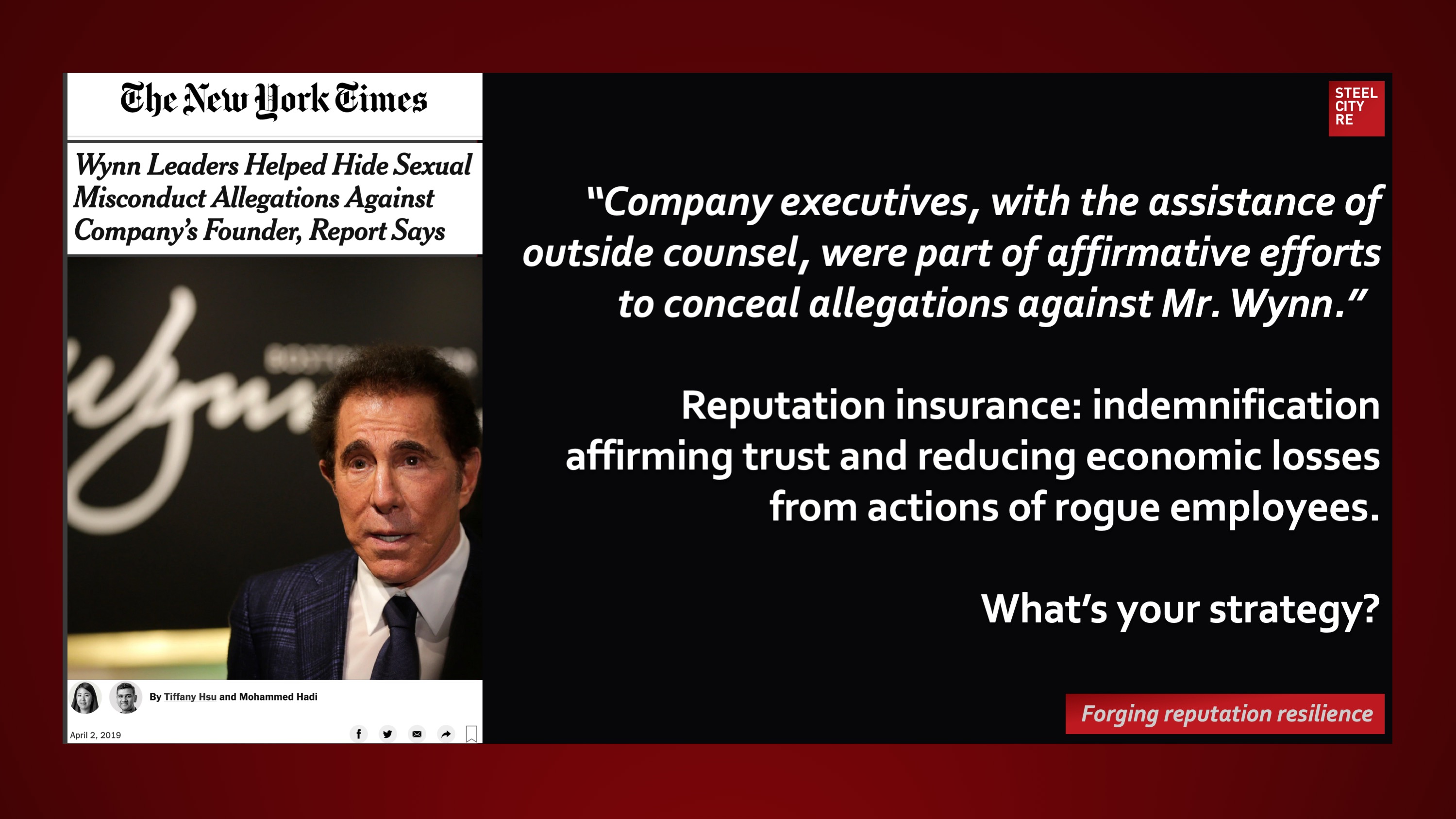

“High-ranking company executives knew about the allegations but did not follow company policy — including a zero-tolerance rule against sexual harassment in place since 2004 — and initiate an investigation, according to the report. The executives also failed to report the allegations either to the full Wynn Resorts board or to the board’s audit and compliance committees, the commission found.”

New York Times

April 2, 2019

“Company executives, with the assistance of outside counsel, were part of affirmative efforts to conceal allegations against Mr. Wynn.”

Reputation insurance offers indemnification affirming trust and reducing economic losses from the actions of rogue employees.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution.

What’s your strategy?