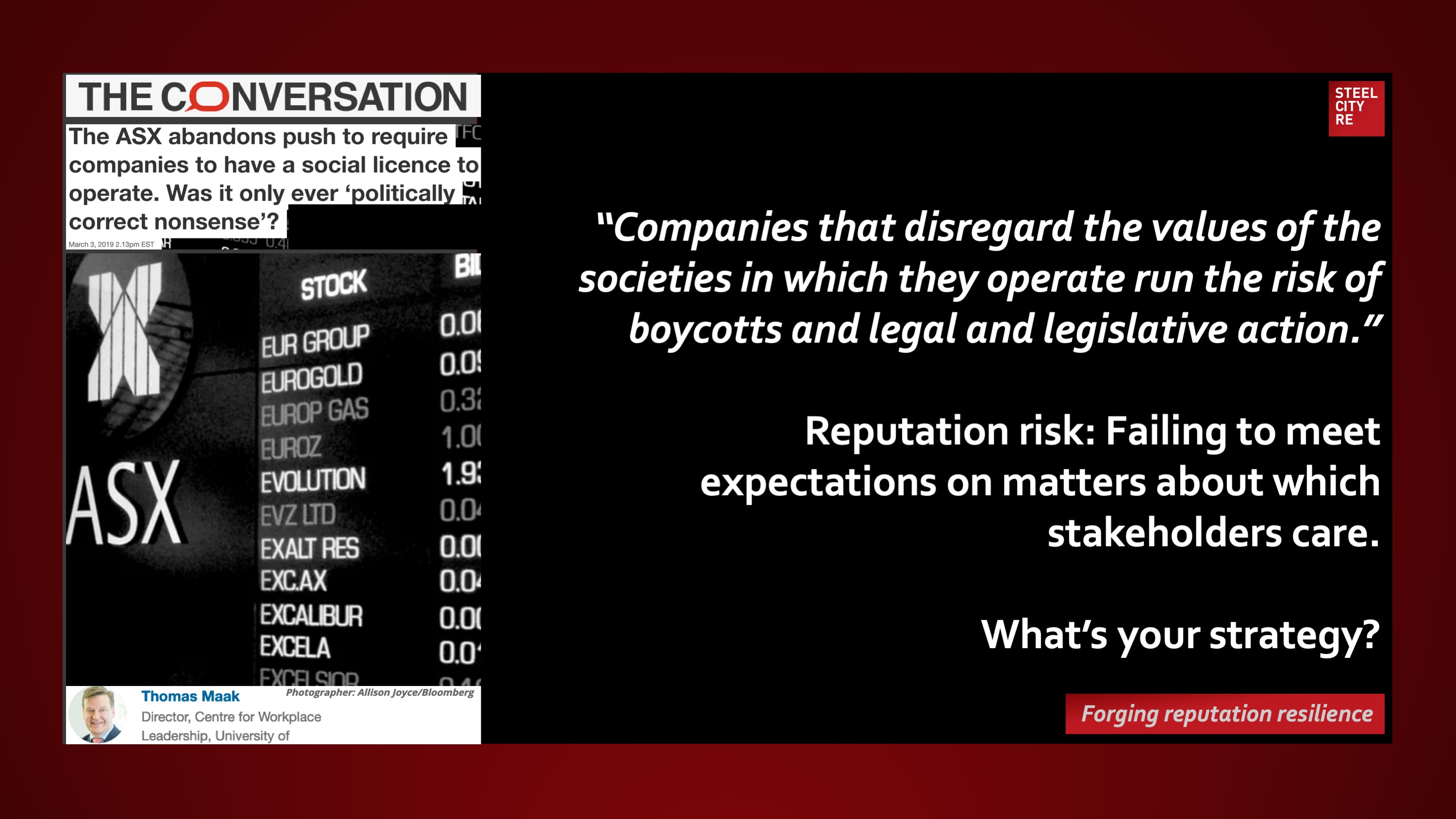

“After months of debate, the Australian Securities Exchange last week dumped a proposal to include reference to a “social licence to operate” in its updated Corporate Governance Guidelines.

“Politically correct” or not, the phrase is an accurate metaphor for the reality that companies that disregard the values of the societies in which they operate run the risk of boycotts and legal and legislative action that will put them out of business.Conversation

As it happens, the mining industry has long been aware of the need to maintain such a licence and made significant progress in embracing social responsibility in the fields of human rights and indigenous inclusion strategy.”

March 8, 2019

“Companies that disregard the values of the societies in which they operate run the risk of boycotts and legal and legislative action.”

Reputation risk: Failing to meet expectations on matters about which stakeholders care.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution.

What’s your strategy?