Benefits for CFO’s

See also:

Our products empower risk managers to inform senior finance executives with strategies and tools for:

Today’s strategic risk managers provide CFO’s with insights and tools helpful in executing corporate financial strategy and protect enterprise value. With this broad and deep quantified visibility into enterprise risk and its management, and innovative strategies for insurance captives, CFO’s are better positioned to meet the requirements of their financial strategy responsibilities and the value-creation expectations of their executive suite and Board.

Articles for CFO’s

May 7, 2024

Podcast. Reputation Spearheads Resilience at a $150bn Financial Services Company. You Don’t Have to Win…

May 5, 2024

AstraZeneca ushers future of risk management and insurance for mission critical risk: outcome policy for…

May 4, 2024

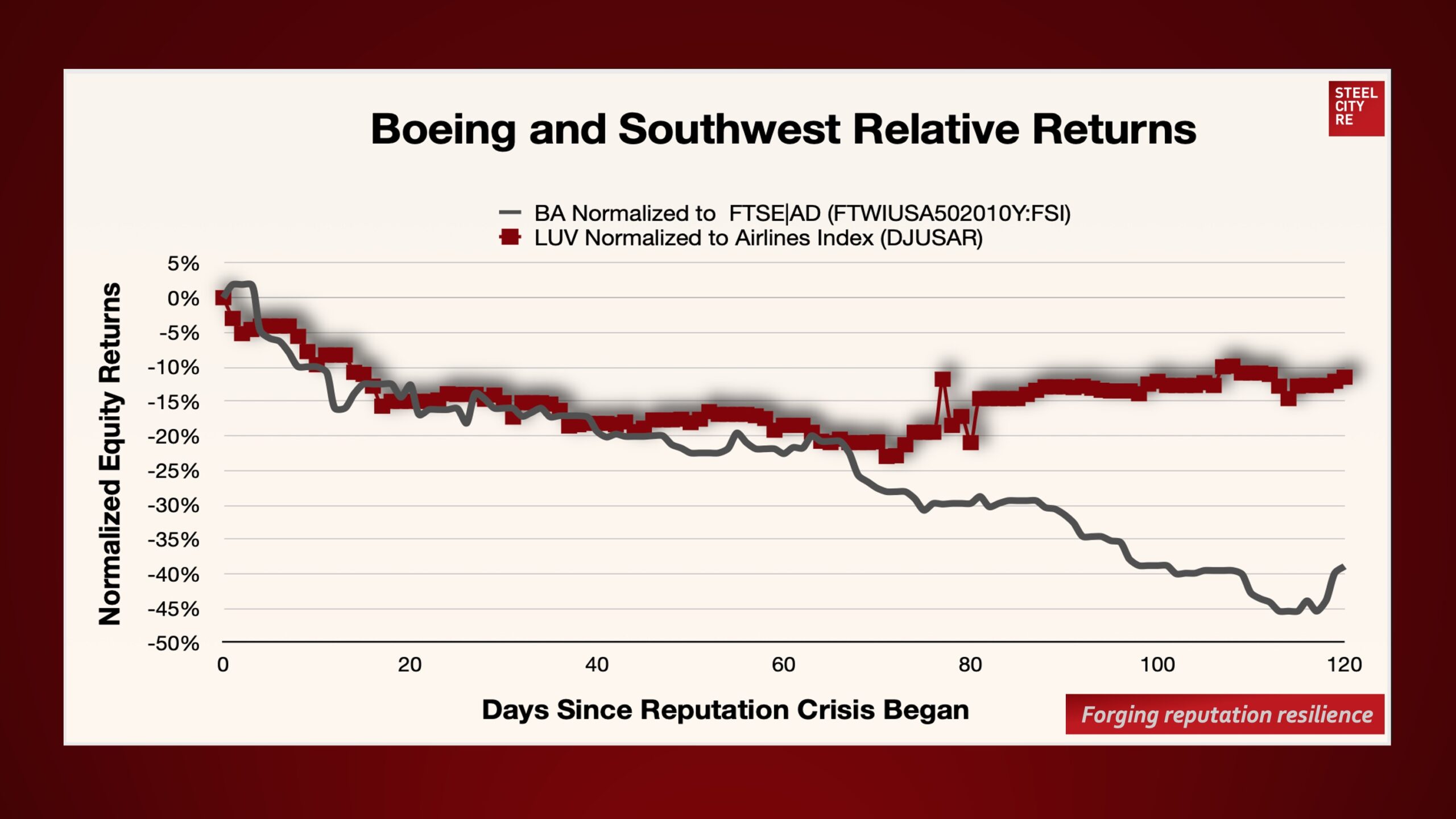

Boeing Company reputation crisis day 120. Equity is down 38.9% to peers; Steel City Re’s…

May 3, 2024

Developing and Refining Risk Appetite and Tolerance. RIMS (S)ERM Executive Report. Monitor the risk landscape…

April 30, 2024

Boeing’s Credit Rating on Cusp of Junk. Reputation risk is a going forward crisis of…

April 27, 2024

5-Minute Adventures in Risk & Resilience. Southwest Airlines’ reputation crisis helps a risk executive persuade…