July 11, 2023

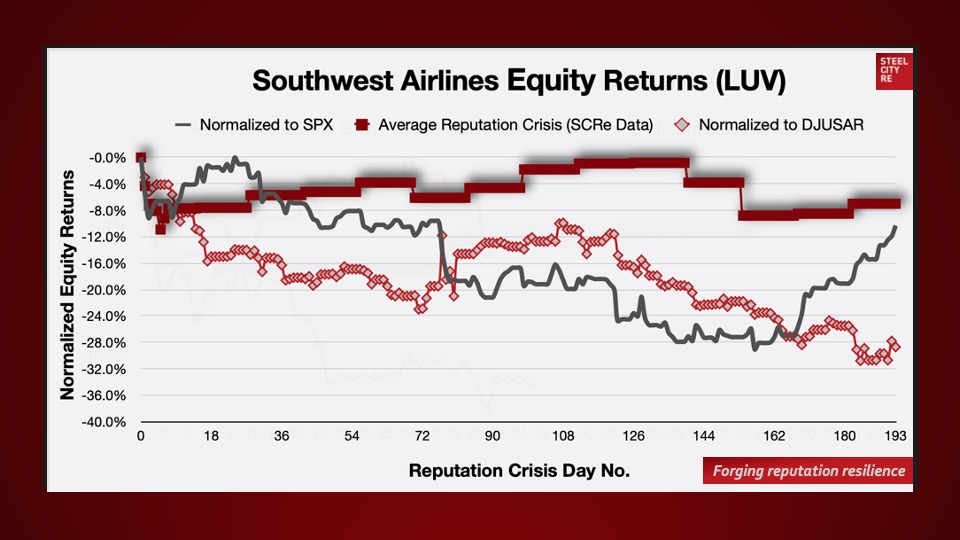

Southwest Airlines (LUV) equity returns at 193 days normalized to the S&P500 returns are -10.3% (predicted based on historic reputation risk for LUV: -7.0%). It is under performing the Dow Jones US Airlines Index (DJUSAR) by 28.7%. The implied loss to shareholders is $2bn.