October 10, 2022

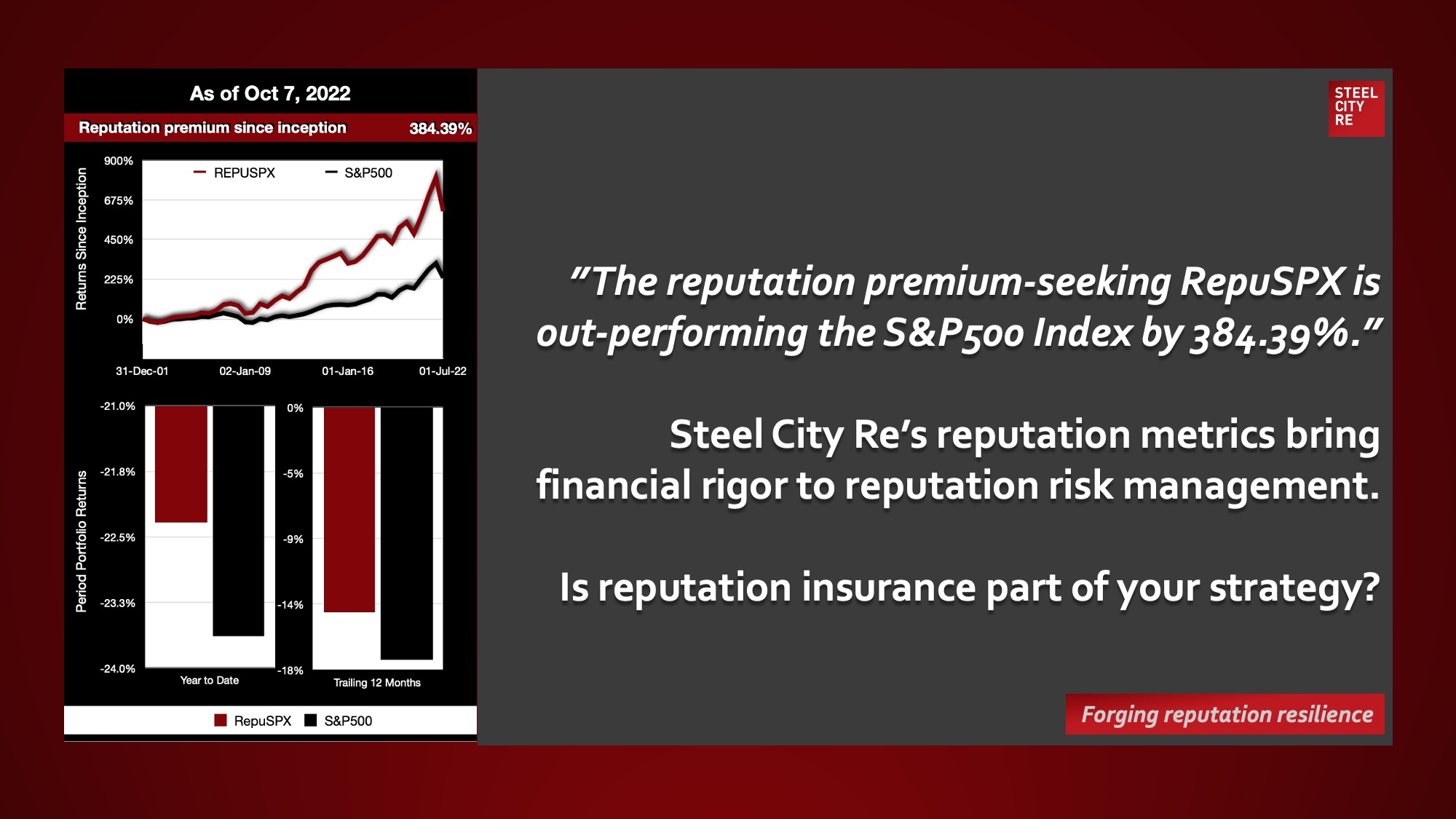

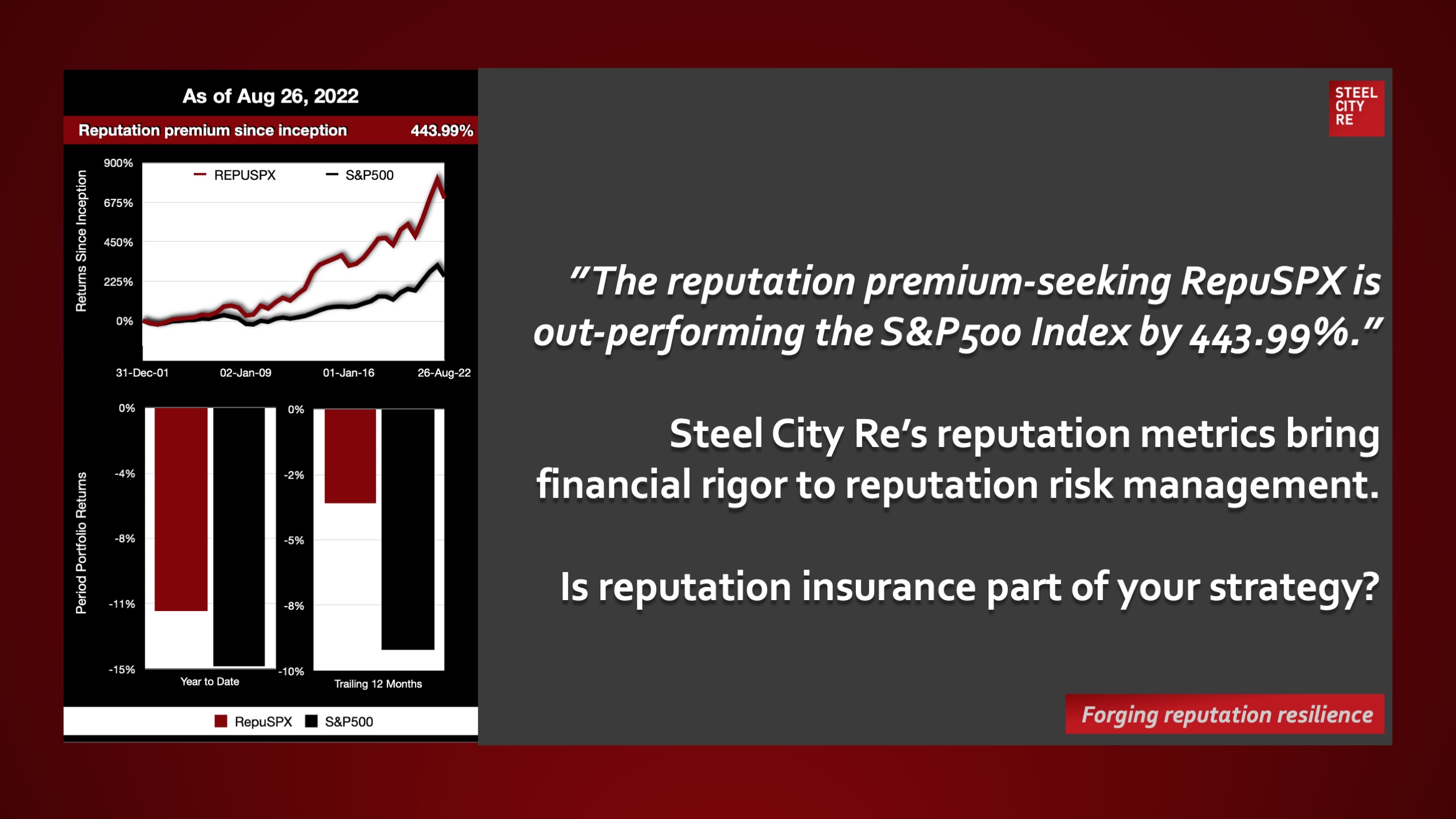

