Reputation Forestalls ESG Risk…

…at a $20bn Commercial Services Company

Interview: Reputation Insurance Forestalls ESG Risk at a $20bn Commercial Services Company

The promoters of virtue who coined the term ESG in 2006 would likely be shocked by the journey their acronym took. Passing like the gold rush through the investment community around 2019, it is now a politically divisive term, a punching bag for conservatives, and a board liability. In 2024, Blackrock, the asset manager and largest promoter of ESG practices within the financial community, disclosed in the risk section of their own 10-K regulatory filing that it “faces increasing focus from regulators, officials, clients and other stakeholders regarding ESG matters.”

Steel City Re imagined a conversation with the risk executive at commercial services firm that promoted environmental responsibility, social justice and gender diversity in governance. The conversation, a composite of individual discussions, has been edited for length and clarity.

Steel City Re. Did the Blackrock disclosure surprise you?

Risk Executive. No. Blackrock’s language clearly spells out that ESG is a matter of focused interest for a wide range of stakeholders, and is therefor a source of reputation risk. We’ve been insuring against losses associated with reputation risk for two decades. The so-called “pile on of litigators, regulators, and bloggers” is a predictable phase in the lifecycle of this complex risk.

Steel City Re. Are you changing any of your reputation risk management practices because of the Blackrock disclosure?

Risk Executive. Yes. Like many risks that are not material in the general sense, we have kept details of our reputation risk management and insurance processes out of our regulatory filings and marketing materials. However, because ESG is core to our human resources and governance strategies, I am fairly confident the legal team will be disclosing that risk in our annual filings. That gives us an opportunity to disclose our decades of reputation risk management and insurance; and take credit for being on top of this risk. It’s something investors will appreciate. Especially after the Bud Light incident.

Steel City Re. You are referring to the “ad that went bad” last year?

