Reputation Neutralizes Fake News…

…at a $7bn Media Company

Interview: A Reputation for Truth Neutralizes Fake News at a $7bn Media Company

Steel City Re imagined a conversation with the risk executive of an iconic publicly traded media company with a century-old reputation for quality reporting. We caught up with him as he was reviewing the company’s Enterprise Risk Management and captive programs for vulnerabilities and opportunities. The conversation, a composite of individual discussions, has been edited for length and clarity.

Steel City Re. What is the focus of your enterprise risk management program?

Risk Executive. Our company’s greatest brand asset is our reputation for trustworthiness. That asset is mission-critical. Our business exists because of it. Everything we do in risk management is ensure that our editorial divisions can protect that asset.

Steel City Re. You protect that brand asset indirectly?

Risk Executive. To protect the integrity of our editorial product, there is a wall of control and corporate risk management respects it. We focus on the property, plant and equipment that keep things running. Our captive is generously funded to ensure the resilience of the editorial team’s function through the worst catastrophic events.

Steel City Re. What keeps you awake at night?

Risk Executive. Fake news, pink slime, or a minor slip up by the editorial team that gets blown way out of proportion by the malevolent forces of fake news and pink slime that inhabit social media. Just the idea of a fabricated negative event worries me and its potential outsized impact on our company’s overall reputation.

Steel City Re. Pink slime?

Risk Executive. Yes, sorry. Propaganda masquerading on the internet as legitimate news. As well as undermining trustworthy, transparent journalism like ours, pink slime can stoke local information wars.

Steel City Re. You indicated those issues are addressed through the editorial team’s own risk management processes.

Risk Executive. Senior management was confident that our stakeholders know what to expect from us and that our reputation is resilient to doubt stoked by fake news, pink slime, and all that. It is doubt that erodes a reputation for trustworthiness in that Hemmingway sort of way. You know, at first, gradually; then suddenly.

Steel City Re. You used the past tense.

Risk Executive. I’m picking up signals that the board is hearing concerns from some investors about this fortress reputation we have. What has sown some doubt in our leadership’s confidence is the incredible event that occurred at Eli Lilly about a year ago.

Steel City Re. Please elaborate.