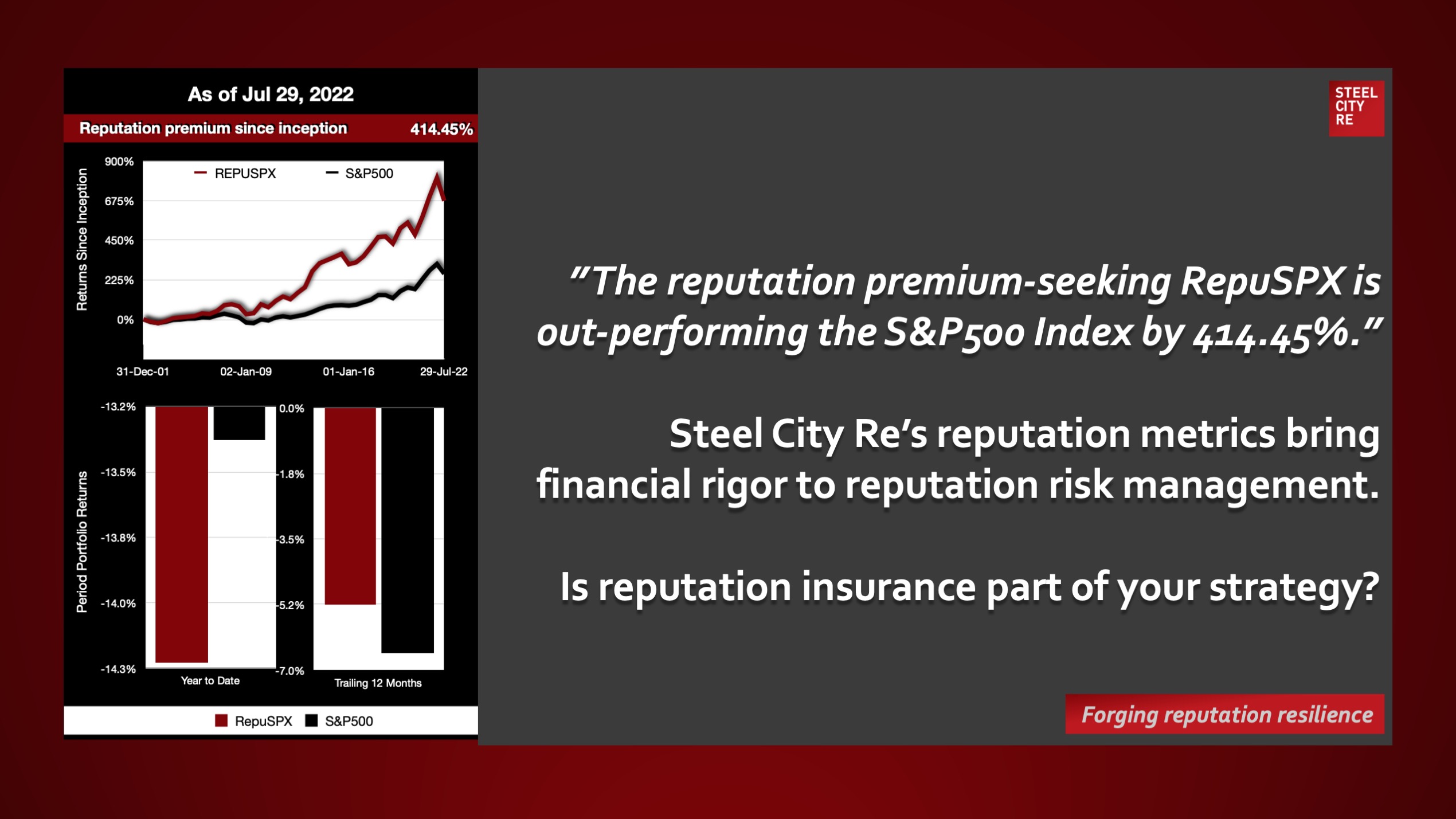

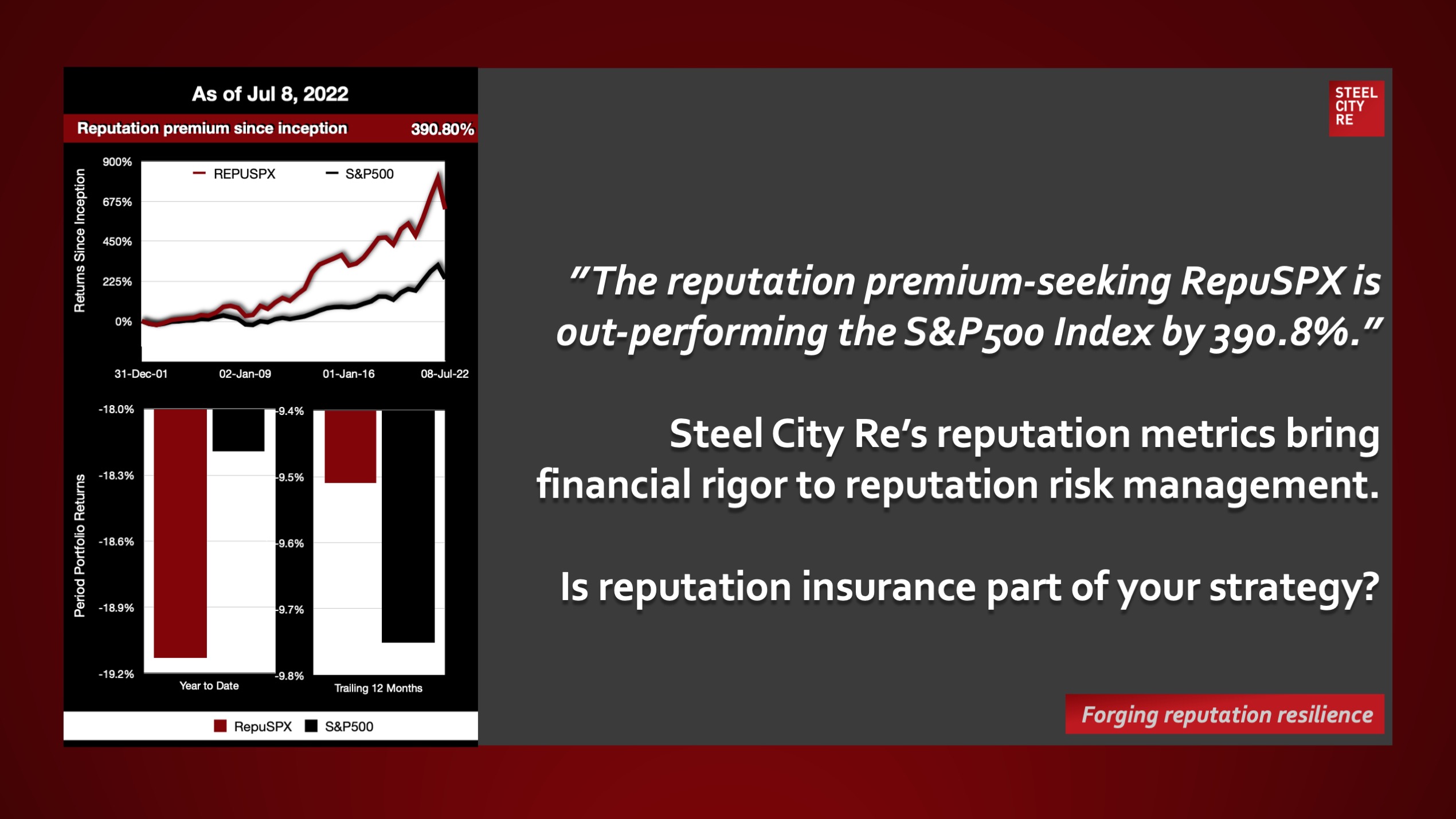

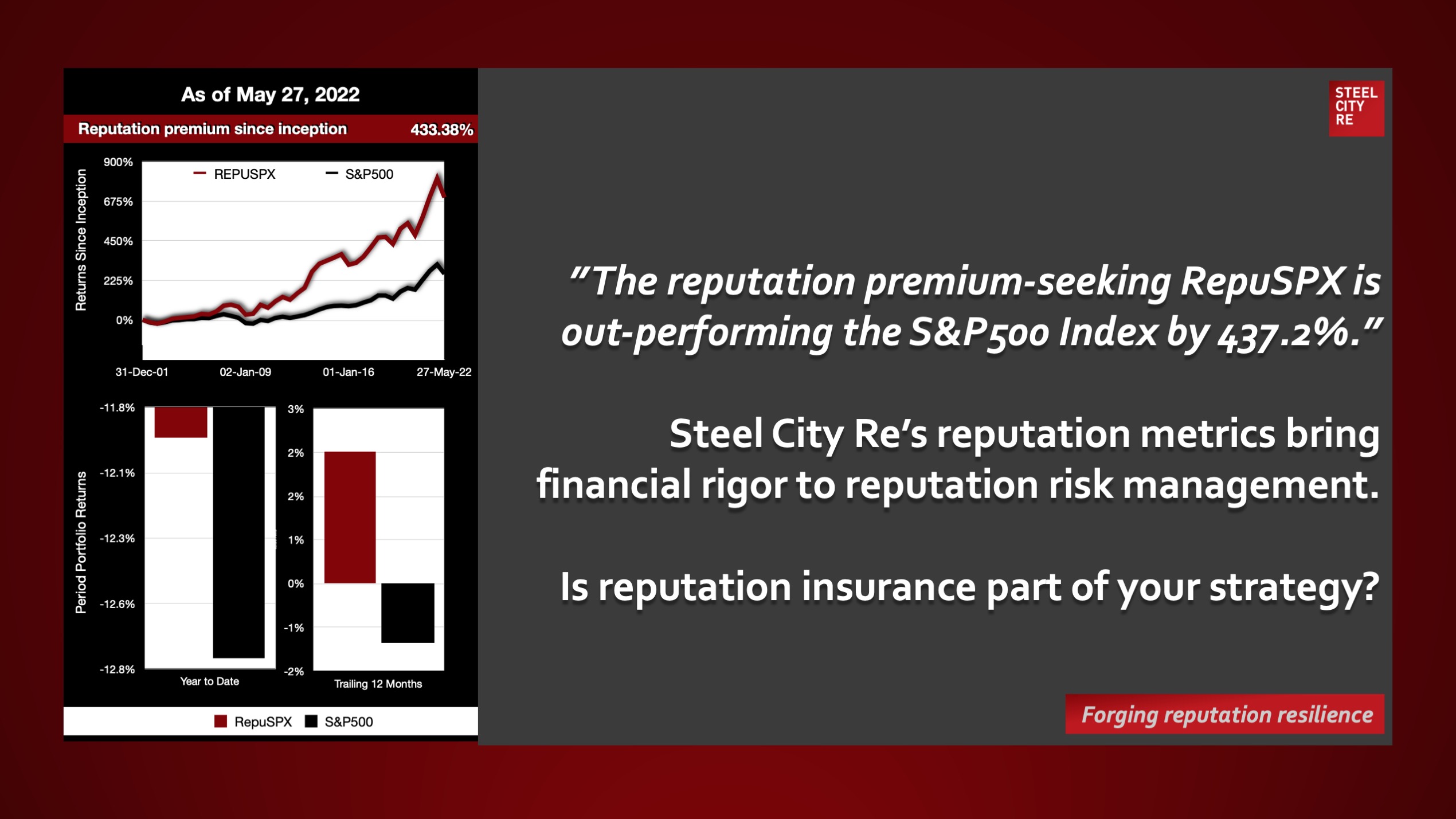