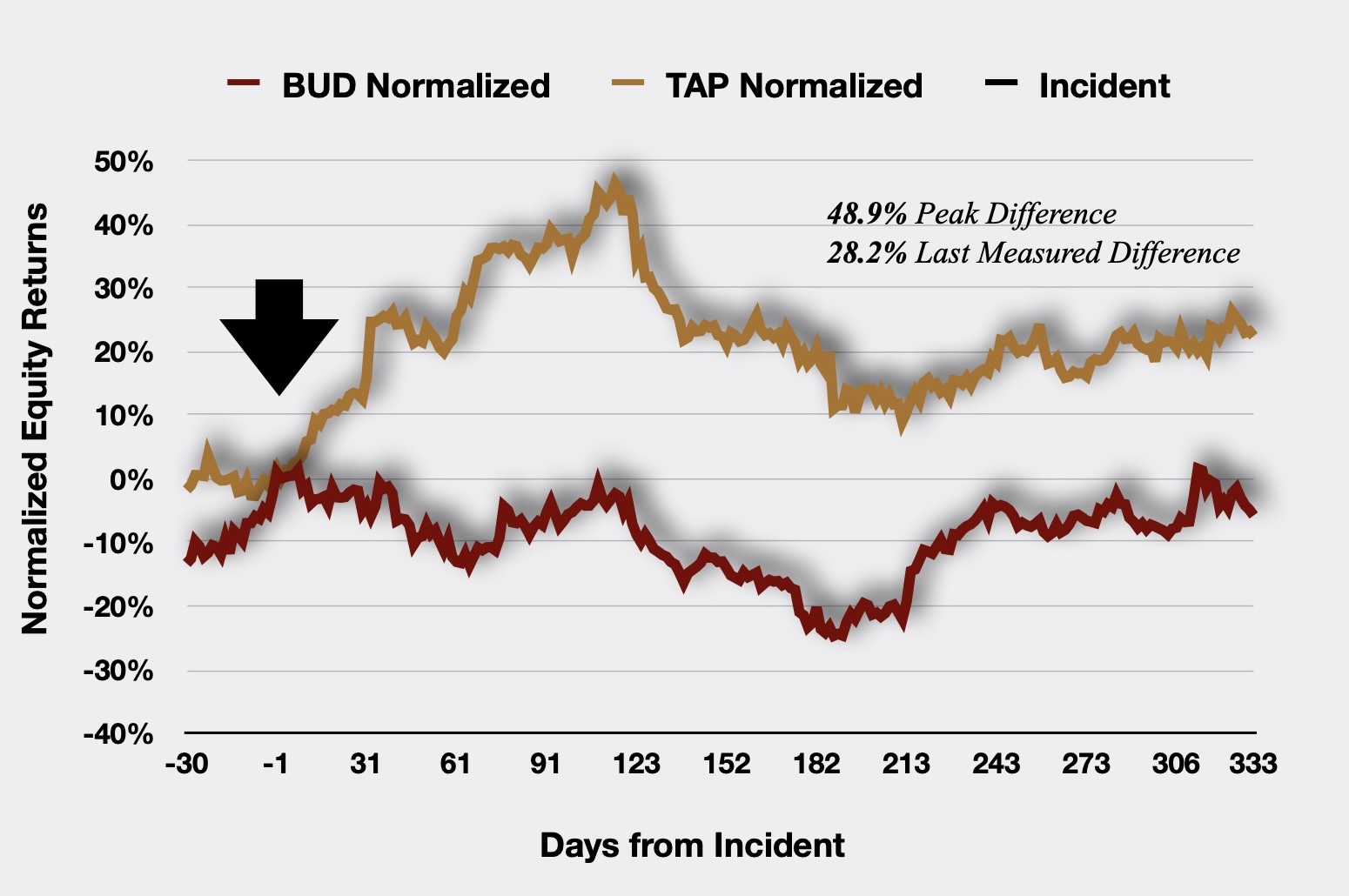

Risk Executive. The world’s largest brewer, Anheuser Busch, may have lost as much as $1.4 billion in sales because of the backlash to socially-aware marketing campaign. Since last April, it is under performing its peer group food index by 14%, which for shareholders translates to losses of about $16bn.

Steel City Re. How would reputation risk management have mitigated that incident?

Risk Executive. Reputation risk management has two key components: a process for knowing the expectations of all of our stakeholders, and mapping them against ESG postures across the enterprise, which is reputation risk intelligence; and a process for helping our stakeholders understand and appreciate what we are doing, which is reputation risk management communications. In the Bud Light incident, management dropped the ball on both processes.

Steel City Re. How would reputation risk insurance perform against ESG-related losses?

Risk Executive. The policy covers six broadly named perils: sustainability, ethics safety, security, innovation, and quality. The first lines up will with environmental issues; the next three cover social and governance issues, innovation is a bonus cover, and quality is a “difference in conditions” type peril. It’s an elegant solution to a vexing risk transfer issue, and it is a program about which I am very proud.

Steel City Re. You had coverage for around 20 years. Have your policies every performed.

Risk Executive. Yes, during Covid. Under terms of our parametric policy, processes for assuring the health and safety of our stakeholders failed. Our measure of reputation value loss reached a trigger value, and, well, that’s that. There’s not much else to do to file a claim under a parametric policy.

Steel City Re. Is there anything else you would like to share?

Risk Executive. Strategically, and following some of the thinking at Blackrock, we are considering phasing out our own ESG language like “DE&I” and replacing it with references to the underlying issues and expectations.

Steel City Re. Such as?

Risk Executive. Strategic communications. The term “ESG” is value-laden. The terms “sustainability, ethics safety, security, innovation, and quality are not.” Conforming to an NGO’s standard for ESG or meeting some rating’s agency measure for ESG is value-laden. Understanding, meeting, or helping shift stakeholder expectations—the essence of reputation risk management—is not. Insuring for reputation value loss is prudent; qualifying for parametric reputation insurance elevates, differentiates, and creates value.

With reputation risk forecasting, management, and insurance, Steel City Re helps companies build and prove to stakeholders their thoughtful risk management and dutiful governance over all that is mission-critical. It is an authenticated story stakeholders can appreciate and value.

Listen to the Risk Manager’s success story (coming soon).

![In a world of polycrisis, […] risk managers need to… market the elevated quality of their risk management processes.](https://steelcityre.com/wp-content/uploads/2023/09/20230926-Steel-City-Re.jpg)