Reputation Enhances Value…

…at a $5bn REIT

Interview: A Reputation for Risk Management Enhances Value at a $5bn REIT

Back-of-house information systems are mission-critical. Strengthening firms’ financial resilience requires that their reputations for information system service excellence—for tracking funds, people, or physical assets—is also resilient.

In financial services, information systems may facilitate and document the flow of funds between and among customers, suppliers, investors, regulators, taxation authorities, and even insurers. In the transportation industry, they may facilitate the movement of passengers, aircraft, flight crews, luggage, and ground staff. For risk professionals, mitigating spectacular malicious efforts to penetrate or disrupt these systems is essential; but so is ensuring that as systems age, they do not fail for mundane social, behavioral, or political reasons.

Steel City Re imagined a conversation with a Risk Executive at a publicly-traded real estate investment trust (REIT) who was worried about the resilience of her company’s aging IT system on which its customers, employees, creditors, investors, tax authorities and the community depended. Even though team members often scrambled to produce reports manually when the system faltered, senior management initially chose to defer a major upgrade because its cost would depress earnings and stock price. The conversation, a composite of individual discussions, has been edited for length and clarity.

Steel City Re. One factor that differentiates you from Risk Executives at other Real Estate Investment Trusts is your visibility in the risk management community.

Risk Executive. I am fortunate to work at a relatively small publicly-traded REIT where I have regular contact with our CEO who understands how our department contributes to the REIT’s overall value beyond negotiating good pricing for our insurances.

Steel City Re. You’ve been honored by your peers for excellence in risk management.

Risk Executive. The value boost our department brings to our firm comes from our reputation for excellent claims management. Our risk management excellence helps us keep our premiums low, but it is in our claims administration that we seek to exceed the expectations of our stakeholders. We help make our tenants and vendors whole through a painless and efficient process in which our insurers also participate. That produces benefits up and down our P&L. Our team excels at handholding, but we have the time to go the extra distance because of the quality of our information system.

Steel City Re. We understand that many risk management budgets are being stressed by the meteoric rise in property insurance premiums, and that senior management had reservations about the spend.

