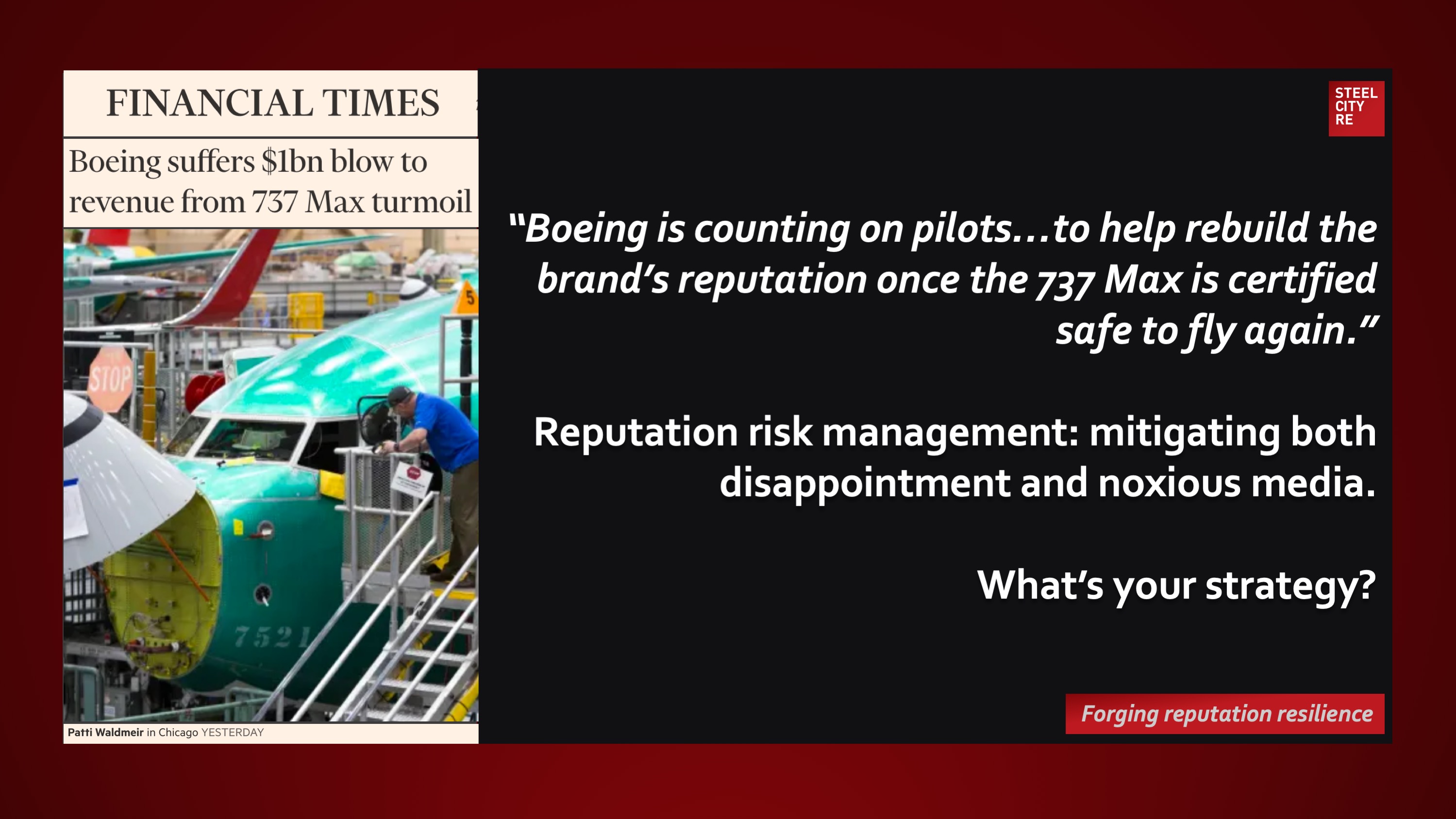

Boeing took a $1bn hit to its revenues and suspended full-year guidance as it revealed the initial financial impact of the worldwide grounding of its 737 Max aircraft last month…Chief executive Dennis Muilenburg said Boeing is counting on pilots, through their “bond” with airline passengers, to help rebuild the brand’s reputation once the 737 Max is certified safe to fly again, but said regaining passenger trust “will take time”.

Financial Times

April 26, 2019

“Boeing is counting on pilots…to help rebuild the brand’s reputation once the 737 Max is certified safe to fly again.”

Reputation risk management helps mitigate both disappointment and noxious media.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution.

What’s your strategy?