In a frank confrontation with the EU’s high command on the margins of a European Council meeting in Brussels, Mrs May said if she could not win any more concessions she might as well hold a snap vote by parliament on her Brexit deal next week.

Theresa May on Friday threatened to crash the Brexit deal crafted by the UK and EU over the past two years unless fellow European leaders agreed to discuss changes to the withdrawal package to help the British prime minister sell it at Westminster.

December 19, 2018

Financial Times

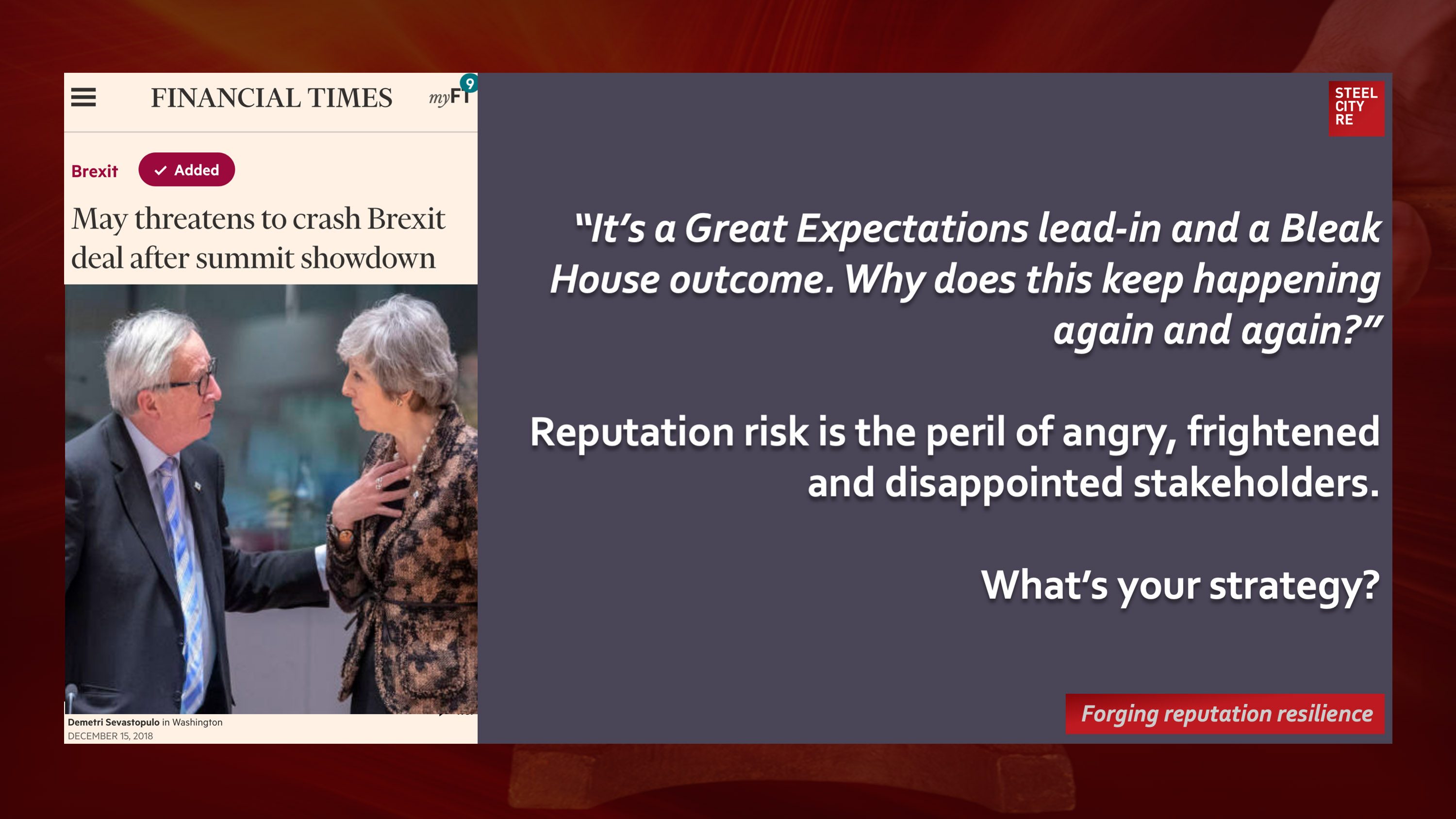

Reputation risk, English literature edition. “An EU diplomat summed up the mood after another rollercoaster EU summit with some seasonal Dickens references: ‘It’s a Great Expectations lead-in and a Bleak House outcome.’”

Reputation risk is the peril of angry, frightened and disappointed stakeholders.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution. What’s your strategy?