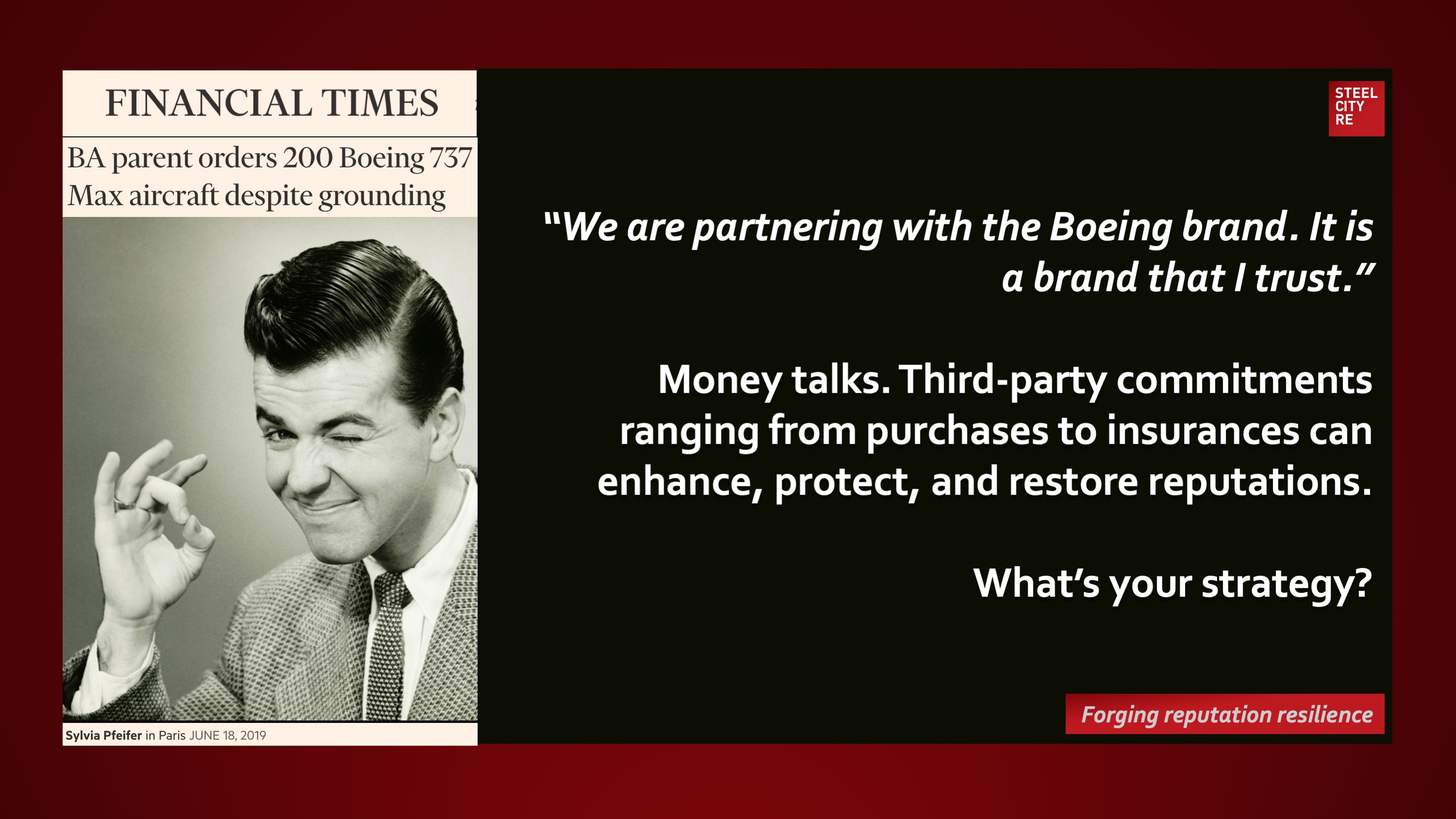

“International Airlines Group, the parent company of British Airways, will order 200 Boeing 737 Max aircraft in a significant vote of confidence in the plane, which remains grounded after two deadly crashes. The agreement, worth an estimated $24bn at list prices, ends an orders drought for Boeing since the second deadly crash of the Max in Ethiopia in March. More than 300 people were killed in the two accidents, which have been linked to a flight-control software on the Max.”

Financial Times

June 19, 2019

“We are partnering with the Boeing brand. It is a brand that I trust.”

Money talks. Third-party commitments ranging from purchases to insurances can enhance, protect, and restore reputations.

For a broader view of reputation risk, discover additional articles by Steel City Re here, mentions of Steel City Re here, and comments on newsworthy topics by Steel City Re here. To read an abstracted summary of reputation risk, see below.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution.

What’s your strategy?