No ESG Without ERM

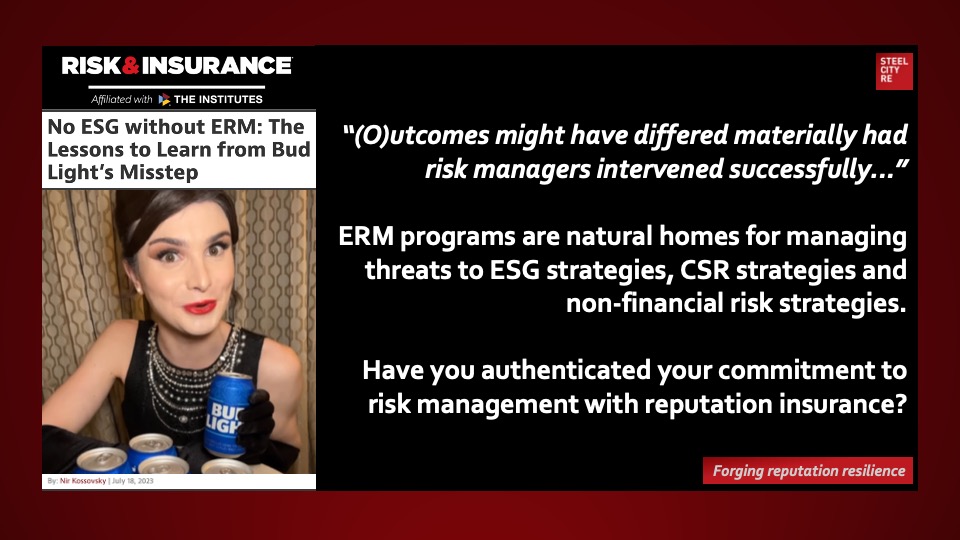

No ESG Without ERM. ESG risk is one of a growing number of stakeholder-centric issues falling under the greater rubric of reputation risk. High-profile, costly risk management failures at AB InBev (Bud Light), Southwest Airlines and Silicon Valley Bank indicate that it is time for risk management to be more fully integrated into corporate processes, like marketing: #letriskmanagersmanagerisk! Reputation risk management needs to be a standard area of enterprise risk management responsibility. Can we drink to that?

Click on the image above to read more (No Paywall).

“(O)utcomes might have differed materially had risk managers intervened successfully…”

Risk & Insurance: July 18, 2023

Steel City Re is an insurance intermediary and risk advisor for reputation value and ESG-linked reputation risk. We offer solutions for measuring reputational risk and reputational value, governance strategies for overseeing reputation risk management frameworks, insurance, and reinsurance. Reputation and ESG insurance and reinsurance are strategic instruments boards use to signal to investors, bond raters, and the courts (and regulators) that their governance processes are effective.

Reputation is Mission-Critical

Oversight of “mission- critical” issues can forestall a broad range of costly issues associated with angry disappointed stakeholders. Losses accrue as companies lose the ability to sell more, faster, and at premium prices; to obtain labor, vendor services, as well as capital on preferred terms; to outperform competitors, deter activists, and assuage regulators. Public manifestations include litigation, regulatory opprobrium and adverse media attention.

A program for reputation resilience, comprising both risk management and insurance (reinsurance)-authenticated oversight for all that is mission-critical, can create value in many ways. To this end, Steel City Re offers a Reputation Resilience Program.

Having a robust Reputation Resilience Program in place offers, amongst other benefits:

- Protection for the company, its staff, executives, and board from litigation and regulatory challenges

- Improved governance processes and better enterprise risk management protocols; i.e., measuring reputational risk

- Establishment of an agile operating, communications, and decision-making team, with clear roles and responsibilities, trained and ready to handle all reputational threats; i.e., a reputation risk management framework

- Proactive management of risks that could give rise to delays or derailing concerns around new product and strategic partnership launches

- Captured behavioral economic value from stakeholders; i.e., value of reputation

- Reduced costs of debt and risk transfer while boosting equity value; i.e., boosting reputational value

A hazard of reputation risk is a lurking gap between stakeholder expectations and reality. Another hazard is the emotional intensity associated with expectations. The peril is anger from disappointed stakeholders. This video and this written summary explain the behavioral economic features of the many perils of reputation risk.

Mitigating risk strategically through expectation management and operational adjustments evinces thoughtful management and dutiful governance. Financing such risks evinces prudence, and doing so publicly enables stakeholders to appreciate and value the effort. These comprise the core of Steel City Re’s professional services.

One Question

ESG-linked reputation risks are prevalent and material. Are reinsurance and insurance for ESG-linked reputation risk part of your strategy?