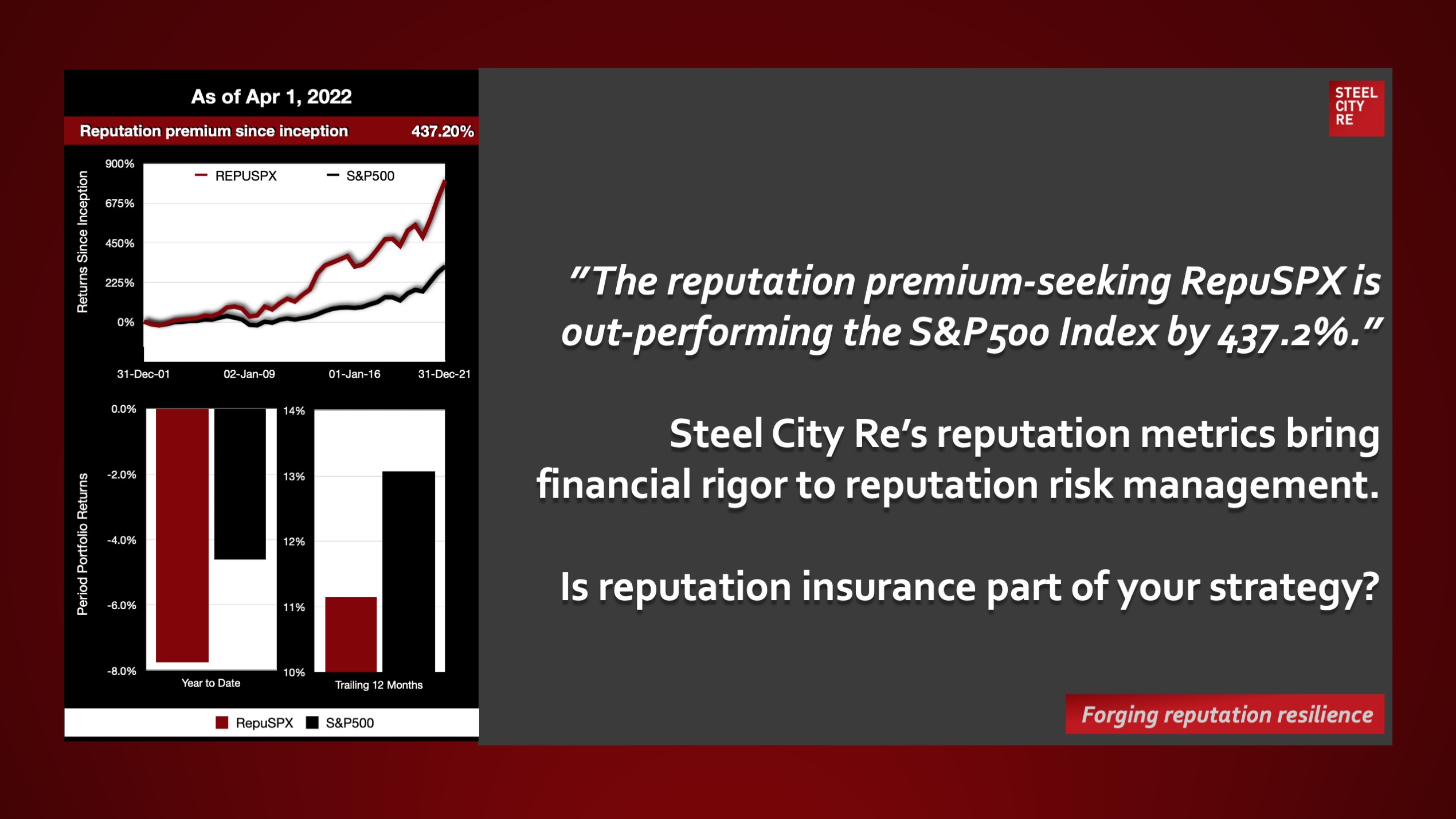

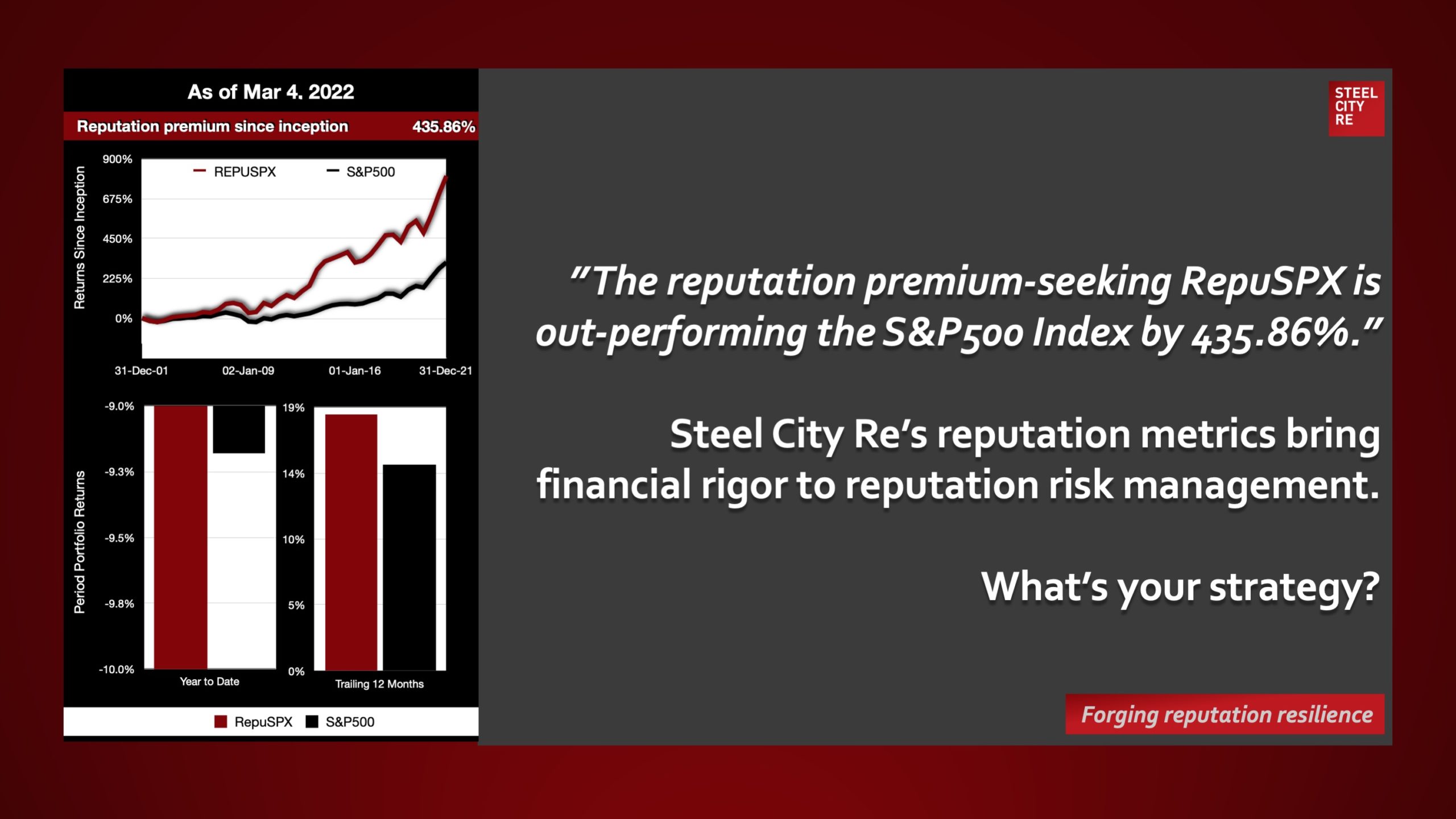

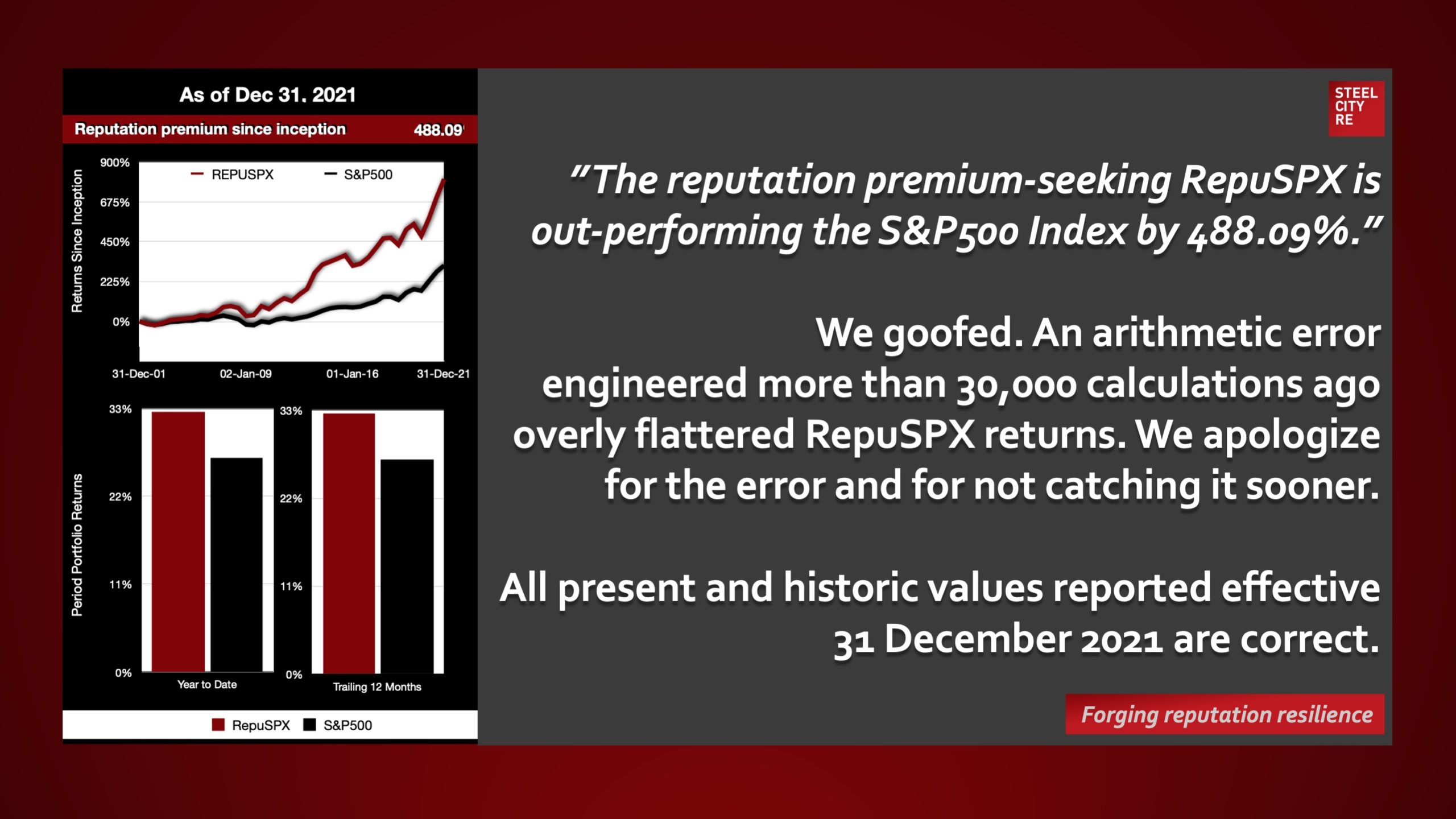

