Reputation Mitigating Regulatory Humiliation…

…at a $50bn Extraction Company

Success Story: A Reputation for Risk Management Mitigating Regulatory Humiliation at a $50bn Extraction Company

A global extraction company’s risk and communications executives sat down with the company’s chief legal officer to discuss a press release from the Department of Justice.

Counsel shared that the DOJ received more than 18,000 whistleblower tips in FY 2023, almost 50% more than the previous record set in FY 2022. She was especially concerned with the trend, as this was followed up with record award amounts and unprecedented public participation.

“I think we have very solid compliance and crisis communications programs. But with a large bounty as an incentive, and new strong enforcement of whistleblower protections, I am worried about meritless challenges by activists accusing us of greenwashing. I am worried about some fabulist bad actor accusing us of corruption. Most of all, I am worried about our public humiliation and reputational damage if regulators treat any of these false allegations as potentially credible and begin an investigation.”

The risk executive shared that he saw an opportunity to mitigate their exposures by establishing as fact that their compliance, risk management and governance programs were thoughtful, dutiful, and responsible.

“That’s what we already do every time we have to defend ourselves in court or with the regulators,” shared counsel. “I am worried about our industry’s checkered reputation. A false story about us will ring true to many.”

The risk executive continued his thought. “While currently we share this only when we are challenged, I’m suggesting we do it preemptively, publicly for all our stakeholders, and have it authenticated with reputation risk insurance. That would give us a first mover advantage, as well as the benefit of the doubt with all our stakeholders -ahead of social media.

The communications officer concurred, commenting “It is true that so much is first litigated in the court of public opinion.”

The risk executive continued by sharing that this preemptive strategy is, at its very core, a more superior form of Enterprise Reputation Risk Management and a topic of much conversation in the risk management community. He went into further detail about how it was based on Nobel Prize winning concepts in behavioral economics.

The communications executive asked, “Other than timing, is this strategy different than our usual crisis communications response?”

The risk executive shared that it was, in one very important way: the company’s messaging on compliance and risk management excellence is authenticated by risk capital from a third party, making it a more meaningful affirmation of quality.”

“I appreciate the benefits of getting ahead of a story,” shared counsel. “I recall a major FCPA issue in 2011 with Morgan Stanley who had in place a world-class compliance program. DoJ let the firm off the hook after a two-year investigation, but in the interim, investors did not give them the benefit of the doubt and their equity value took a beating.”

“This strategy is designed to get ahead of false allegations and earn the trust of our stakeholders,” replied the risk executive.