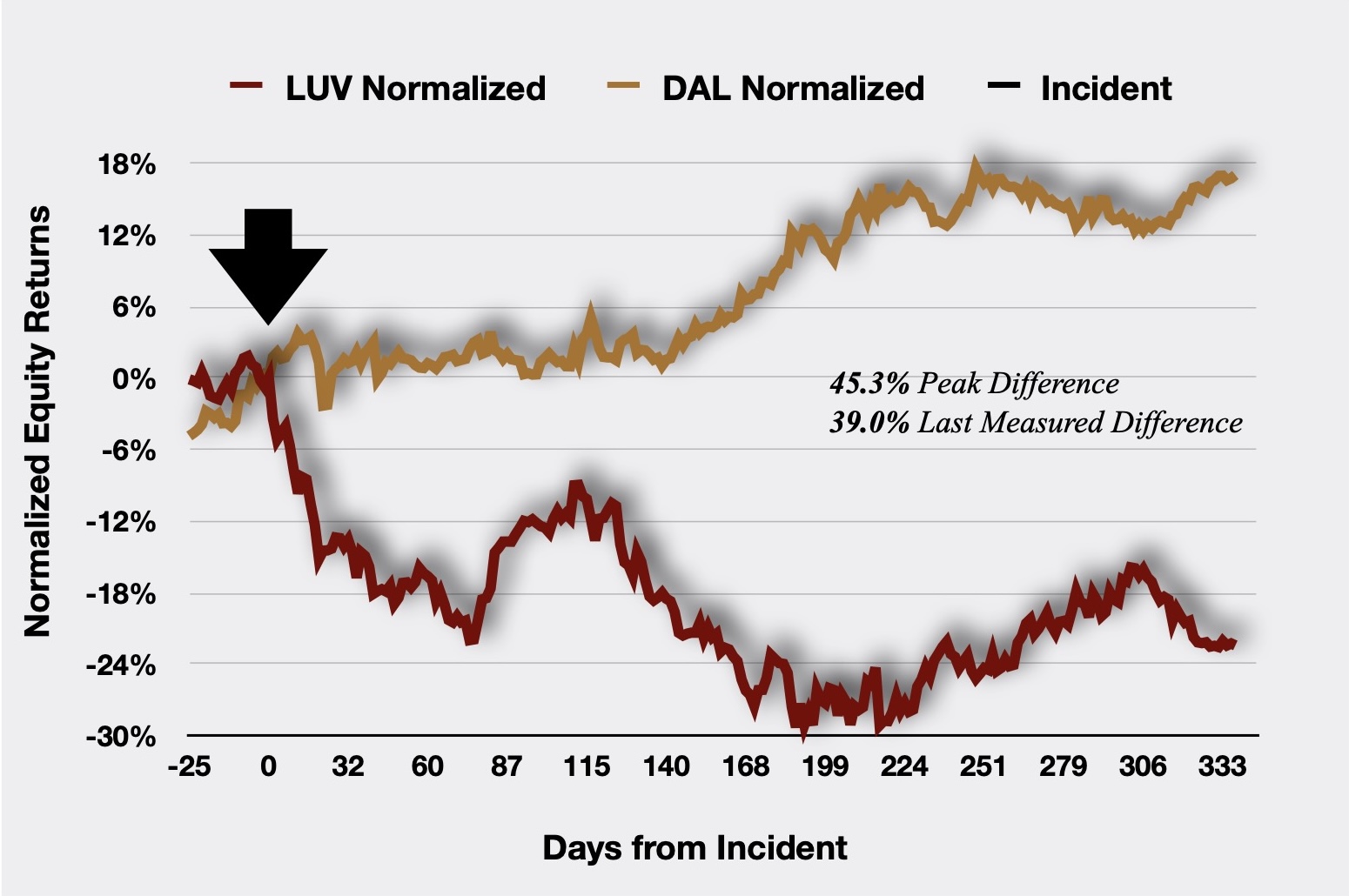

Risk Executive. Coming out of COVID, budget negotiations were a struggle even though our CEO liked promoting our awards to investors. We were growing and our information system was struggling. But the back office was not a priority initially. My pitch to our CFO got a big boost from the information system failure at Southwest Airlines.

Steel City Re. Please explain. It seems that there would little relevance in the lessons of a consumer-facing transportation firm.

Risk Executive. Southwest Airlines experienced a massive mission-critical IT systems failure that disrupted operations, angered many stakeholders, knocked the stock price back at least 20% and cost investors about $4 billion. One of our larger institutional investors connected the dots and asked our CEO about our information system. As our CFO explained, the investor alluded to strengthening financial resilience, and appreciated that our risk management processes were part of our competitive advantage.

Steel City Re. Then you had an enterprise risk management conversation with your CFO?

Risk Executive. Yes. The new hot enterprise risk management focus is resilience by mitigating threats to enterprise value. The investor was concerned that risks to the stability of our information systems threatened our reputation for claims management excellence. That would be bad for our firm and our profitability.

Steel City Re. Your CFO is a sophisticated financial professional!

Risk Executive. Certainly. Also I published a paper on the topic in Risk Management magazine. With that paper as my authority, I proposed to my CFO a three-part strategy that could be shared with the investor that would demonstrate how our firm was going beyond industry standards to manage risk to our mission-critical systems and avoid the fate that befell Southwest Airlines.

Steel City Re. Are you willing to share a high-level summary of that strategy?

Risk Executive. Absolutely. I love how our risk community willingly shares and learns from one another. The three parts:

- Situational Awareness: Elevating reputation risk intelligence and forecasting capabilities to understand what stakeholders expected from their interaction with our firm, how they would be impacted if the software failed, and how they would respond;

- Extraordinary Risk Management Competence: Cover the cost of loss from reputational damage of an IT system failure in our captive to show the investor that we could value, measure the frequency and severity of loss, and mitigate the risk;

- Authenticate the quality of our situational awareness and risk management competence by authenticating the risk management processes and captive insurance strategy with re/insurance that is underwritten with objective discrimination.

Steel City Re. Would you explain the meaning of objective discrimination?

Risk Executive. In this case, objective discrimination means there is a quantitative measure of reputation risk management quality below which firms won’t qualify for coverage. It’s like the objective grade point averages and test scores below which a student will simply not be considered for admission to an Ivy League university. Getting insurance coverage, just like gaining college admission, is therefore a mark of quality. Our CEO, a graduate of Yale, likes to remind of us of this mark of distinction from time to time.”

Steel City Re. Your conversation with your CFO referencing the Southwest Airlines crisis was dispositive?

Risk Executive. Almost. I had help. Because of my enterprise risk management role and our firm’s culture, I have collegial relationships with the whole C-Suite. Our legal officer affirmed that this strategy would augment D&O defenses by evidencing dutiful governance; our communications officer agreed that investors and employees would appreciate that this strategy increased the protection of cash flow; and my CFO added that besides giving comfort to the board, it would help secure better rates with the bond markets and lower premiums for a broad range of casualty products.

Steel City Re. Is there anything else you would like to share?

Risk Executive. We have a gifted CEO. He thought this strategy would help elevate his personal brand as a leader among the many REITs and better position himself and our firm for more acquisitions.

With reputation risk forecasting, management, and insurance, Steel City Re helps companies build and prove to stakeholders their thoughtful risk management and dutiful governance over all that is mission-critical. It is an authenticated story stakeholders can appreciate and value.