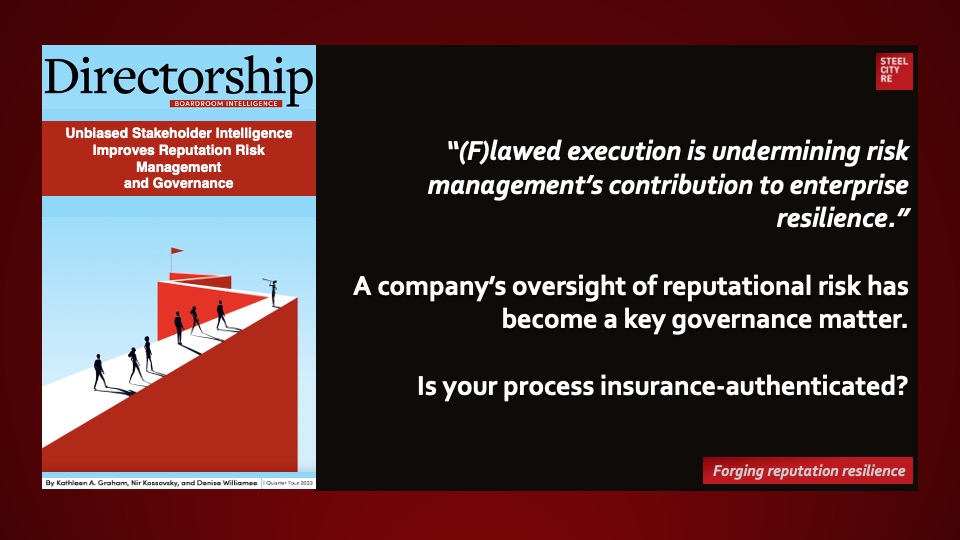

In a world of polycrisis, […] risk managers need to… market the elevated quality of their risk management processes. The author thanks for their contributions to this article:

Courtney Davis Curtis, University of Chicago; Deyna Feng, Cummins, Inc.; Mary C. Friedl, Redbox; Kathleen A. Graham, The HQ Companies; Chris Hammond, Stepan; Enya He, Blu Clarity PBC; Carnell R. Jones, Trinitas Ventures; Christy Kaufman, Zillow Group; John C. Kline, Discover Financial Services; Manuel Padilla, MacAndrews & Forbes Incorporated; Soubhagya Parija, FirstEnergy and New York Power Authority; Kristen Peed, CBIZ; Theresa Severson, Kite Realty Group; Seung Yoo, Regal Rexnord Corporation; and Denise Williamee, Steel City Re.

![A CEO and former Los Angeles County deputy coroner on what he feels derailed the ESG movement […] ESG died from toxicity and dysfunctionality. Culpable parties include investors, fund managers, corporate communicators and politicians.](https://steelcityre.com/wp-content/uploads/2023/10/20231006-Steel-City-Re.jpg)

![In a world of polycrisis, […] risk managers need to… market the elevated quality of their risk management processes.](https://steelcityre.com/wp-content/uploads/2023/09/20230926-Steel-City-Re.jpg)