Reputation for Safety…

…at a $40bn Manufacturing Company

Interview: Reputation for Safety Sets Apart a $40bn Manufacturing Company

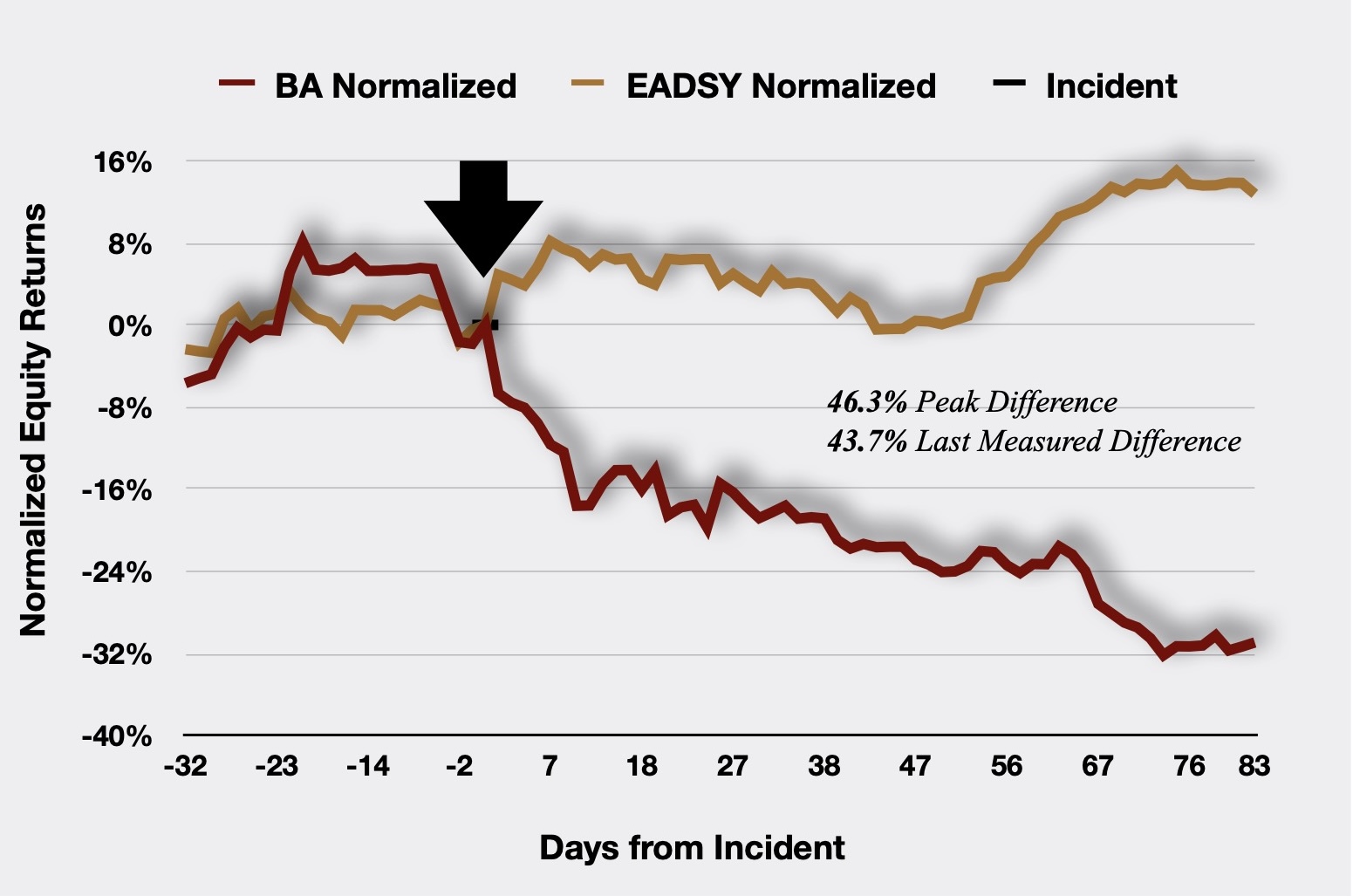

High profile failures in quality and safety such as those afflicting the Boeing Company can lead to questions that may overwhelm a risk executive.

