Southwest Airlines (LUV) Reputation Crisis Day 375

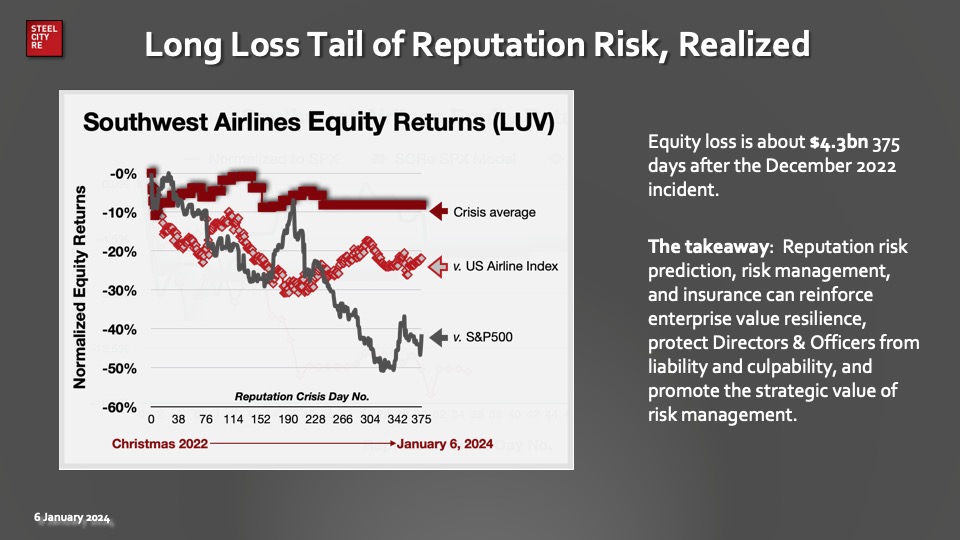

It has been a little over 11 months since Southwest Airlines’ software failed dramatically, leaving a range of stakeholders disappointed, and often angry. Prior operational failures of the same software system did not trigger a reputational crisis, but as Steel City Re’s Resilience Monitor showed, stakeholders were already showing material signs of unrest evidenced by a surge in reputation value volatility. This volatility is a hazard for a reputation crisis that is likely to incinerate significant value. At crisis day 375, Southwest equity is under performing the S&P500 index by 41.4% and the US airlines index by 21.9%**. (**In Steel City Re’s experience, a company in a reputation crisis will under perform its peers by an average of 23.3%.)

Click on the image above to read more (No Paywall).

At crisis day 340, Southwest equity is under performing the S&P500 index by 41.4%.

Steel City Re: December 2, 2023

Steel City Re’s strategic tools help risk managers build corporate resilience by predicting reputation risk, protecting enterprise value, and promoting risk management. We help risk managers manage risk and add value across Boardrooms, C-Suites, and operational silos through reputation resilience.

Reputation is Mission-Critical

Southwest Airlines reputation crisis. Today’s sophisticated risk managers are strategic. They know that enterprise damage from reputation risks might be their greatest and longest lasting peril, so they monitor for red flags. They foster a culture that respects those warnings and facilitate processes to mitigate those risks. Their diligence strategically builds enterprise-wide resilience that informed stakeholders can appreciate.

The results of strategic reputation risk management are evident in reputation resilience. More than crisis recovery, they include customers buying, not boycotting; employees working, not fleeing; investors buying, not selling; lenders adjusting interest rates down, not up; regulators deferring, not enforcing; and social license holders acquiescing, not protesting.

Having a robust Reputation Resilience Program in place offers, amongst other benefits:

- Protection for the company, its staff, executives, and board from litigation and regulatory challenges

- Improved governance processes and better enterprise risk management protocols; i.e., measuring reputational risk

- Establishment of an agile operating, communications, and decision-making team, with clear roles and responsibilities, trained and ready to handle all reputational threats; i.e., a reputation risk management framework

- Proactive management of risks that could give rise to delays or derailing concerns around new product and strategic partnership launches

- Captured behavioral economic value from stakeholders; i.e., value of reputation

- Reduced costs of debt and risk transfer while boosting equity value; i.e., boosting reputational value

Southwest Airlines reputation crisis. A hazard of reputation risk is a lurking gap between stakeholder expectations and reality. Another hazard is the emotional intensity associated with expectations. The peril is anger from disappointed stakeholders. This video explains the behavioral economic features of the many perils of reputation risk.

Mitigating risk strategically through expectation management and operational adjustments evinces thoughtful management and dutiful governance. Financing such risks evinces prudence, and doing so publicly enables stakeholders to appreciate and value the effort.

One Question

Southwest Airlines reputation crisis. ESG-linked reputation risks are prevalent and material. Is promoting the quality of your risk management program part of your strategy? At least 14 risk manager peers think it should be!