Benefits For CLO’s

See also:

Our products empower risk managers to support senior legal executives with strategies and tools for:

Today’s strategic risk managers support their CLO’s with insights and tools for use in corporate securities litigation and compliance strategies. With broader and deeper visibility into reputation risk from financial, operational, hashtag-identity, and ESG-stakeholder capitalism issues, they are better positioned to anticipate hazards, avoid them, or mitigate damage, thereby navigating the expectations of stakeholders and providing significant value for their executive suite and Board.

Articles for CLO’s

April 7, 2024

“Unsavory” may be forgiven, if not forgotten. Speculation aside, objectively, none of Steel City Re’s…

March 25, 2024

The new program “will create new incentives for individuals to report misconduct,” “If anything (said…

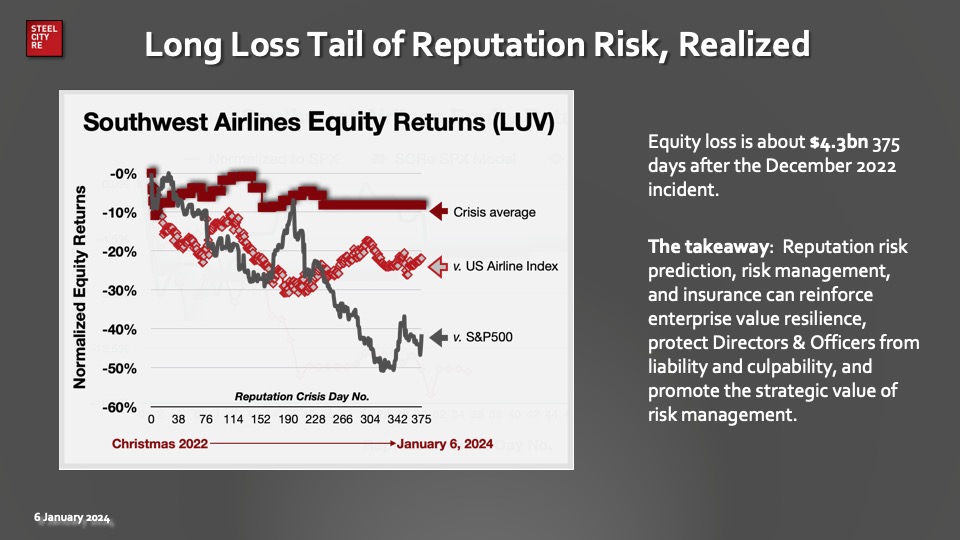

January 6, 2024

Southwest Airlines reputation crisis. At crisis day 375, Southwest equity is under performing the S&P500…

December 12, 2023

Environmental issue? Investors scrutinizing! According to Kossovsky, shareholders seem most concerned about the impact of…

November 7, 2023

Reputational risk from $1.5 Trillion ESG debt. Bankers servicing one of the world’s biggest ESG…

October 16, 2023

Fox experienced a surge in reputational risk in the summer of 2021, according to reputational…

![Reputational risk from $1.5 Trillion ESG debt. Bankers servicing one of the world’s biggest ESG debt markets are now actively seeking legal protections to guard against the potential greenwashing allegations that may be ahead. […] Lawyers advising SLL bankers say the reputational risks associated with mislabeling such products are now too big to ignore.](https://steelcityre.com/wp-content/uploads/2023/11/20231107-Steel-City-Re.jpg)

![Mitigate value-destroying legal risk. For Fox, Kossovsky said. “This new reputation at FOX Corporation, if it [is] indeed forming, is or will be value-destroying.”](https://steelcityre.com/wp-content/uploads/2023/10/20231016b-Steel-City-Re.jpg)