Steel City Re imagined a conversation with one such executive at manufacturing company that historically enjoyed a reputation for reliability with its industrial clients. It provides both branded and OEM quality parts that are fairly priced. The conversation, a composite of individual discussions, has been edited for length and clarity.

Steel City Re. How has life been for you lately?

Risk Executive. Ever since the OEM door plug detachment from a Boeing aircraft in-flight, I’m hearing from worried customers about quality and safety issues that they never raised before.

Steel City Re. Have you made changes to your quality practices as a result.

Risk Executive. Not at the operating level. Our engineering and production groups have always adhered strictly to protocols in an alphabet soup of quality controls: GMP, Six Sigma, and TQM. We have covered potential losses arising from manufacturing errors with our captive and have reinsured that captive for recall and products liability risk.

Steel City Re. Are you worried about reputation risk?

Risk Executive. We have not had that concern in years. We are not a consumer brand and our name is not a household term. At least that was the mindset of senior management prior to the Boeing incident. They felt that as long as we paid attention to our quality processes, our firm’s reputation would remain resilient. Now that our customers see how far down the supply chain problems may arise—the door plug was originally fabricated by Boeing’s airframe contractor in Malaysia—the opacity of our supply chain leaves our customers on edge.

Steel City Re. Is this a new situation?

Risk Executive. The lack of trust is new. Our leadership team recognizes that this is a classical economics problem, not a manufacturing problem.

Steel City Re. It is a manufacturing problem to your customers, though.

