Reputation Spearheads Resilience…

…at a $150bn Financial Services Company

Interview: Reputation Spearheads Resilience at a $150bn Financial Services Company

The banking sector has been having a rough go of things. Regulators would like more Tier 1 capital, activists would like both more and less “ESG,” and the deteriorating quality of commercial real estate loans is an ever-present threat to balance sheets. In this environment, bond raters and equity investors are asking pointed questions.

Steel City Re imagined a conversation with a risk executive at a publicly-traded financial institution who was part of a committee organized by the reputation risk counsel at the board’s behest to explore new creative risk management options. The conversation, a composite of individual discussions, has been edited for length and clarity.

Steel City Re. You’ve avoided the many scandals in this sector that have popped up over the past decade. Is there room for risk management improvement?

Risk Executive. We’re operating in an environment in which several bank failures, regulatory warnings of more bank failures, recent high-profile loans and a noteworthy cryptocurrency exposure are raising concerns among all stakeholders. Our investors see all that we have done in the past as table stakes, and they are now asking the board what are doing next to strengthen financial resilience.

Steel City Re. Can you share what you’re looking at?

Risk Executive. Our reputation risk counsel is leading this initiative because he is a creative thinker. We previously looked at reputation insurance coverage for non-damage business interruption (NDBI) but didn’t see limits sufficient to provide meaningful balance sheet protection or Tier 1 capital relief.

Steel City Re. Insurance is not an option, then?

Risk Executive. Not exactly. We think the opportunity here is to address the named peril of reputation risk differently. There is a historic lesson in the experience of Morgan Stanley around 2012 that we’ve interpreted too narrowly.

Steel City Re. There was no reputation insurance in 2012.

