That Uber “is a textbook “bezzle” — John Kenneth Galbraith’s coinage for an investment swindle where the losses have yet to be recognized — is likely to come as a surprise to its many satisfied customers.”

December 6, 2018

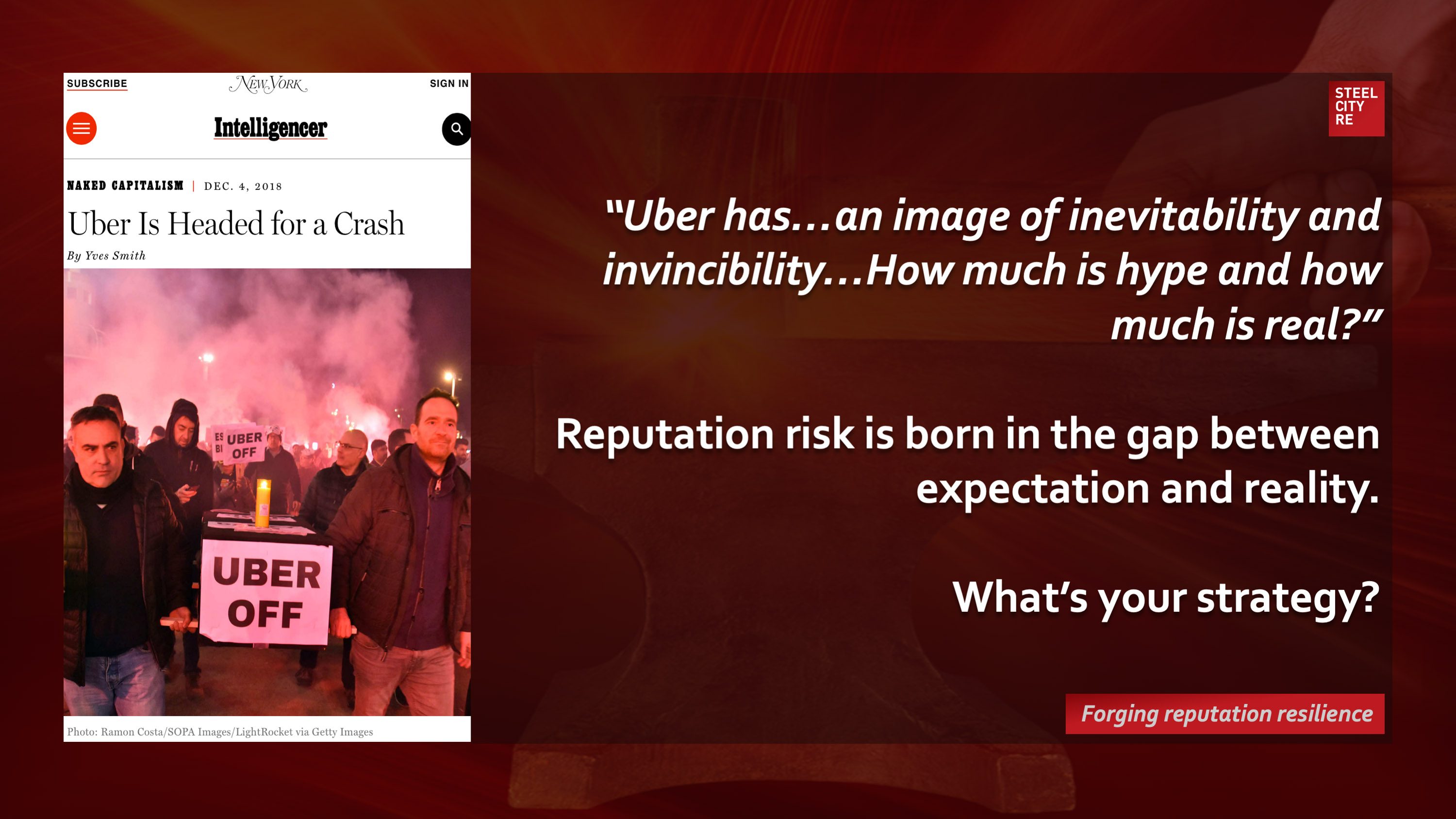

New York

“Uber has…an image of inevitability and invincibility…How much is hype and how much is real?”

Reputation risk is born in the gap between expectation and reality.

Reputations are valuable strategic intangible assets. Threats to these assets⏤ enterprise reputation risks, often mislabeled “brand risks” ⏤ need to be managed, and management needs to be overseen through reputation risk governance lest reputational damage or reputational harm result in long-tailed go-forward losses in economic value and/or political power. Because these intangible risks arise from the interplay of stakeholder expectation, experiences, and media amplification, parametric insurances for intangible asset risks, for reputational value, for reputational harm, and for reputation assurance help mitigate risk by telling a simple, convincing and completely credible story of quality reputation governance to stakeholders. This story telling effect is the expressive power of insurance complementing insurance’s better known instrumental power of indemnification.

Risk management, risk financing in insurance captives, and risk transfer through reputation insurances comprise the constituent elements of a comprehensive solution. What’s your strategy?