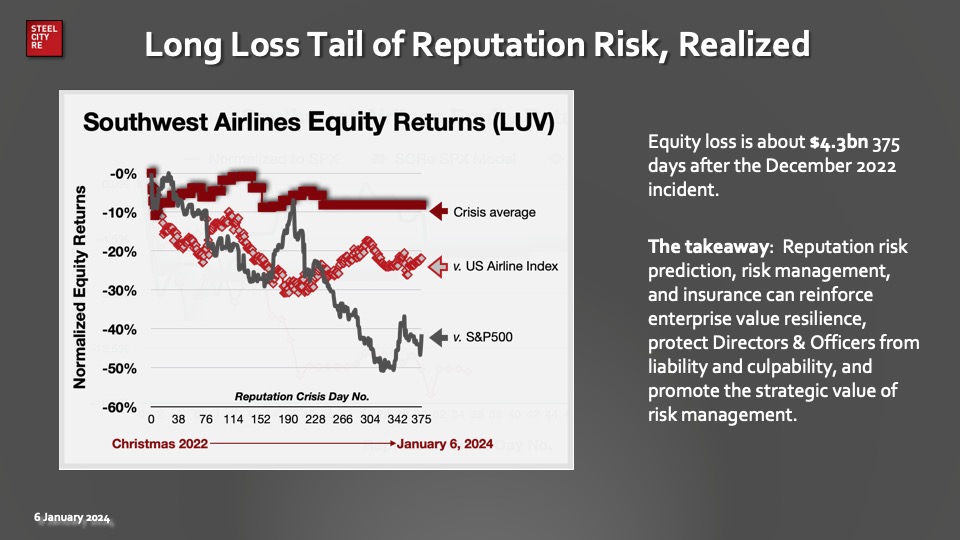

Reputation value loss and crises comprise widespread stakeholder disappointment and diminished trust, causing go-forward economic losses that Steel City Re has been measuring accurately for nearly two decades.

It is impossible to predict or prevent every possible reputational incident.

No matter what systems are in place, a group of rogue employees can ignore them or override them. Reputation value loss in a crisis can be caused by a failure far down the supply chain or by political or cultural changes that upend the status quo. Privacy issues facing social media companies and sexual harassment issues being elevated by the #metoo movement are two such issues that sometimes can appear seemingly out of nowhere.

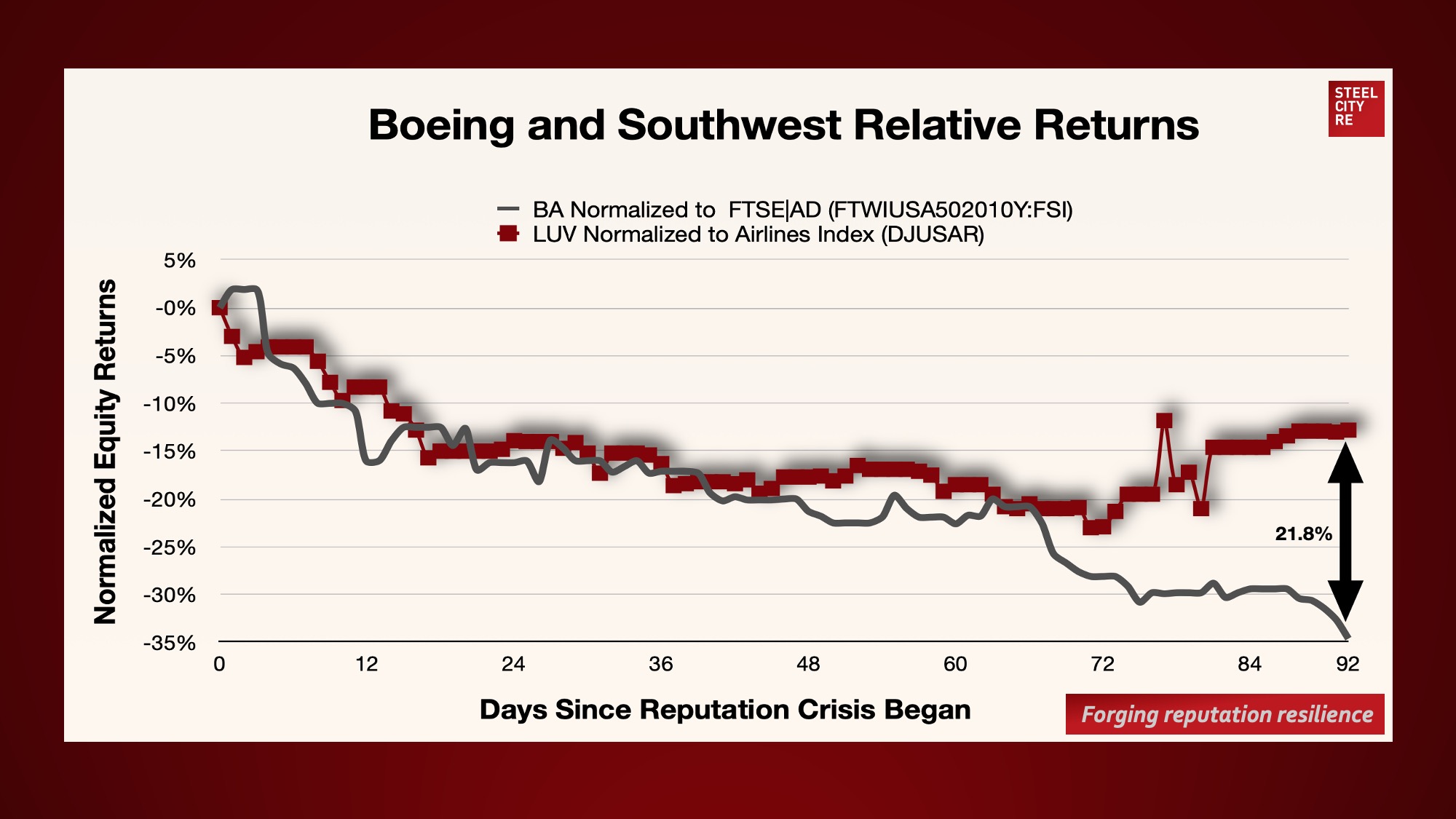

Disappointed stakeholders destroy value by becoming disloyal customers, disengaged employees, distracted suppliers, distrustful creditors, dismissive investors, and determined litigators & regulators. When stakeholders are disappointed, the additional costs will amplify the operational losses by 200% to 700%.

The most severe losses are associated with regulatory action. The losses will register immediately in market cap and potentially in bond downgrading. All go-forward losses eventually become apparent in a company’s profit and loss statement and the bottom line, net income. Corporate finance executives should be able to model reputational value at risk.

DOJ’s new policy heightens risks to individual reputations and likely will make finger pointing and individual blame far more common.”

Nir Kossovsky, CEO, Steel City Re

Large organizations can usually recover from reputational crises, given enough time and money. Individual reputations are not as resilient.

In our current culture, with weaponized social media, and angry public and political figures anxious to direct that anger, and easy access by a mass audience to information on corporate finances and leadership – corporate reputational crises often turn into personal ones for officers and directors.

These individuals could lose millions of dollars in future income as a result of a spotlight being shone and fingers being pointed in their direction – an increasing risk now as the Department of Justice adopts a policy of rewarding companies that identify individual misdeeds.

Anyone in a corporate leadership position needs to ask themselves: “If I am asked – by a government agent, in a deposition or in a Congressional hearing – whether I did everything reasonable to properly set or meet my stakeholders’ expectations, what will my answer be? Will I be able to point to independent, third-party analysis and underwriting that validates my actions?”