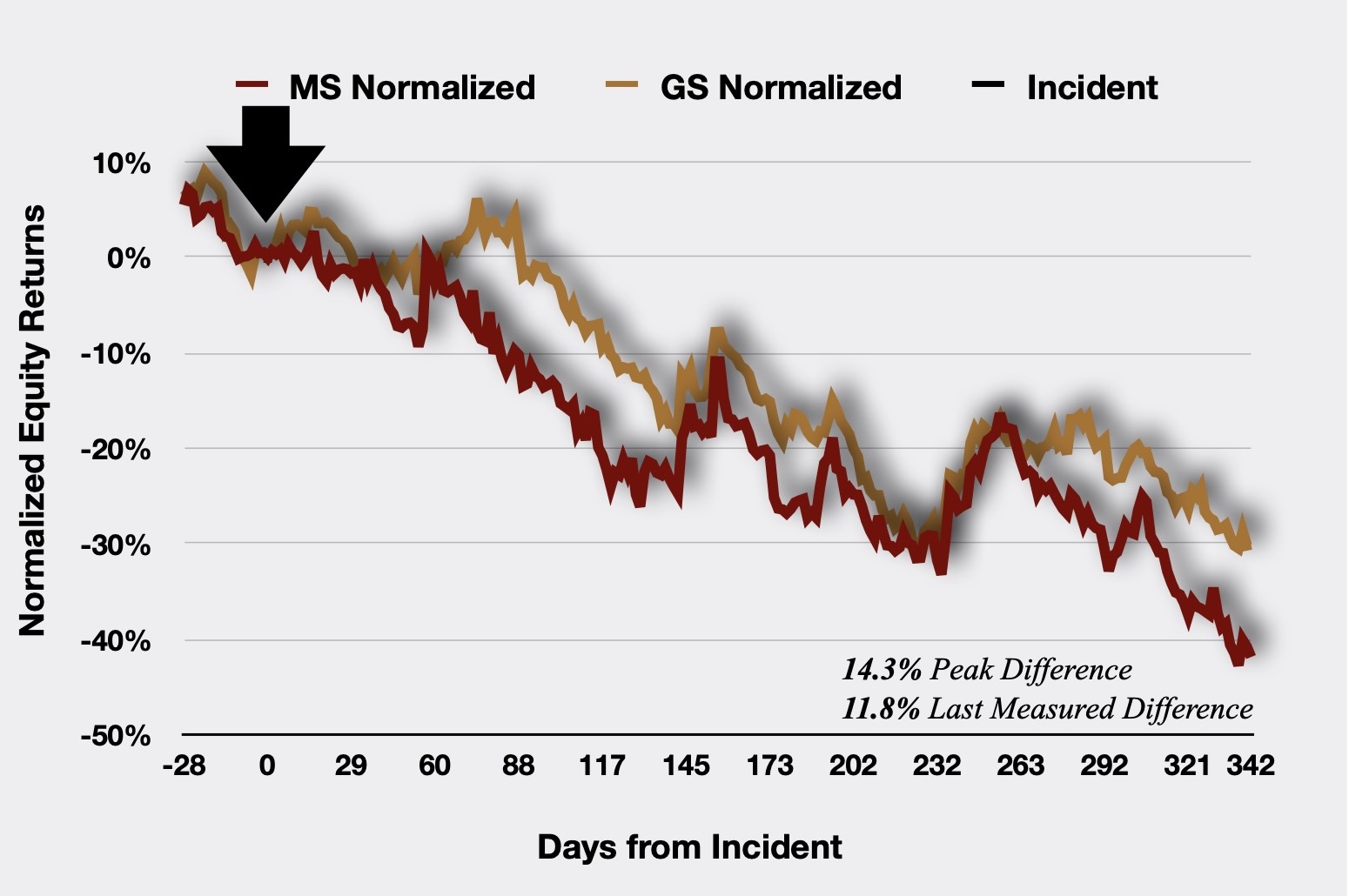

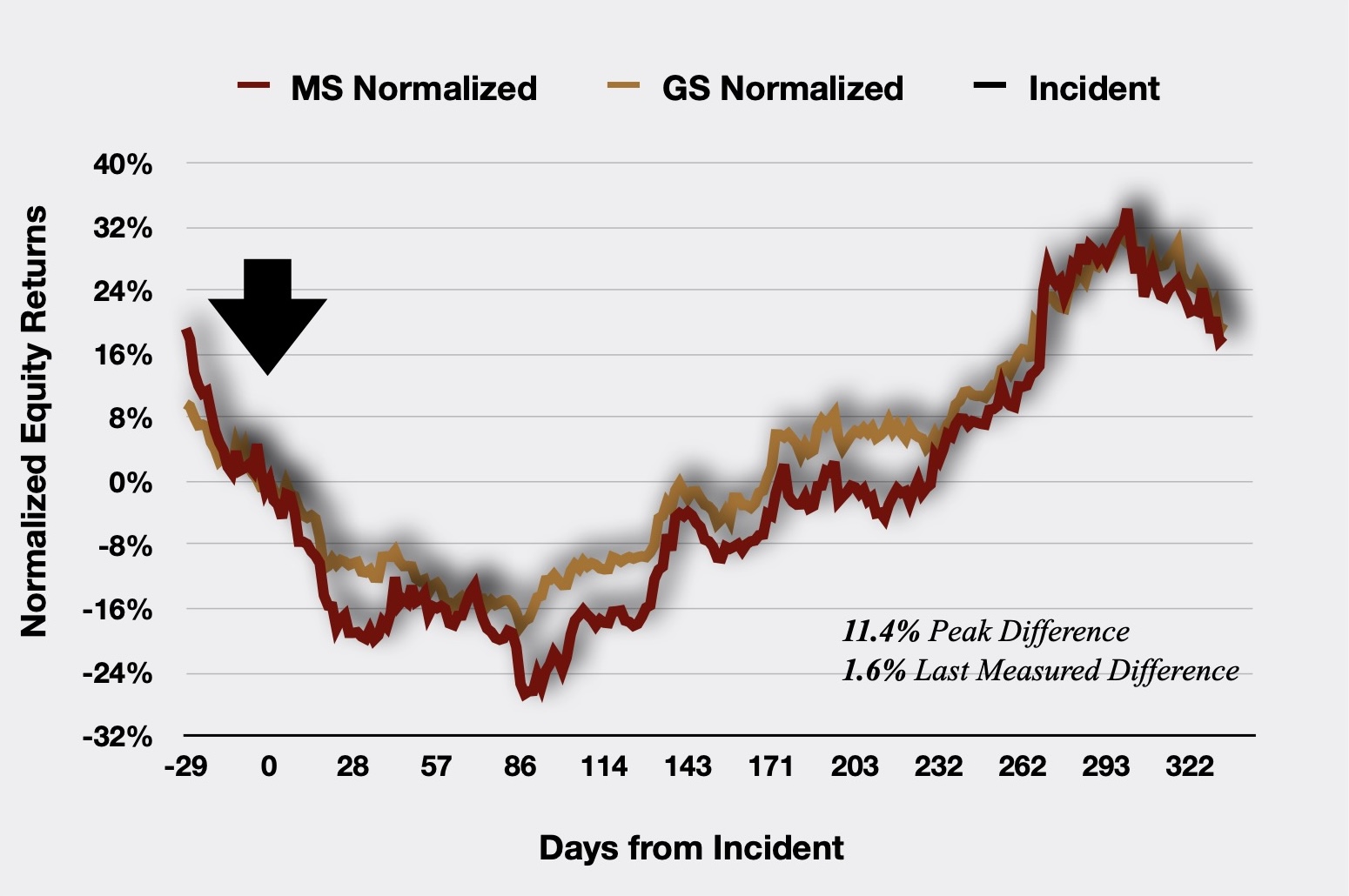

Risk Executive. Morgan Stanley was able to avoid an estimated $70 million fine for a bribery scandal in 2012 because of their demonstrably high quality—but not perfect—anti-corruption processes. The challenge was that it took the Department of Justice two years to make that determination, so while they were exculpated, they experienced some pain for two years.

