We help risk managers manage risk.

With reputation risk forecasting, management, and insurance, we help you build and prove to stakeholders your firm’s thoughtful risk management and dutiful governance over all that is mission-critical; i.e., an insurance-authenticated story stakeholders can appreciate and value.

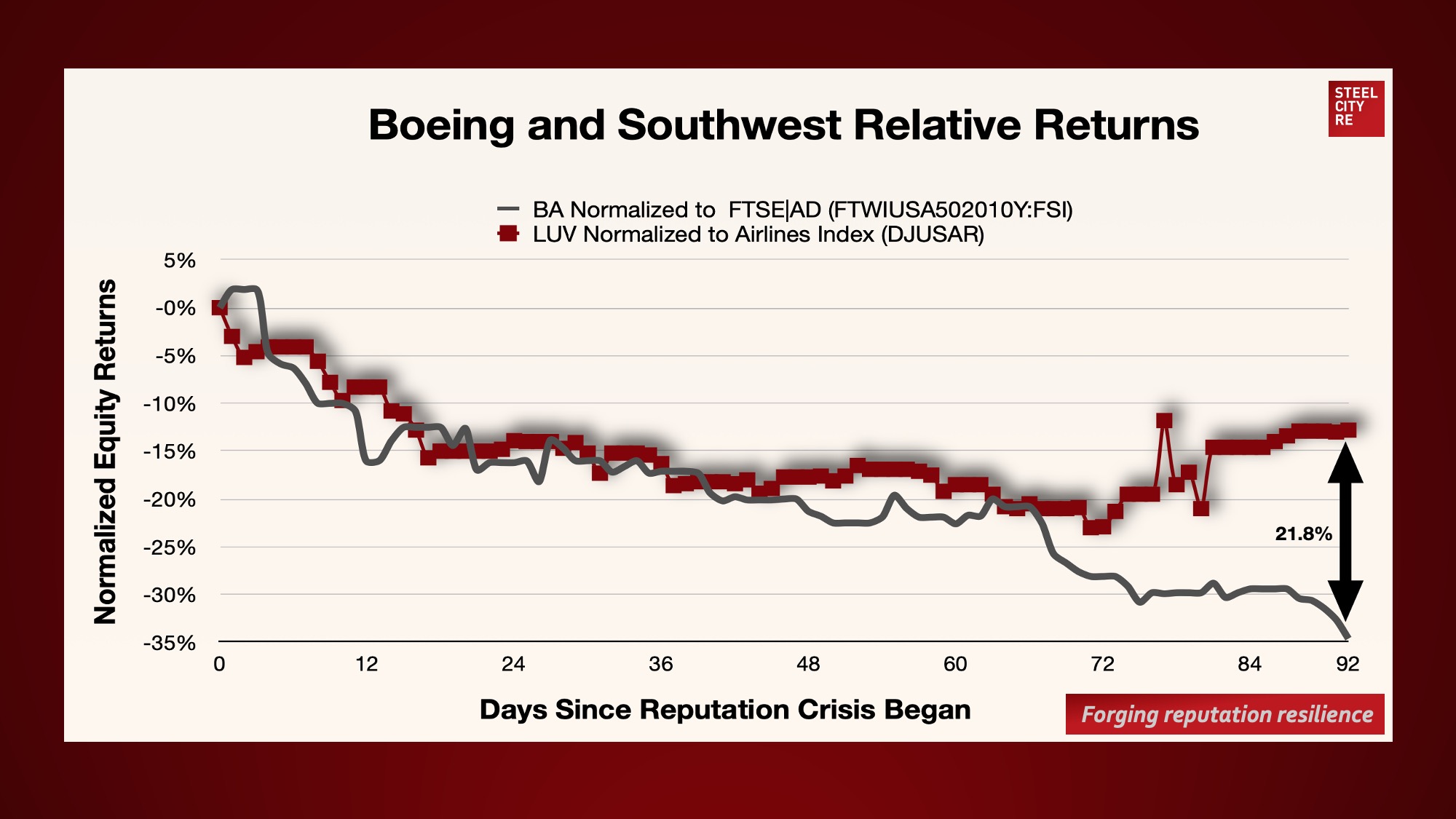

Today’s sophisticated risk managers are strategic. They know that enterprise damage from reputation risks might be their greatest and longest lasting peril, so they monitor for red flags. They foster a culture that respects those warnings and facilitate processes to mitigate those risks. Their diligence strategically builds enterprise-wide resilience that informed stakeholders can appreciate.