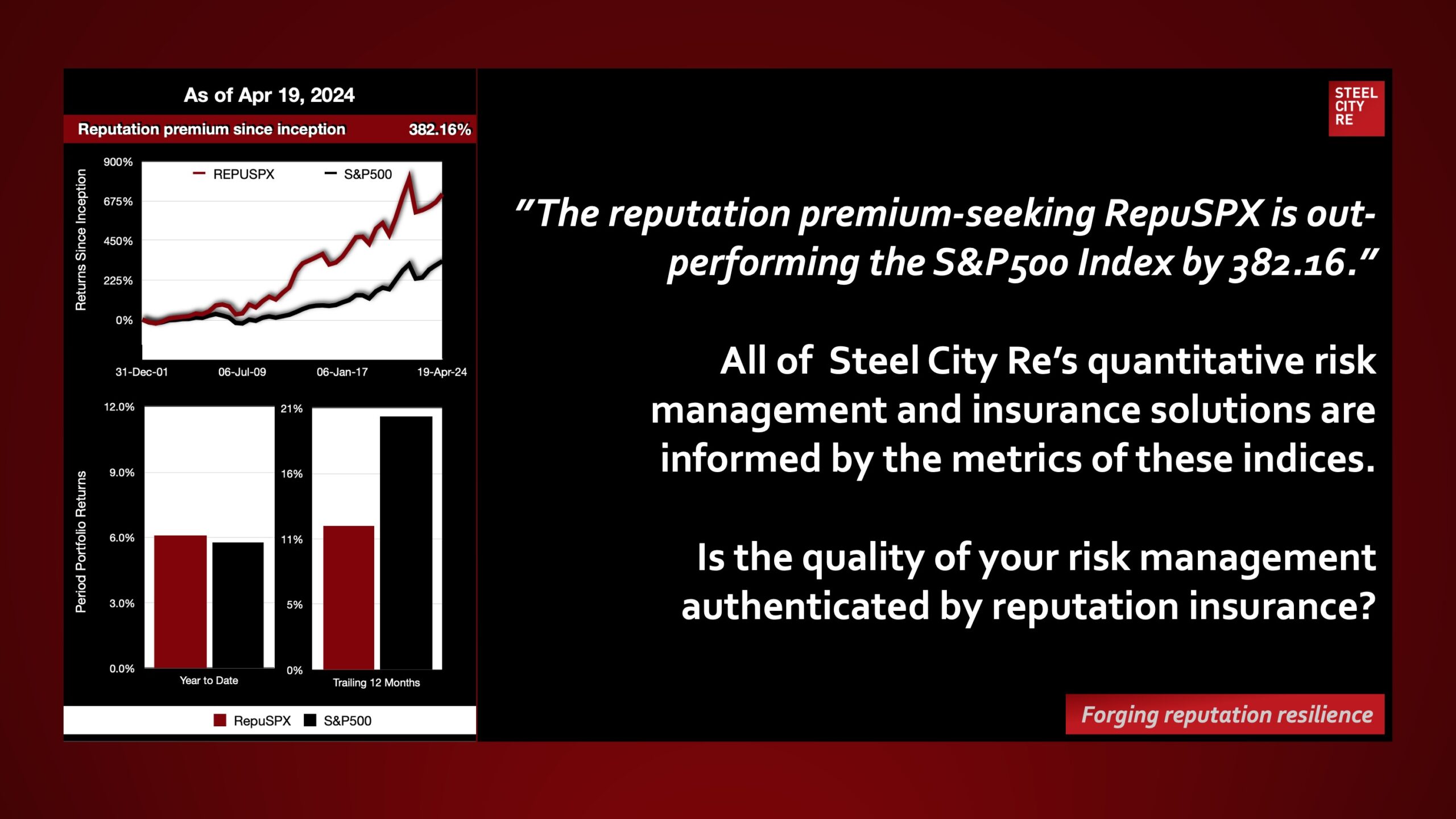

The communications executive added, “One of our goals in MarCom is to raise value. The ability to protect a backslide with a pre-positioned story belongs to risk management. On the other hand, if there is evidence that this strategy can raise value, our budget can support this strategy”

The risk executive shared that more recent data reflected that investors reward companies that have such risk management systems in place with up to a 9% equity bump because they expect regulators will be more lenient.

“I appreciate risk management’s interest in taking the lead but isn’t this more up Marcom’s power alley?” asked counsel.

“This strategy is risk and insurance focused, often beginning with an insurance captive, because the risk world understands that if a company’s captive is insuring a risk, the CFO is confident that the risk team has figured out how to value, measure the frequency and severity of loss, and mitigate the risk.”

The communications executive added that their measures of sentiment, trust, and ESG features don’t capture risk.

“Furthermore,” continued the risk executive, “the quality of the risk management strategy—the feature that most impressed regulators in the Morgan Stanley case—is authenticated by a parametric insurance product that is underwritten with objective discrimination. Our reputation risk numbers are excellent- we can sail over that bar, but those with less robust programs and more volatile risk measures—of which there are many in our sector as your noted—will be denied coverage. This objective bar limits reinsurance to only to the best risks in a way that regulators and the capital markets can understand.”

“This is the strategy I want to use to mitigate the humiliating sting of a whistleblower’s false allegations,” said counsel. “I’d like to see a project plan and budget by Tuesday afternoon to review internally amongst my team before selling it to our CFO at our quarterly review meeting on Friday. Great dialogue and research, everyone. I think we have a strategy the board will be very pleased with.”

With reputation risk forecasting, management, and insurance, Steel City Re helps companies build and prove to stakeholders their thoughtful risk management and dutiful governance over all that is mission-critical. It is an authenticated story stakeholders can appreciate and value.

Listen to the Risk Manager’s success story (coming soon).