ROI of Risk Management

Companies that mitigate reputational risk with risk management, financing, and insurances from Steel City Re can dissuade reputational attacks, thereby reducing the cost of negative events, the ensuing media coverage, and the costly tail of impaired cash flow. Our products reduce boards’ exposure to shareholder derivative suit liability and companies’ cost of capital at the same time.

- See also:

- Measuring Value

- Features of Risk

- Cost of Loss

Reputation risk management is a battle for the mind of stakeholders.

Strong corporate governance and reputation risk management are the kind of authentic, simple to understand story marketers and investment relations professionals need to be telling stakeholders. It helps mitigate reputational risk.

Not only does it inspire their confidence, it’s compelling to ESG raters, bond raters, and investors; and it shields the personal reputations of individual board members and provides leverage in negotiating D&O liability coverage in a hard insurance market. It produces a positive return on investment (ROI).

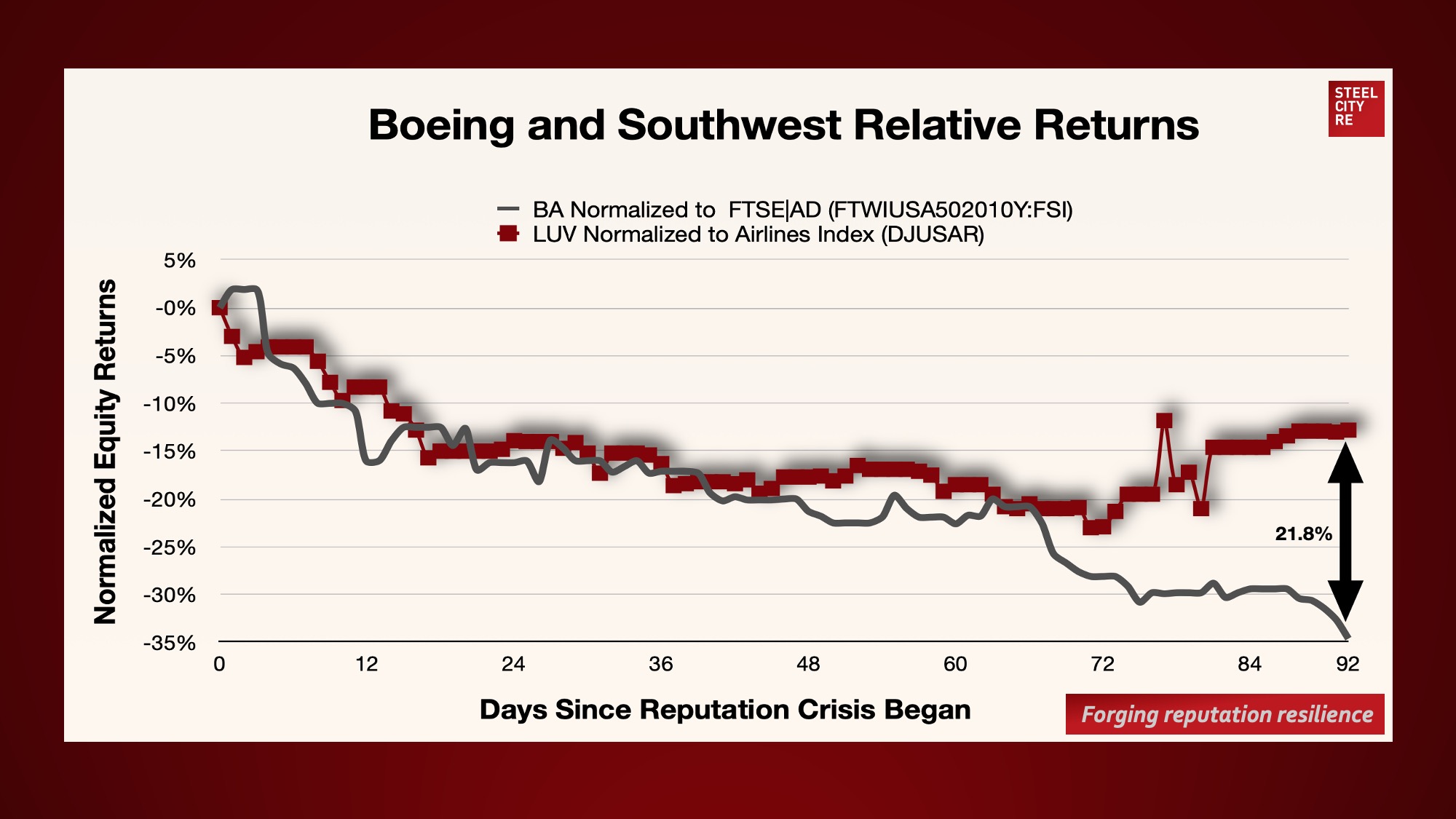

“Companies could add 20% of value or lose up to 30% of value depending on their reputation risk preparedness, and (crisis) management behaviour.”

Joint study by Aon and Pentland Analytics

Benefits to firms that mitigate reputational risk

Equity investors in companies paying less for capital will see higher earnings and a stock boost; bond holders will see bond values rise up to 20 basis points.

Employees directly experiencing that which is captured in stories of improved reputational risk governance will be more engaged.

Board members backed by authentic stories of reputation risk governance gain enhanced personal protections against culpabilities in the court of public opinion.

CEOs recognized in authentic stories of enterprise reputation risk management leadership will create enterprise value, and are at least less likely to be seen as having failed and forced to walk the plank to atone for reputational crises.

A “risk management system built into (Merck’s) governance structure…(has strengthened their ability) to fend off future reputational issues.”

Nir Kossovsky, CEO, Steel City Re