Steel City Re. Are you suggesting insurance can relieve some of that pain?

Risk Executive. Yes, we believe insurance used strategically can provide the transparency that the DoJ’s own processes obscured. We are looking at the big strategic picture and looking for an efficient way to shift the focus from Tier 1 capital to a strategy to mitigate reputation risk before stakeholder’s take adverse actions that would strain our balance sheet. Fundamentally, senior management has an interest in keeping any failure in risk management from becoming material and potentially damaging the firm’s reputation. Absent reputational damage, we would not need more capital because we would not be exposed to a bank run, a major fine, or other adverse stakeholder reaction.

Steel City Re. I’ll push back here. What could protect a bank more than a bigger balance sheet?

Risk Executive. Capital is very expensive. We think we can get significant strategic benefits at a much lower cost. Since regulators and investors are both heavily influenced by their trust and confidence in our board and CEO, we’re looking at ways to exculpate our leadership by explaining some future adverse event as an unforeseeable lightning strike, as Morgan Stanley did years ago. We’re thinking now that evidence of reputation risk management–whose quality is authenticated by a third party—would substantiate exculpation.

Steel City Re. Given the size of fines and the typical loss in equity value in a crisis, it seems that evidence of dutiful—but not as you said, perfect—governance might benefit the C-suite and board.

Risk Executive. I appreciate your skepticism. Bearing in mind the focus of bond raters and investors, we are looking at a three-pronged strategy to better authenticate how we are going beyond industry standards for “Headline Risk” to strengthen financial resilience:

- First, using our captive to provide a new layer of protection for Non-Damage Business Interruption and Reputation Value Loss with an all-risk outcomes-based (parametric) cover to show that we have a process to value, measure the frequency and severity of loss, and mitigate the risk;

- Second, deploy some very simple processes based on the military’s use of fusion cells to better understand stakeholder expectations and the mission-critical risk environment; and

- Authenticate the quality of our situational awareness and risk management competence by authenticating the risk management processes and captive insurance strategy with re/insurance that is underwritten with objective discrimination.

Steel City Re. “Objective discrimination?” I’m hearing that more often lately.

Risk Executive. The effective need for less Tier 1 capital is in the cachet of the risk management strategy as authenticated by the insurance. Morgan Stanley didn’t have that option in 2012. The insurance we are looking at has a quantitative hurdle for risk management quality which is established during underwriting. Qualifying for insurance is a sign of risk management quality. Michael Spence did his Harvard Doctoral Dissertation on this very topic in 1972. He picked up a Nobel Prize in Economics for that work in 2001.

Steel City Re. Yes, that was the Nobel Prize in 2001 in Economics—markets with asymmetric information. I better appreciate why you believe insurance used strategically can signal risk management quality.

Risk Executive. I can share that our reputation risk counsel agreed that the detailed strategy I shared with you would likely help mitigate the intensity of regulatory humiliation and mollify aggrieved investors were there to be some untoward event. He also agreed that it would be most effective if it were introduced carefully to the public domain before a crisis occurs, and that it would be more effective if it were authenticated by insurance. Third-party validation with objective discrimination carries much weight.

Steel City Re. I imagine that was a difficult conversation.

Risk Executive. Not really. He graduated from Harvard law. It was the cachet of Harvard graduate Spence and his Nobel Prize that won him over.

Steel City Re. Is there anything else you would like to share.

Risk Executive. Reputation risk counsel is confident the board will like this. But what counsel especially likes is the cost. We buy very high limits of D&O coverage, so finding a parallel insurance-based risk solution that does not require high limits will be appealing to our CFO. We won’t need to buy substantial coverage to get the desired strategic effect, which is effectively a warranty on the quality of our reputation risk management.

With reputation risk forecasting, management, and insurance, Steel City Re helps companies build and prove to stakeholders their thoughtful risk management and dutiful governance over all that is mission-critical. It is an authenticated story stakeholders can appreciate and value.

Listen to the Risk Manager’s success story (coming soon.)

![Reputational risk from $1.5 Trillion ESG debt. Bankers servicing one of the world’s biggest ESG debt markets are now actively seeking legal protections to guard against the potential greenwashing allegations that may be ahead. […] Lawyers advising SLL bankers say the reputational risks associated with mislabeling such products are now too big to ignore.](https://steelcityre.com/wp-content/uploads/2023/11/20231107-Steel-City-Re.jpg)