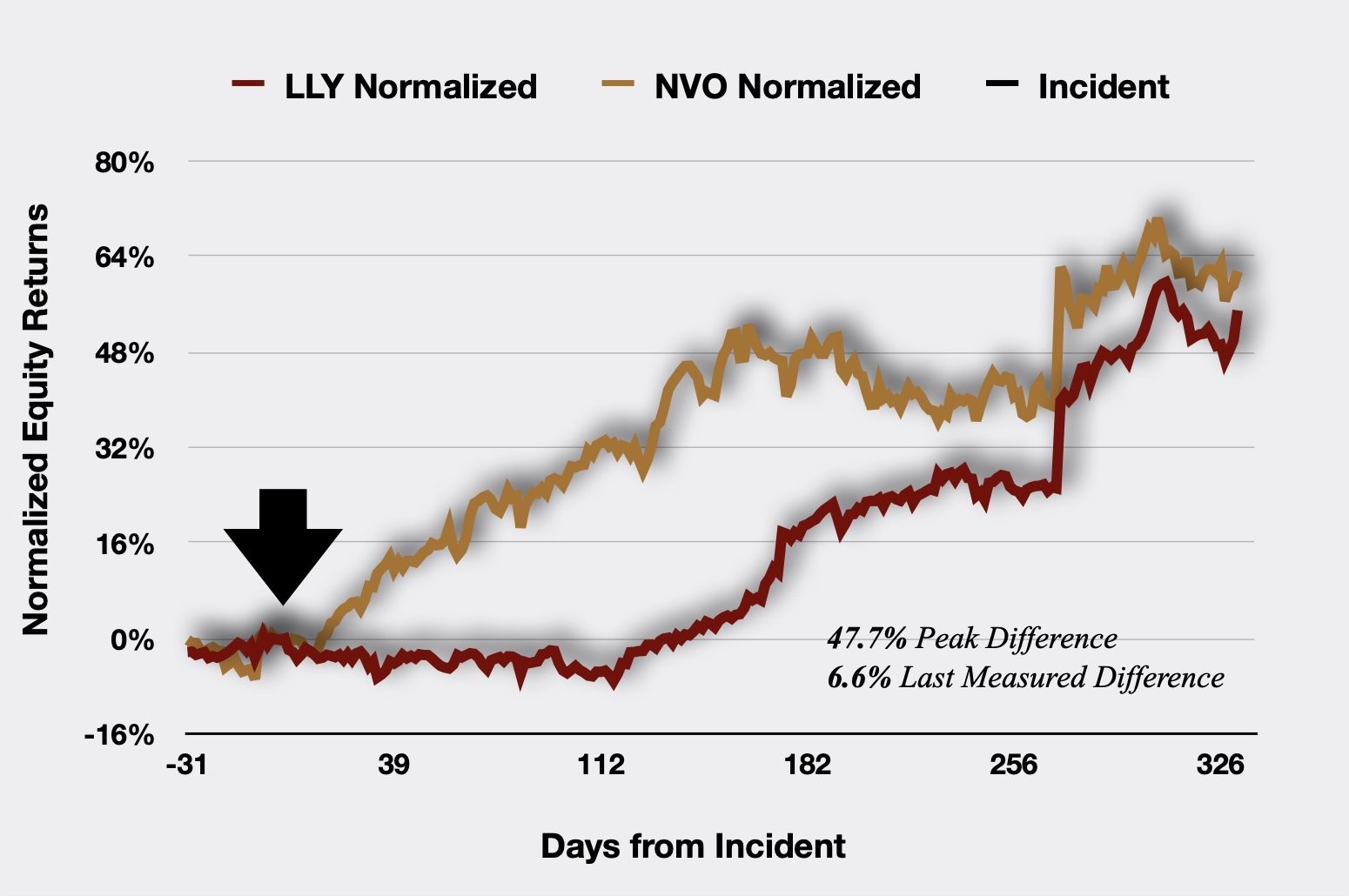

Risk Executive. Eli Lilly and Company had delighted its investors for many years with its profitable margins on insulin. Its well-established reputation for holding firm on pricing had seen off challenges from regulators and activists. That reputation collapsed in the face of a single fabricated social media message falsely announcing that the company would make insulin available for free.

Steel City Re. I recall that some reporter appropriated the Lilly Twitter account and issued a tweet to prove something, but it all blew over rather quickly.

Risk Executive. That’s the popular narrative, but that is not what actually happened. In under 3 hours, regulators, activists and investors forgot about Lilly’s prior reputation and accepted that false assertion as the truth. Shareholders panicked, shaving 7% off of their market cap in the first 48 hours. Lilly’s efforts to correct everyone’s misunderstanding—classical reputation crisis management procedures—outraged and galvanized consumers, activists, and progressive regulators into an outsized reaction.

Steel City Re. You’re arguing that their fortress reputation for pricing collapsed under pressure from motivated stakeholders.

Risk Executive. Sixty days after the company apologized for being the victim of a disinformation assault and its aftermath, its equity was under performing the ARCA pharma index by 9%—a relative loss of around $30bn. On the 112th day of its crisis, Lilly conceded that its reputation for pricing discipline was no longer believed by stakeholders and it announced a 70% reduction in the price of insulin.

Steel City Re. That history is forgotten because of the cash flow tsunami from the new appetite suppression drugs, but I get your point that reputation resilience is never a sure thing.

Risk Executive. At the editorial level we have world-class processes for managing the operational risks to our reputation for trustworthiness, but they are opaque to outside stakeholders. At the corporate level, we have lawyers, marketing and communications specialists, and lobbyists to respond to crises. But between the time of an incident, a slip up, fake news, or pink slime news and our response, stakeholders have to rely on their confidence in our opaque processes. At Lilly, that confidence held for less than three hours.

Steel City Re. I was just thinking that the time window you mentioned is not much greater than the time between the launch and impact of a missile in the United States from a hostile nation halfway around the world.

Risk Executive. A malicious act of tampering with our reputation for trustworthiness—given our role nationally—is a national security matter, which means we can roll our captive into this solution. I’ve been thinking about our vulnerable time window and our need to win the battle for the minds of our stakeholders before it starts.

Steel City Re. This is sounding remarkably martial.

Risk Executive. Actually, this is in our power alley. Let me outline a three-pronged plan to augment the resilience of our mission-critical reputation for trustworthiness focusing on our different stakeholder groups.

- Because reputation is at risk when something threatens what is mission-critical to us, stakeholders in the capital and risk markets will recognize that if we are using our captive for reputation risk, we have figured out how to value, measure the frequency and severity of loss, and mitigate the risk. An NDBI policy is ideal here;

- Second, we want to show that our insurance and risk management processes—including those in the editorial departments—are rich in “risk management” by improving our risk forecasting and intelligence capabilities to the level expected by our internal stakeholders;

- Third, for the benefit of our external stakeholders who do not have visibility into the above, let’s authenticate the quality of our captive operations and risk management processes by reinsuring the captive with an all-risk outcome-linked parametric cover (which could potentially replace some existing excess coverages). My colleagues in communications can help us share this reinsurance story in a way that is simple, easy to understand, and completely credible.

Steel City Re. That’s a very simple yet sophisticated strategy.

Risk Executive. I think sophistication is something our leadership, board, and investors will appreciate, given who we are. The key is that this strategy will make us more resilient to malicious disinformation than Lilly was.

With reputation risk forecasting, management, and insurance, Steel City Re helps companies build and prove to stakeholders their thoughtful risk management and dutiful governance over all that is mission-critical. It is an authenticated story stakeholders can appreciate and value.

Listen to the Risk Manager’s success story (coming soon).

![Exec Chair Misconduct Allegations […] TKO saw a "massive reputation value drop," according to Steel City Re's Resilience Monitor.](https://steelcityre.com/wp-content/uploads/2024/03/20240320-agenda-TKO-director-independence-mcMahon-Steel-City-Re.jpg)