Benefits For D&O’s

See also:

Our products empower risk managers to help Board members protect the assets of their firms:

Today’s strategic risk managers provide Boards with the insights and tools they need for dutiful governance of mission-critical issues. With this broader and more actionable oversight into risk, Boards are better positioned to provide effective oversight and meet the value protection and compliance expectations of their shareholders.

Articles for D&O’s

April 20, 2024

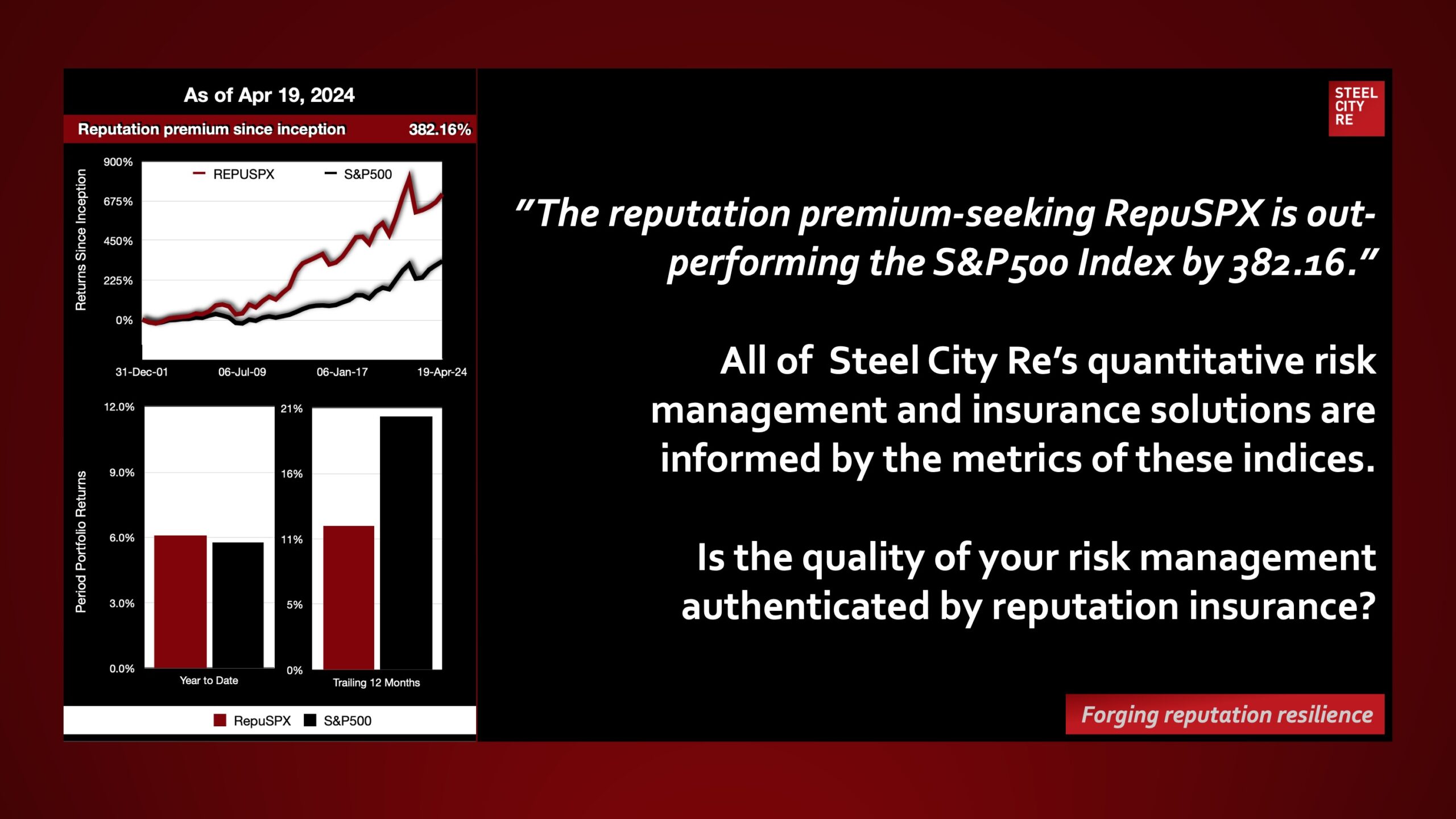

Reputation arbitrage premium: The reputation premium-seeking RepuSPX is out-performing the S&P500 Index by 382.16%

April 7, 2024

“Unsavory” may be forgiven, if not forgotten. Speculation aside, objectively, none of Steel City Re’s…

March 25, 2024

The new program “will create new incentives for individuals to report misconduct,” “If anything (said…

January 23, 2024

$5 trillion worth of shareholder votes want more ERM this year. The investment stewardship team…

January 6, 2024

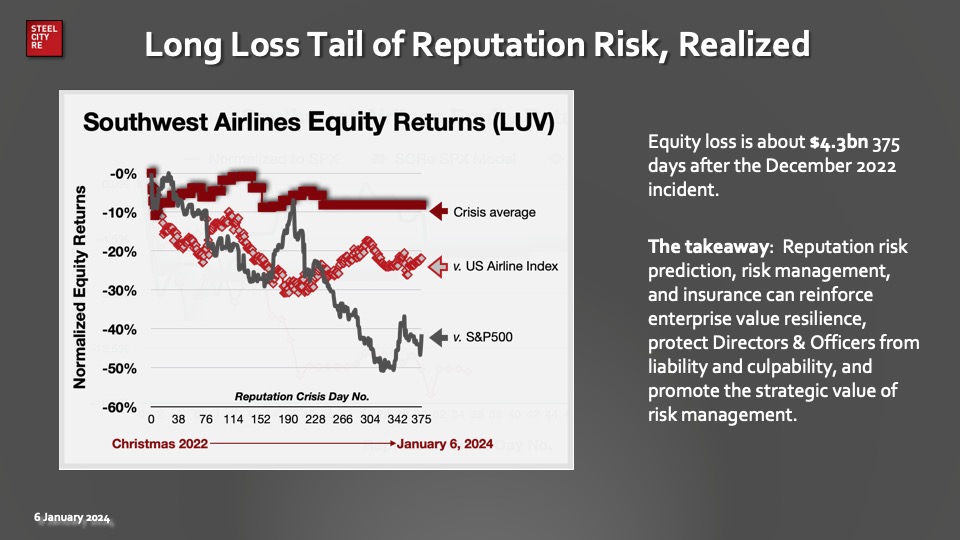

Southwest Airlines reputation crisis. At crisis day 375, Southwest equity is under performing the S&P500…

December 12, 2023

Environmental issue? Investors scrutinizing! According to Kossovsky, shareholders seem most concerned about the impact of…