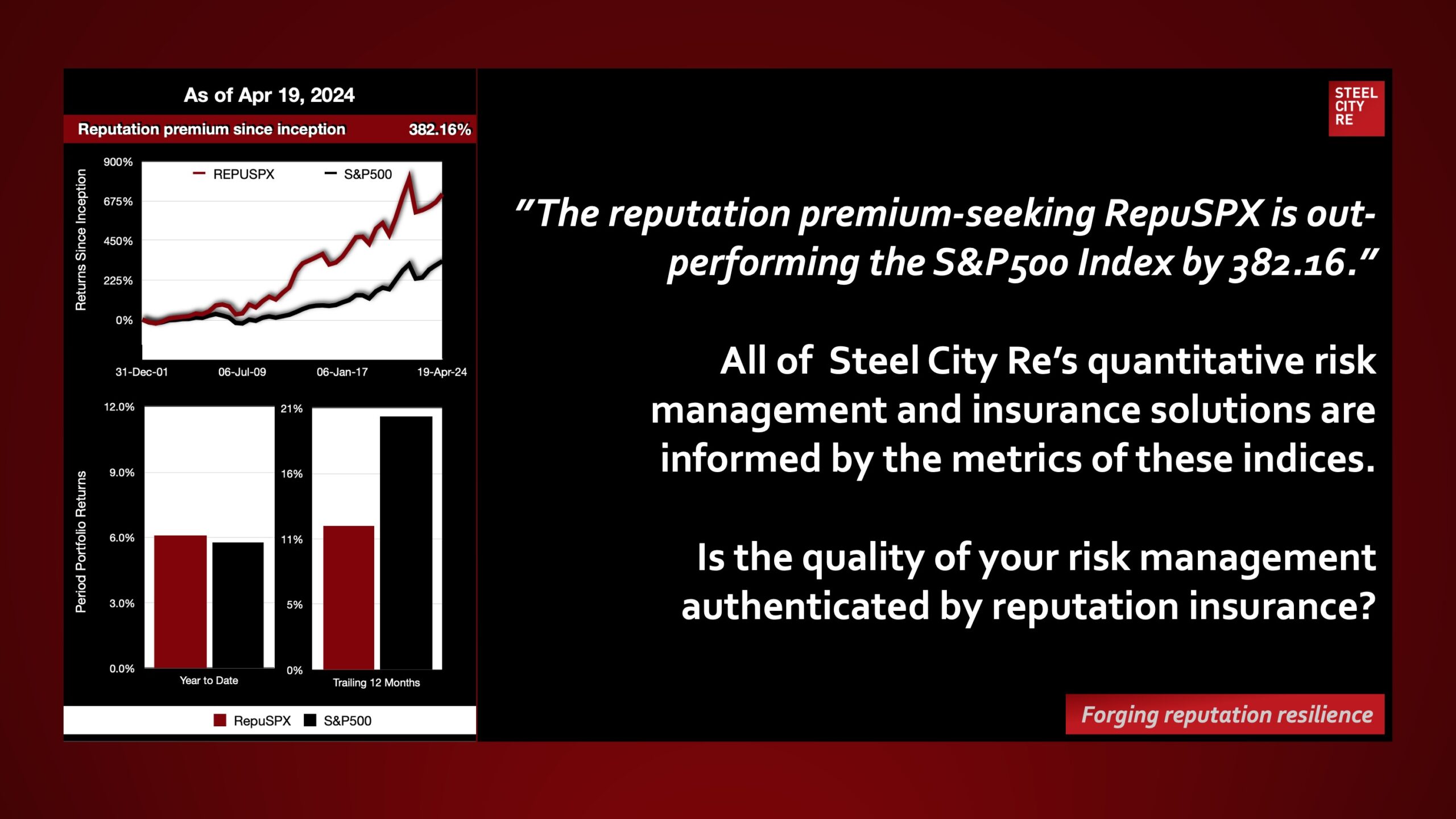

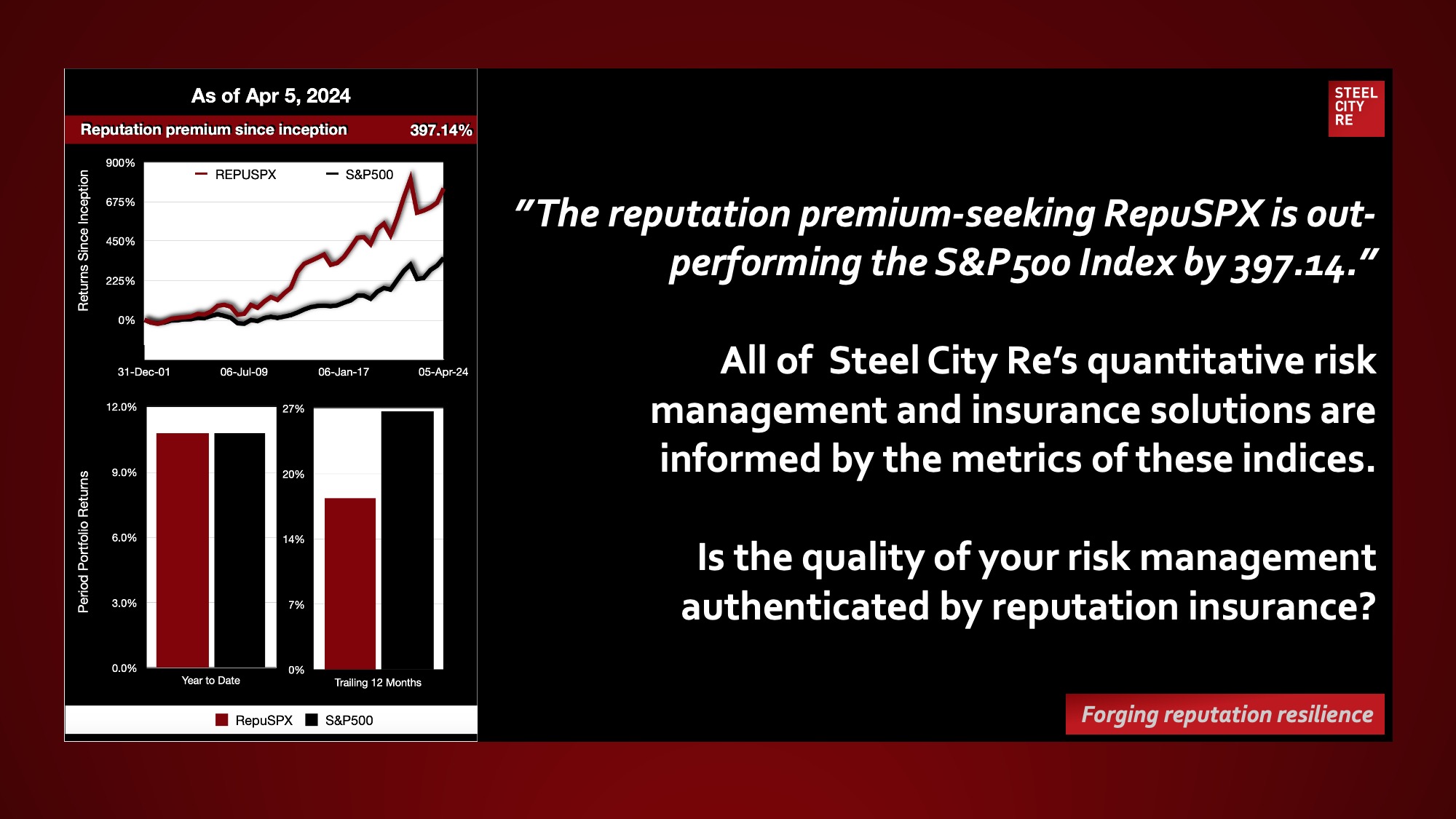

The results of strategic reputation risk management are evident in reputation resilience. More than crisis recovery, they include customers buying, not boycotting; employees working, not fleeing; investors buying, not selling; lenders adjusting interest rates down, not up; regulators deferring, not enforcing; and social license holders acquiescing, not protesting.

Steel City Re’s strategic tools help risk managers build corporate resilience by predicting reputation risk, protecting enterprise value, and promoting risk management through strategic risk transfer.

Steel City Re is a reputation risk specialist fostering reputation resilience through risk prediction, management, and transfer (re/insurance).

Predict Reputation Risk

Our Resilience Monitor is the world’s only objective, forward-looking AI-powered indicator of a company’s reputation value and risk. It provides timely quantitative measurements for risk strategies.

Protect Enterprise Value

Our Reputation Risk Strategy Framework includes advisory tools for risk managers to combine external human intelligence with existing ERM practices, and communicate the effectiveness of strategic risk management.

Transfer Risk Strategically

For corporate resilience to have value, stakeholders must discover and trust it. We support that with the world’s only strategic parametric reputation risk captive insurance and reinsurance solutions.