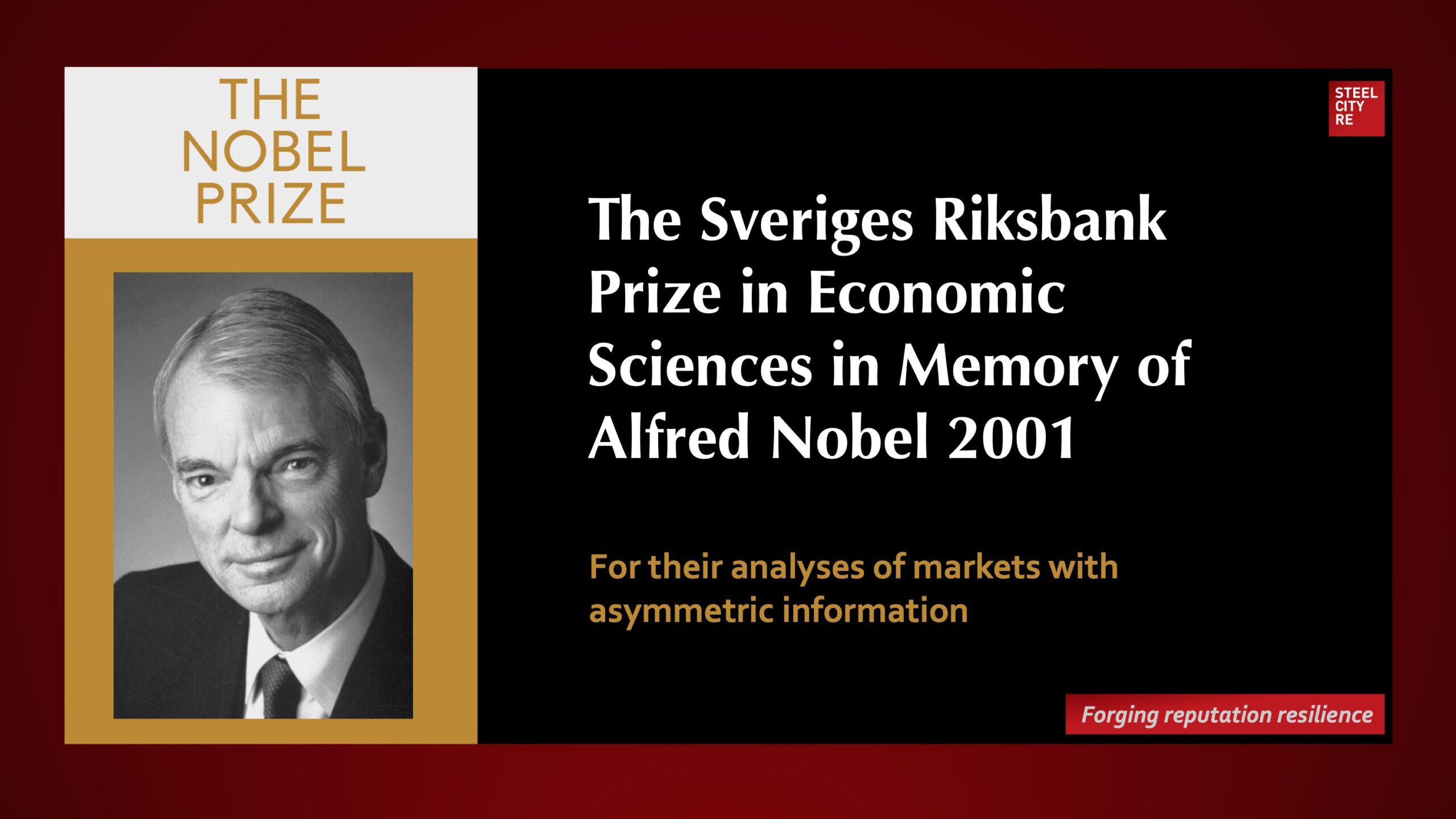

Risk Executive. Yes, but the solution was worked out in economics and luckily for me, it involves strategic insurance. It was originally worked out by Michael Spence, who received the Nobel Prize for this work in 2001.

Steel City Re. I recall the work was about signaling in markets with asymmetric information.

Risk Executive. Asymmetric, meaning, we know the rigor by which our products are designed and produced according to quality and safety protocols, but our customers don’t.

Steel City Re. How are you using insurance strategically.

Risk Executive. Because our new problem is anxious customers, not a production problem, we are taking a page from the insurance history books. In the mid 1980’s, D&O insurance was rolled out to mitigate the problem of anxious directors and those anxious about directors, not a sudden change in executive behavior.

Steel City Re. I follow. D&O insurance was available initially only to the best risks, so companies that had D&O insurance after a 3rd party underwrote them were able to recruit high caliber directors. D&O insurance was a signal of higher governance quality.

Risk Executive. My leadership team thinks we can do the same with reputation insurance. The key elements of the full solution are our captive, a measurement and monitoring system, and an objectively selective re/insurance product for our captive—that’s the Nobel Prize winning strategic insurance part.

- Our customers are sophisticated. They will recognize that if we are using our captive for reputation risk, we have figured out how to value, measure the frequency and severity of loss, and mitigate the risk well enough to own it. An NDBI policy is ideal here;

- Second, we’re rightly proud of our processes. We’ll show that our insurance and risk management processes are rich in “risk management” by improving our risk forecasting and intelligence capabilities for safety risks to the level expected by our stakeholders;

- Third, we’ll authenticate the quality of our captive operations and risk management processes by reinsuring the captive with an all-risk outcome-linked parametric cover (which could potentially replace some existing excess coverages). Our customers, our Investors, and even our regulators know that parametric policies will not be written for firms that are bad risks. It is a signal that is simple, easy to understand and completely credible.

Steel City Re. Any final thoughts?

Risk Executive. We’re pushing to roll this out quickly, in part because it will help differentiate us from the competition, and in part because Boeing has become a fixture in the news. Each new revelation triggers another round of customer anxiety.

With reputation risk forecasting, management, and insurance, Steel City Re helps companies build and prove to stakeholders their thoughtful risk management and dutiful governance over all that is mission-critical. It is an authenticated story stakeholders can appreciate and value.

Triggered by the challenges at the Boeing Company, a risk executive and her leadership team use insurance strategically to allay her firm’s customers’ new fears of quality and safety. Read the interview or listen to the the episode in 5-Minute Adventures in Risk and Resilience linked below.