Parametric Insurance

A parametric reputation insurance policy anchors coverage for lost reputation value—the go-forward cost of loss from emotionally charged stakeholders. Insurance coverage is led by the Lloyd’s syndicate, Tokio Marine Kiln. The parametric reputation insurances, when covered by captives, tactically indemnify losses. Captive reinsurance strategically signals superior reputation risk management and governance. Separate additional towers for non-damage business interruption, crisis management, and related losses are available.

Parametric Reputation Insurance and ESG Insurance

Qualification for Steel City Re’s parametric solutions begins with a review, generally completed in less than 45 days, of a company’s quantitative measures of reputational health. Approximately 30% of public companies (and a much smaller fraction of privately-held companies) will qualify for coverage purely on an analysis of reputation health and risk implied by these quantitative measures.

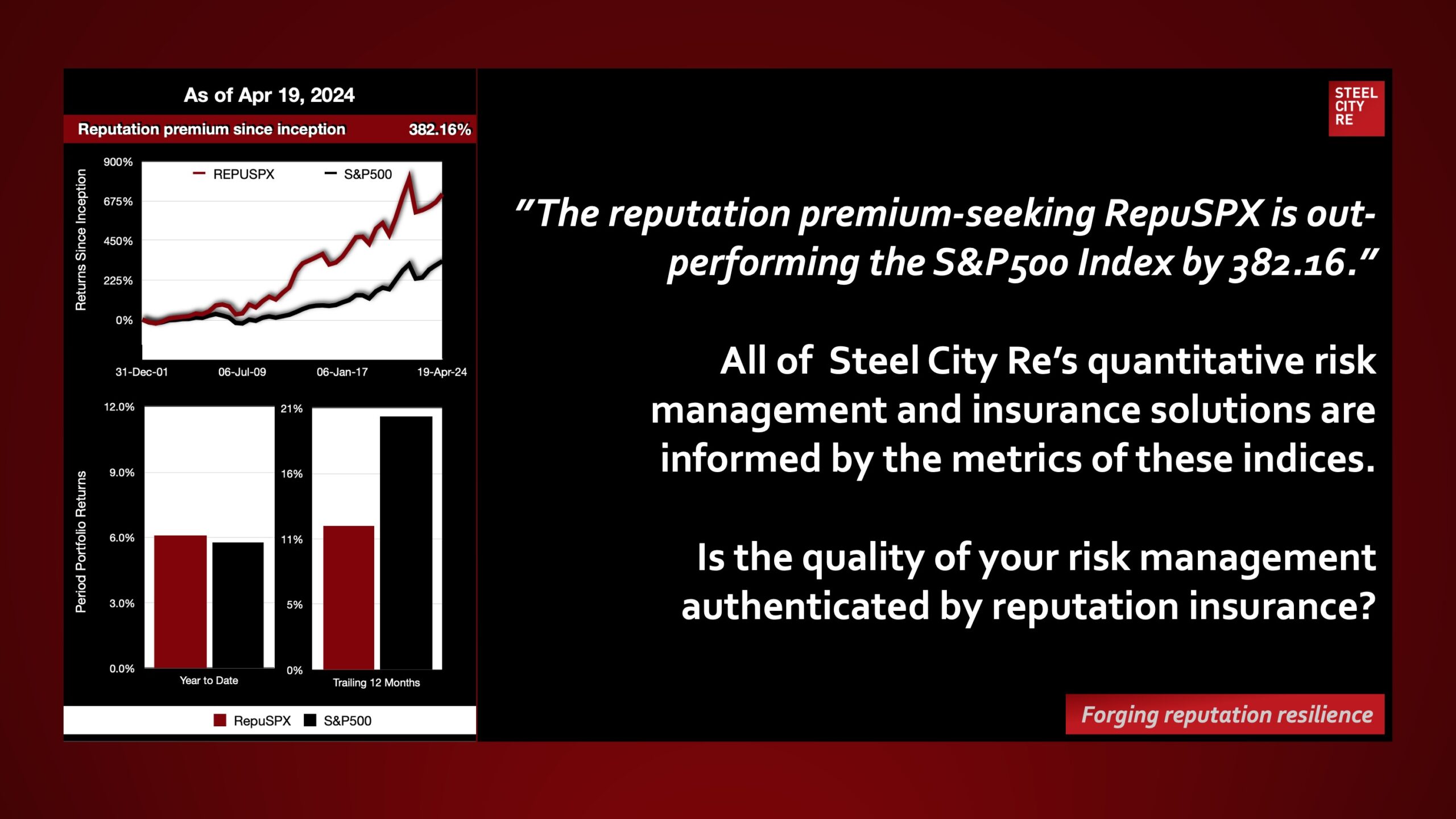

The parametric solutions, including the policies, are based on a reputational value index. This is a normalized multi-scalar index using weekly expectations for future economic performance and equity expectation variance to estimate departures from the reputational value range norm. Estimates are stratified by commercial sector, market capitalization, compliance authority, and index volatility. The Index utilises 20-years of weekly reputational value data for about 7800 companies at a single name resolution.

Coverage

Parametric reputation insurance policy: The objectives of coverage are both strategic and tactical. Typical risk transfer policies provide coverage with limits capped at $100 million. While this limit is growing, levels of coverage as low as $10 million can have a strategically impactful expressive force to mitigate a reputational crises.

Additional instrumental value for loss absorption may be structured through a captive insurance vehicle.

To protect value and mitigate the peril, companies should augment and substantiate their enterprise risk management (ERM) story with a captive…before the onset of a crisis.

“…these reputation-based indemnification instruments, structured like a performance bond or warranty with indexed triggers, communicate the quality of governance, essentially absolving board members of damaging insinuations by activists.”

Directorship Magazine, National Association of Corporate Directors

Triggers and Indemnification

Reputation Assurance, ESG Insurance, and a form-following captive insurance policy are parametric solutions. A Reputational Value Loss is triggered by a failure of a scheduled enterprise level governance or Board oversight process, evidenced by both negative media and a 20-week sustained drop in the Insured’s Reputational Value Metrics.

Levels of indemnification for risk transfer are typically structured so that the Gross Premium is in the vicinity of 1-2% rate on line. Levels of indemnification for captive insurance vehicles typically lead to higher Gross Premiums.

Parametric policies are products of Steel City Re’s maths group. Underwriting capacity for the insurance policies is led by the Lloyd’s syndicate, Tokio Marine Kiln.

Insurance Policy and Typical Indemnification Scenario

Parametric reputation insurance policy: An insured sustains an operational failure in one or more areas felt to be the duty of senior management and the board to oversee, such as ethics, innovation, quality, safety, sustainability, and security. The failure sparks stakeholder outrage that is memorialized in the media.

Within 90 days, the reputational value metric (parameter) falls below the first Loss Gate. Two weeks later the parameter drops below the second Loss Gate. Twenty weeks later, the parameter has consistently remained below the 2nd Loss Gate thereby meeting the parametric condition for indemnification at the second Loss Gate that typically pays 40% of limits. No extenuating circumstances are noted, so the claim is honored anywhere between 22 and 40 weeks from the triggering event.

A sample of Steel City Re’s basic parametric insurance policy form for both Reputation Insurance and ESG Insurance can be downloaded through the link below.

What’s your strategy?

Reputational risk is a concern for every company, organization or individual in corporate leadership. Let us help integrate parametric insurance into your reputation resilience strategy.