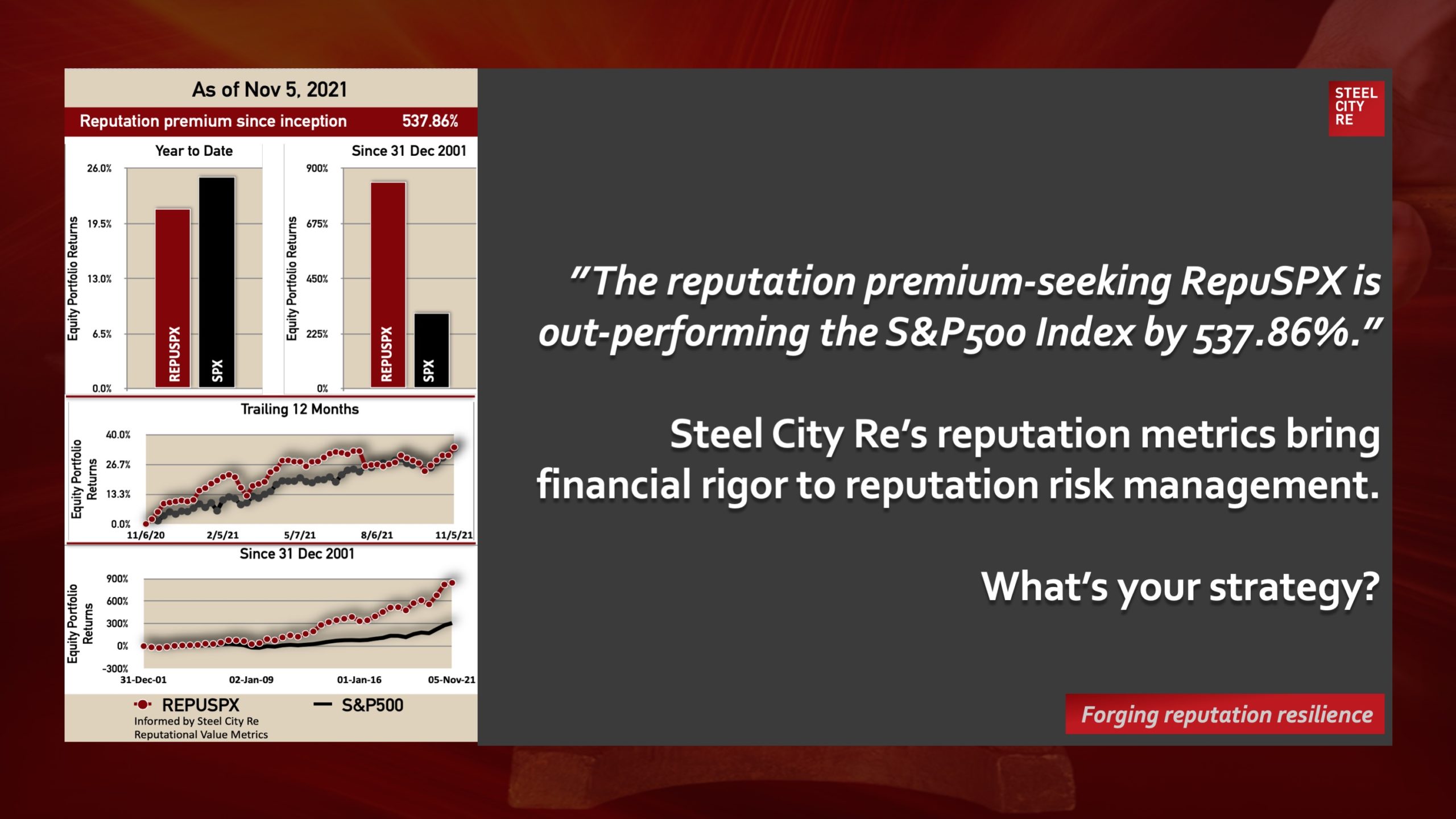

Reputation Arbitrage October 2022. The reputation premium-seeking RepuSPX is out-performing the S&P500 Index by 384.39%. The trailing twelve month spreads over the S&P500 of the three reputation-linked indices comprising RepuStars Variety Corporate Reputation Composite Equity Index family range from 1.09% to 3.19%. The trailing twelve month return spread between the two reputation-based price-only indices, REPUVAR and REPUSPX, is at a low of 2.1%. All three indices are outperforming the S&P500 this calendar year.